If your portfolio includes a broad-based bond index fund, you’ve probably noticed its value has fallen significantly over the past several weeks. Judging from recent e-mails I’ve received, the reasons for this decline are not always clear, so let’s take a closer look.

Most investors understand that when interest rates rise, bond prices fall. But there are many different interest rates, and they all affect your bond fund in different ways. The shortest of short-term rates is the target for the overnight rate, which is set by the Bank of Canada to control monetary policy—in other words, to keep inflation low. This rate influences the prime rate banks use to price variable-rate mortgages and lines of credit, so it’s the one most widely discussed in the media.

The Bank of Canada has kept the target rate at 1% since September 2010: that’s more than 32 months, the longest period it has ever remained unchanged. Meanwhile, the prime rate has held firm at 3% during this same period. I’ve been asked by some investors why they’ve seen their bond holdings fall when “interest rates haven’t gone up.”

But as I’ve mentioned, this short-term benchmark is only one of many interest rates. The yields on two-year, five-year, 10-year and longer-term bonds move independently of the target rate, and these are the rates that affect your bond index fund. They’re rarely reported in the financial media, but you can follow them on the Bank of Canada’s website.

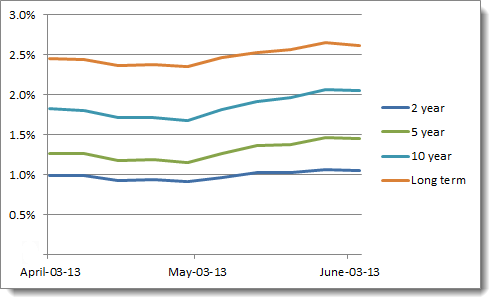

The chart below shows the yield on several benchmark Government of Canada bonds over the last two months:

Notice that all of these rates moved upward in May, and the steepest line belongs to 10-year bonds, which have seen yields jump from 1.68% at the beginning of the month to 2.07% on May 29. As a result the iShares DEX Universe Bond (XBB), the BMO Aggregate Bond (ZAG) and the Vanguard Canadian Aggregate Bond (VAB), all which have an average term of about 10 years, saw their market prices fall significantly during the month:

The price is only half the story

There’s another extremely important point to understand. Whenever you look up bond ETFs using a tool like Google Finance, as I did above, the results are highly misleading. These charts show only the change in market price, not the interest payments paid to investors in cash, so they do not reflect the total return of your bond ETF.

These days, with virtually all bonds trading at a premium, you should expect the market price of your fund to fall even if interest rates hold steady. However, the cash payments from the underlying bonds are in the neighbourhood of 3% to 3.5% for broad-based index funds, which will offset at least some of that price decline. Indeed, the three ETFs above each delivered a total return of more than 1.5% during the 12 months ending in May, even though their market prices fell considerably during that time.

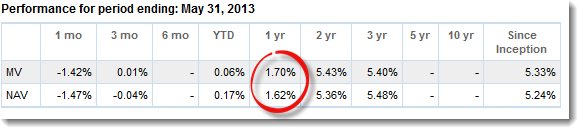

Remember this when you look at your brokerage statement. Say you bought ZAG on May 31, 2012, and paid $15.96 per unit. Exactly one year later its price was $15.70, so your statement would show a loss of –1.63%. However, the fund’s total return over that period was +1.62%, because the interest payments more than offset the price drop. You didn’t lose money, even though I’m sure some investors thought they did.

An individual fund’s total annual return never appears on your statements, so you should periodically visit your bond fund’s website to see how it’s really doing. Click the “Performance” tab to see the total return on the fund including price changes and reinvested interest payments. Here’s what they look like for ZAG:

If yields continue to rise, bond funds can and will deliver negative returns even after accounting for interest payments, so you should be prepared for that. Remember why bonds are in your portfolio: they lower overall volatility and provide a cushion when equities inevitably suffer a downturn. If bonds do have a difficult year, that’s not a reason to abandon them: it’s an opportunity to rebalance.

Follow up:

Disregarding tax issues, etc., for the sake of simplicity: I’m guessing that in a rising rate environment increasing YTM can be brought about, broadly speaking, in two ways:

A. reduce the unit price, keeping distributions more or less constant;

B. keep the unit price more or less constant, while increasing distributions.

How do ETF companies tend to balance out unit price v.s. distributions to achieve increasing YTMs? For example, can unit holders expect unit prices to stay within a certain range of the initial offering price before distributions are increased? Or is it possible that unit prices can drop precipitously to bring about increases in the YTM?

@John: In the short term, it’s A. When rates rise, the bonds in the ETF portfolio fall in price but the coupons (and therefore the distributions) don’t change. Gradually, as older bonds get sold near maturity and are replaced with newer, higher-yielding bonds, the distributions will increase, so B comes into play as well.

ETF providers don’t control the unit price or the distributions: the market does. The unit price simply reflects the value of the underlying bonds in the portfolio, and the distributions are simply the interest payments from those bonds. So, yes, the unit price can indeed fall precipitously when rates move sharply higher.

Hello CCP

Thanks you for the article. I am a TD E-Series Bond index fund holder, and I have been experiencing the exact scenario detailed in your article. My question is regarding the Avg. YTM of my bond fund. How does the Avg.YTM affect total returns and what can I expect by holding it beyond the avg.YTM? Thanks

“An individual fund’s total annual return never appears on your statements, so you should periodically visit your bond fund’s website to see how it’s really doing.”

I had iShares bond ETFs that paid a monthly interest in cash, so it was easy to see that there was more to the fund than just the share price.

But I’ll be damned if I can figure it out how to track interest in my work (Standard Life Canadian Bond Index) RPP. They told me there is no monthly payment, but that interest is paid whenever its paid. I’ve been wanting to see this in action, so have been checking the account every day for two months and have yet to see any change in the number of units or share price (other than the daily share price changes). I’d have assumed any interest payment would go to buying more units of the fund, but that hasn’t happened (yet).

Any suggestion on how interest is actually paid out in a fund like this? Is it only when the individual bonds mature at the end of the 5, 10, etc years?

@TJL: I’m assuming your RPP is invested in mutual funds. If so, then they are correct that the interest and dividends are paid into the fund as they are received. The unit price may change, though you would never notice because these changes would be disguised by the daily changes in the market price. Usually at the end of the year the fund distributes this income to investors: it could be paid in cash but in most cases it will be reinvested in new shares. That’s when you should see the number of shares increase. However, the price will fall by an equivalent amount, so the value of the holding won’t change.

This is confusing, I realize. The best explanation I’ve seen is on page 11 of this document:

https://www.phn.com/portals/0/pdfs/FormsandDocuments/030-2013-rbc-1834-S-tax-invet-mutal-fund-final.pdf

Thanks! That answers my question perfectly.

hello

I would like to invest in some bond ETFs for the fixed income portion of my portfolio.

I am quite worried that forthcoming rising interest rates will my demolish these bond funds value.

any thoughts on the folowing bond funds with respect to my concern:

ZAG 9.9 year duration

ZCS 2.9 year duration

ZLC 22 year duration

better to just stick with GIC?

thanks!

@dan: The short answer is to stick to short-term bonds or GICs if you are concerned about volatility in fixed income. One would expect that bond funds with a higher duration should have higher returns over the long run, but they absolutely can suffer larger losses over short periods. This may help:

https://canadiancouchpotato.com/2011/07/07/holding-your-bond-fund-for-the-duration/