Everyone loves a discount, but if you’re buying bonds these days you may be out of luck.

Just over a year ago, the BMO Discount Bond (ZDB) was launched as a tax-efficient alternative to traditional bond ETFs. ZDB tracks the broad Canadian market, but it selects bonds trading at a discount, or at a very small premium. Discount bonds have a lower coupon than comparable new bonds, and they will mature with a small capital gain. That combination is more tax-efficient than premium bonds, which have higher coupons and mature at a loss.

A discount bond ETF is a great idea for non-registered accounts, but it faced challenges from the beginning. After many years of interest rates trending downward, there simply aren’t many discount bonds in the marketplace. Traditional broad-market bond ETFs hold between 500 and 900 issues, but ZDB holds just 55.

This constraint has become more urgent after the Bank of Canada unexpectedly cut short-term rates in January. Yields on intermediate and longer-term bonds also fell, driving bond prices up sharply. Suddenly bonds that were trading at a discount were priced at or above par.

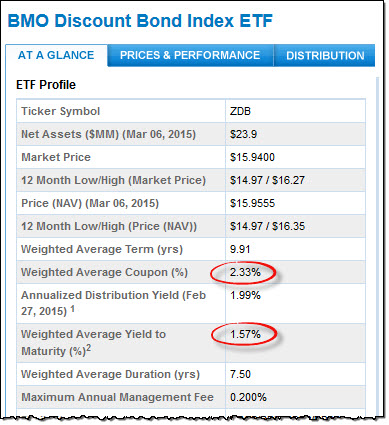

In my blog post introducing ZDB, I explained that there’s an easy way to tell if the bonds in an ETF are trading at a premium: just visit its website and compare the fund’s average coupon to its yield to maturity. If the average coupon is higher, then most of the bonds in the ETF are trading at a premium. ZDB’s distinguishing feature when it was launched was that its coupon was significantly lower than its yield to maturity. But that’s no longer the case:

A good trade-off

I recently spoke with my contacts at BMO about this predicament, and they confirmed it is becoming increasingly difficult to find new discount bonds. That means the managers of ZDB will face some big decisions when the fund’s next rebalancing date arrives in April.

They could relax the constraints and buy bonds that trade at slightly higher premiums. ZDB’s benchmark, the FTSE TMX Canada Universe Discount Bond Index, includes only bonds with a price of $100.50 (that’s 0.5% above par), but the fund managers could choose to buy bonds up to $101, for example. That wouldn’t cause much tracking error, because performance is always measured on a before-tax basis. But, of course, it would make the ETF less tax-efficient.

When you consider the trade-offs, adding more premium bonds is probably the right decision. The alternative would be to slavishly follow the index, and that would leave ZDB holding even fewer bonds than it does now. Risk management always needs to come before reducing taxes, so if better diversification comes at the cost of slighter higher taxes, then that’s the way it has to be.

Going forward, I expect BMO will have a discussion with FTSE about making some changes to the index. This is always controversial, because no one wants to change the rules in the middle of the game. But an index benchmark has to be investable in the real world, and in this case it’s the market that changed the rules.

The tax benefit is still there

While it will be interesting to watch ZDB evolve, let’s not lose sight of the fact that it should always be expected to outperform traditional bond ETFs on an after-tax basis.

Consider the BMO Aggregate Bond (ZAG), which should behave very similarly to ZDB on a before-tax basis. (As of March 6, their 12-month returns were almost identical, according to Morningstar.) This traditional broad-market ETF has a yield to maturity of 1.67%, only slightly more than ZDB’s. But its coupon is much higher at 3.85%, which means more of ZAG’s return will be lost to taxes.

Even if ZDB isn’t truly a discount bond ETF anymore, its relative tax benefit is still there. It’s still a good choice for investors who want broad-market bond exposure in non-registered accounts.

I don’t understand what is the appeal of ZDB and BXF when we have HBB, a 100% tax efficient ETF

Very interesting – but I do have a very “newbie” kind of question about discount bonds:

Is a discount bond the same as a strip bond? If yes, does this mean that strip bonds are also hard to find?

If no, what is the difference?

@Lawrence: Some investors are not comfortable using swap-based ETFs. It’s also important to note that BXF holds only short-term bonds, so its exposure is quite different from that of broad-market funds such as HBB or ZDB.

@CeclieB: strip bonds and discount bonds are not the same thing, though strip bonds, by their nature, are always sold at a discount to par.

http://www.investopedia.com/terms/s/stripbond.asp

http://www.investopedia.com/terms/d/discountbond.asp

Thank you for this informative article. As a newbie to the CP method, and learning to manage my own investments, I struggle at times with all the moving parts, so please bear with me.

I had considered BXF in my taxable account as a way to deal with part of my Bond allocation which exceeds that which I can hold in my RRSP where the bulk of my bonds holdings will be placed. (VAB) My thinking was because it was a shorter term duration fund, it wouldn’t be as highly sensitive to interest rate changes, it was tax efficient, and, in any event, would effectively ‘follow’ the interest rate trend.

Am I on the right track here, or should I, based on your article, look to something else. It seems you are saying that BXF doesn’t fall under this discussion because of the very fact that it is a shorter duration holding.

Thank you for your wonderful website, and commitment to educating us…

@Ly: Thanks for your comment, and for the kind words. Your description of BXF is accurate: it is indeed a tax-efficient alternative to VAB, but with a shorter duration and therefore less sensitivity to changes in interest rates. ZDB would also be an alternative if you were looking for a tax-efficient alternative with very similar characteristics to VAB (duration, term to maturity, etc.).

Doesn’t this make ZDB useless to us couch potato investors?

They are using an active strategy to deal with current market conditions. Nobody can predict the future but an etf seems broken to me when it can’t even achieve its own stated goals…

@CCP: Can you also explore HBB a bit more perhaps as an article. Specifically I have two questions:

1. Suppose a counter party defaults with HBB and the benchmark return was supposed to be 5% for a given year. What happens then? Does HBB keep the cash and deposit interest, effectively lose the difference between the deposit interest and 5% benchmark?

In other words, even if the counter party defaults. HBB investor still keeps the principle money and even some deposit interest?

2. Suppose a large number of the bond in the index defaults, and the benchmark return is -50%. Then basically HBB will hand over approximately 50% of its asset to the counter party?

Your help is greatly appreciated.

I seem to find the bond aspect incredibly confusing. So if we are trading at a premium, we would of paid say $106 on a $100 dollar bond to get a 5% coupon lets say. So now we get a 5% coupon until the bond matures and our yield to maturity would be 4.7% in this case? So we lose $6/100 in bond at maturity and take a capital loss. So regardless our bond etf will fall in value if rates remain the same or go up.

Now if I have it right (which I doubt), does that not mean taking into account if both tax efficient and inefficient bond etf were held in a RRSP, then the tax inefficient should do better if taxes weren’t involved? They have higher payouts and the previous analysis showed they lost when taxes involved. But without, would CBO not do better overall?

I probably have that wrong but in taxable accounts then, what do you recommend for us couch potato guys? For CAN, US, INT and bonds? I know equities are more tax efficient so not too worried as much about them. But for bonds do we go with HBB, ZDB or first strip bond? Will these be losers if rates ever go up again? Are the only good for this rate environment??

Sorry for long response. These bonds are becoming my obsession :)

@Ian: I wouldn’t call this active management at all. An actively managed bond fund tries to select individual bonds believed to be undervalued and/or tries to anticipate where interest rates are headed. None of that is going on here. It’s simply a lack of available bonds that fit the criteria laid out in the index. A year ago, when the methodology was first applied, there were only about 50 bonds that fit the bill. Now there are even less. Sticking rigorously to the index would result in a fund that could have only a very small number of bonds: not be enough to provide meaningful diversification. So changing the methodology is really the only way of addressing the problem.

@Wali Le: I wrote about HBB here:

https://canadiancouchpotato.com/2014/05/08/a-tax-friendly-bond-etf-on-the-horizon/

I also discussed the counterparty risk of swap-based ETFs in reference to HXT and HXS. The concepts are the same for HBB:

https://canadiancouchpotato.com/2011/06/06/understanding-swap-based-etfs/

https://canadiancouchpotato.com/2011/06/10/more-swap-talk-with-horizons/

https://canadiancouchpotato.com/2011/06/08/swap-based-etfs-what-are-the-risks/

@Bruce: Yes, if you buy an ETF full of premium bonds you should expect its price to fall over time unless interest rates go down. You are compensated with a higher coupon, so on a pre-tax basis (such as in an RRSP or TFSA) you are no better or worse off than if you bought an ETF of bonds trading at par. However, on an after-tax basis, the high-coupon premium bonds are much worse than bonds sold at par or at a discount. This is because interest and capital gains are taxed at different rates. It’s similar with foreign equities: before tax, a 5% capital gain and a 3% dividend gives the same total return as a 3% capital gain and 5% dividend. But after tax, I’d much prefer the former.

As for what I recommend for Couch Potato investors who hold fixed income in taxable accounts, I suggest either a GIC ladder (which is similar to buying bonds at par) or a low-coupon bond ETF.

Some bond-related articles you might find useful:

https://canadiancouchpotato.com/2013/08/07/is-your-bond-fund-really-losing-money/

https://canadiancouchpotato.com/2013/06/10/whats-happening-to-my-bond-etf/

https://canadiancouchpotato.com/2013/03/06/why-gics-beat-bond-etfs-in-taxable-accounts/

https://canadiancouchpotato.com/2011/07/07/holding-your-bond-fund-for-the-duration/

@CCP

You mentioned laddered GIC. Are there GIC ETF? I dont like looking for the best 5yr GIC every year. It doesnt feel the same as rebalancing every year since I have to research for the 5yr GIC with the best rate. Compared to putting numbers in a spreadsheet to figure out how much in what will bring me back to the correct allocation.

@CharlieF: There are no ETFs that hold GICs. I’m not even sure such a thing would be possible.

I have read many articles about reinvesting RRSP tax refunds which the experts say superchargers your account but don’t quite get it. I know you can contribute 18% of ones prior year income but how can I also put in the tax refund from RRSP contributions? wouldn’t I go over. So for example i have my taxes done today and can contribute this year 18% of last years income which I do every year. But how am I able to also contribute the tax refund in a few weeks when I get it from gov’t ? Does the refund from rrsp contributions not count towards the maximum amount? very confusing.

@Jake: You can only reinvest your refund if you have sufficient contribution room. So if you are maxing your RRSP every year, then this isn’t an option. The advice is aimed at the vast majority of people who aren’t maxing out their RRSPs.

I am curious. Would u recommend hbb or zdb for taxable accounts? After reading your articles it almost seems swap based is a much better way to go especially since finding discount bonds seems to be harder and harder. The risks to swap based products seem almost minimal relatively speaking. I almost think the swap based could be better vs vun in taxable as well?

I have a large holding in vsb but after reading your last analysis it seems I am making very little after taxes. So which would u use in your own portfolio?

Thx again

@Bruce: In our practice at PWL Capital we use low-coupon bond funds or GICs when we need to hold fixed income in taxable accounts. We do not use swap-based ETFs for either bonds or equities. Don’t forget BXF as an option as well: it would be closer in character to VSB, since it includes short-term bonds only.

Thx Dan….I am curious after reading all your blogs. Why not use HBB? It appears that ZDB is not very diversified because of the limited discount bonds out there. HBB eliminates the interest taxes completely and you can compound every dollar as opposed to ZDB. It also give complete index exposure and isn’t limited by the availability of discount bonds. I like both products but deciding between the two is scrambling my brain. Any opinion as to why one over the other would be appreciated….

thx

An interesting thought; How can you compare a GIC to a bond (to know which may be a better investment) even ignoring taxes for a moment, at first one would simply say compare the YTM … but if you look at the definition of YTM on just about any website it always states it assumes the coupon payments are reinvested at a rate matching the bond it self (in real life this is probably very difficult to accomplish for an individual bond) ! Of course a GIC’s rate does not assume this, so right off the back that would make such comparisons unfair.

But I came across this interesting document that states the assumption that YTM factors in reinvested coupons is a wide spread fallacy:

http://www.economics-finance.org/jefe/econ/ForbesHatemPaulpaper.pdf

@Taal: I think you’re making the comparison more complicated than it needs to be. You can simply think of a GIC as roughly equivalent to Government of Canada bond (because it is CDIC insured) of the same maturity. The most important difference is liquidity: in most cases, GICs must be held to maturity, while government bonds can be sold at any time.

@Bruce: The decision really comes down to the risk of the swap-based structure. If you understand the risks and are comfortable with them, then HBB is fine. You should also consider the real after-tax benefit of a swap-based bond fund when interest rates are as low as they are today:

http://www.canadianportfoliomanagerblog.com/hbb-vs-gics/

Just one last thought (I hope). If you weren’t in the highest tax bracket and only paid 20%, do these tax efficient etfs really matter? Or is the benefit only marginal at that point?

Thx again

@Bruce: It’s really up to the investor to determine how much work he or she wants to go through to save taxes. I would tend to agree with you that if you are in a low tax bracket, and especially of your holding is relatively small, the tax efficiency of your bond ETF may be a trivial matter.

Thanks, Bruce, for your dogged pursuit of answers in this area. I, too, find the Fixed Income portion difficult to get my head around at these rates. ;o)

With this morning rate cut… good luck finding ANY discount bonds !

Hi Dan, I am presently using ZAG in my registered and non-registered accounts. After maxing out my tax-sheltered accounts, I started building a CCP portfolio in my taxable account with my other money, with the intention of transferring as much over to my RRSP and TFSA next year as I can. Hopefully all of it!

Should I be using ZDB in my taxable account while doing this, then selling it and buying ZAG? I was thinking this would not be very cost efficient due to the commission fee to sell and realistically I will only be holding the bond ETF in my taxable account for a year. Or maybe it’s simply better to build my extra savings in a High Interest Savings Account and deposit it all into my RRSP and TFSA once I get my allocation rooms sorted to simplify things. Any thoughts or recommendations?

Perhaps a podcast question? ‘I have maxed out my TFSA and RRSP. How should I continue building my Couch Potato Portfolio until January, when I get more room available? Particularly if I am an aggressive saver and able to save up this much money ahead of time’

Thanks!!!!!

@Erin: It’s hard to comment here, because the right solution depends on many factors, including the amounts involved. In general, I encourage people to avid complicated strategies for managing regular contributions, and that would include things like buying ZDB in a taxable account for 12 months and selling it to by ZAG in a registered account. Your suggestion of using a high interest savings account makes much more sense.