The Couch Potato strategy calls for a significant allocation to US and international stocks. When you live in a country with a small, poorly diversified stock market, global diversification is extremely important. But it does carry a price in the form of foreign withholding taxes.

Many countries levy a tax on dividends paid to foreign investors: the rate varies, but for US stocks it is 15%. (Foreign withholding taxes do not apply to capital gains.) With broad-based US index funds now yielding about 2%, the withholding tax amounts to an additional cost of 30 basis points. As you can see, the impact of withholding taxes can be far greater than that of management fees, which get a lot more attention.

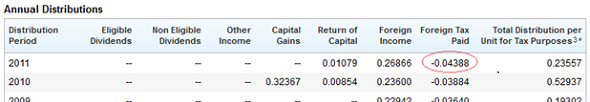

To learn how much tax is withheld by your fund, click the “Distributions” tab on its web page and look under the heading “Foreign Tax Paid.” Here’s what the table looks like for the iShares S&P 500 (XSP). Notice the amount of tax paid for 2011 ($0.04388 per share) is approximately 15% of the foreign income received ($0.26866):

Investors and advisors are often unaware of how foreign withholding taxes affect returns, and the reason is simple: they’re damned complicated. The amount of tax you pay varies with the type of account (taxable, RRSP, TFSA) and the structure of the fund.

What type of account?

Let’s start with account types. If you hold foreign stocks in a non-registered (taxable) account, withholding taxes always apply: if a company pays a 20-cent dividend each quarter, only 17 cents ends up in your account. The good news is the amount you paid will appear on your T3 and T5 slips and you can recover some or all of it by claiming a foreign tax credit on your return.

The other key point is that Canada has tax treaties with the US and many other countries that have agreed to waive withholding taxes on stocks held in registered retirement accounts, including RRSPs, RRIFs and Locked-In Retirement Accounts (LIRAs).

Note this exemption does not apply to Tax-Free Savings Accounts (TFSAs).

What type of fund?

The structure of the fund you’re using for your foreign investments is also extremely important—and even more confusing.

First consider Canadian funds that hold foreign securities directly, which includes mutual funds such as the TD e-Series and some (but surprisingly few) US and international equity ETFs on the Toronto Stock Exchange. Because these funds hold the individual stocks directly, the managers can track the withholding taxes and report them (through a T3 slip) to investors who hold the funds in a taxable account. That allows the investor apply for the foreign tax credit.

However, if you hold these funds in an RRSP, you forfeit the exemption you would otherwise receive on foreign withholding taxes. That’s because the fund itself pays the withholding taxes: you don’t pay it directly. And because you’re investing in an RRSP, the fund won’t issue a T3 slip that would allow you to recover it.

With US-listed ETFs the US withholding tax is recoverable in a non-registered account: you’ll receive a T5 slip that specifies the amount paid. Better yet, if you hold these ETFs in an RRSP, you’re exempt from US withholding taxes. The downside is that when a US-listed ETF holds international stocks there’s an extra layer of withholding tax applied by the stocks’ native countries. There is no way to recover that tax.

The final category is Canadian-listed ETFs that hold US-listed ETFs. These include a number of Canadian iShares and Vanguard funds. Rather than holding their underlying stocks directly, they simply hold units of their New York–listed counterparts.

When you hold these in a taxable account, you can recover taxes withheld by the US-listed ETF, but those withheld by non-US countries are not recoverable. In an RRSP, you may incur two levels of withholding tax and neither is recoverable, which makes this structure particularly tax-inefficient for international equities.

Confused yet? You’re not alone. To provide you with a handy reference I’ve broken down all of the categories, provided examples of common funds in that category, and summarized the tax implications in each type of account.

A. Canadian fund that holds US or international stocks directly.

TD US Index Fund e-Series (TDB902 and TDB904)

iShares US Fundamental (CLU and CLU.C)

BMO S&P 500 (ZUE and ZSP)

TD International Index e-Series (TDB911 and TDB905)

iShares International Fundamental (CIE)

BMO International Equity (ZDM)

iShares MSCI EAFE IMI (XEF)

- In a taxable account, US or international withholding taxes apply, but are recoverable.

- In an RRSP or TFSA, US or international withholding taxes apply and are not recoverable.

B. US-listed ETF that holds US stocks.

Vanguard Total Stock Market (VTI)

iShares S&P 500 (IVV)

- In a taxable account, US withholding taxes apply, but are recoverable.

- In an RRSP, US withholding taxes do not apply.

- In a TFSA, US withholding taxes apply and are not recoverable.

C. US-listed ETF that holds international stocks.

iShares MSCI EAFE (EFA)

Vanguard FTSE Developed Markets (VEA)

iShares MSCI Emerging Markets (EEM)

Vanguard FTSE Emerging Markets (VWO)

Vanguard Total International Stock (VXUS)

- In a taxable account, international withholding taxes apply and are not recoverable. US withholding taxes apply, but are recoverable.

- In an RRSP, international withholding taxes apply and are not recoverable. US withholding taxes do not apply.

- In a TFSA, international and US withholding taxes apply and are not recoverable.

D. Canadian ETF that holds a US-listed ETF of US stocks.

Vanguard US Total Market (VUS and VUN)

Vanguard S&P 500 (VSP and VFV)

iShares S&P 500 (XSP and XUS)

- In a taxable account, US withholding taxes apply, but are recoverable.

- In an RRSP or TFSA, US withholding taxes apply and are not recoverable.

E. Canadian ETF that holds a US-listed ETF of international stocks.

iShares MSCI Emerging Markets IMI (XEC)

iShares MSCI EAFE (XIN)Vanguard FTSE Developed ex North America (VEF and VDU)

Vanguard FTSE Emerging Markets (VEE)

- In a taxable account, international withholding taxes apply and are not recoverable. US withholding taxes apply, but are recoverable.

- In an RRSP or TFSA, US and international withholding taxes apply are not recoverable.

For tables suggesting the most tax-efficient account for each type of fund, see this post.

Many thanks to Justin Bender at PWL Capital for verifying the accuracy of this post. For more information, I also recommend this document from Dimensional Fund Advisors, which discusses international (non-US) withholding taxes in detail.

This post is intended for educational purposes only and does not constitute tax advice for any individual. You should always consult with a specialist before making any investment for tax reasons.

Excellent article, thank you! I have a question regarding ETFs that hold other ETFs that fall into these A,B,C,D,E categories. For example, XAW, which you recommend in your model portfolio. It includes IVV (category B), XEF (category A), IEMG (category C), among others. Does the tax treatment of XAW follow the tax treatment of the underlying ETFs that it holds? For example, is the IVV portion of its holdings (and the dividends it issues) subject to category B taxes, while XEF is subject to category A taxes, all while holding XAW?

This is a follow-up to my previous comment (although it hasn’t been posted yet). My previous comment was regarding XAW and its tax treatment. I had assumed that the tax treatment of XAW would follow the tax treatment of the underlying ETFs that it holds (i.e. category B for IVV, category C for IEMG, category A for XEF, etc). Now that I think about it a little more, I think my assumption was incorrect. To explain my reasoning, let’s look at XUS. XUS holds IVV. According to this page, IVV is category B if held directly but XUS is category D because it holds IVV. For the same reason, I imagine IVV’s portion of XAW would be category D, even though IVV is category B if held directly. Likewise, IEMG’s portion of XAW would be category E, even though it’s category C if held directly. I’m not sure about XEF, as XAW (a Canadian ETF) would be holding a Canadian ETF (XEF) that holds international stocks directly. I think that it would still be classified as category A but I’m not certain. So in other words, is it correct for me to conclude that XAW would get the tax treatment of categories D, E, and A because of IVV, IEMG, and XEF? There are other funds that XAW holds, but I excluded those for simplicity.

@Johnny: To get the foreign withholding tax exemption, a US-listed ETF has to be held directly by you in your RRSP. If it’s held within XAW, then it’s held indirectly by you, so there is no exemption. Justin’s calculator will help:

https://www.canadianportfoliomanagerblog.com/wp-content/uploads/2019/02/CPM-Foreign-Withholding-Tax-Calculator-2019.xlsx

Thanks for the link. Justin’s calculator is extremely helpful and it helped me understand XAW’s (and other aggregate funds’) taxation category. For anyone who’s wondering, XAW’s taxation is a combination of D, A, and E. Its breakdown is as follows:

IVV/IJG/IJR/ITOT -> D (note: these would be B if they were held directly)

XEF -> A

IEMG -> E (note: this would be C if held directly)

Combined weighted average unrecoverable withholding tax (per Justin’s spreadsheet) as of Dec 31, 2018 is:

TFSA: 0.36%

RRSP: 0.36%

Taxable: 0.04%

It seems to me that these withholding taxes make XAW fairly unattractive for registered accounts.

@Johnny: “It seems to me that these withholding taxes make XAW fairly unattractive for registered accounts.” I disagree. The withholding taxes are inevitable in a TFSA: there is no better alternative. In an RRSP, reducing withholding taxes would require you to hold multiple ETFs including some that trade in US dollars. The additional complexity and transaction costs would, in many cases, overwhelm the cost of the withholding taxes.

@CCP

Fair enough. As with most things, it depends on the situation, but your points are very valid.

Hi CCP – excellent article.

Wondering if VXC, VIU, VFV, VUN (hold in TFSA) are subject to 15% withholding tax.

Thanks

@Ale: Unrecoverable foreign withholding taxes apply on all US and international equity funds when held in a TFSA. There is no way to avoid these taxes if you hold foreign equities in TFSA.

An income trust that is listed on TSX has holdings in the US and pays the dividend in US currency……is there a withholding tax on this

@Ken: If the holdings are based in the US, then there will likely be withholding tax on any distributions. This is similar to holding US stocks via a Canadian ETF or mutual fund.

What if I buy a US stock in my TFSA that has no dividends like AMZN? Will I incur any losses that I am not foreseeing other than the currency exchange by the brokerage?

Thanks for providing such great information on FWT – I keep referring back to this when rebalancing my portfolio!

I have been keeping my Canadian equities in my TFSA and my US and Global equities in my RRSPs. however I need to purchase more foreign equities and don’t have anymore contribution in my RRSPs. I do have more room to contribute to my TFSAs though.

Would it be better to purchase those foreign equities in my TFSAs and accept the FWT impact, or purchase them in a taxable account so I can at least recover those taxes? Alternatively, should I just contribute to my TFSA but buy more Canadian equities, even though that would make my portfolio over weighted on that asset class?

thanks!

Greg

@Greg: While reducing FWT is a noble goal, it is quite far down on the list. By that I mean the “contribute to a TFSA v. RRSP” decision is much more important. It never makes sense to contribute to one account rather than the other simply because you plan to purchase more of a specific ETF that is already in one of those accounts. And it definitely never makes sense to use a non-registered account instead of a tax-sheltered account for FWT reasons.

This may help:

https://canadiancouchpotato.com/2015/01/30/the-wrong-way-to-think-about-withholding-taxes/

Thanks very much for the clear answer! I hadn’t seen the other blog post before but that definitely makes sense!

@CCP, your guidance and assistance please would be much appreciated as always…

I am currently in the process of researching/L&G and was planning to execute the following 70/30 ETF allocation post-retirement to achieve a desired 3.06% Dividend Yield on my investment portfolio to fund $40k~ annual living expenses and wanted to know if I understand the blog correctly from a tax-efficiency perspective.

RRSP / LIRA (contribution room for household maxed)

XUS.TO – – – 26% – – – $330k~ (R) / 40k~ (L)

XEF.TO – – – 10% – – – $140k~ (R)

XEC.TO – – – 5% – – – $70k~ (R)

TFSA (contribution room for household maxed)

ZRE.TO – – – 10% – – – $140k~

Non-Reg

XUS.TO – – – 4% – – – $50k~

XIU.TO – – – 5% – – – $70k~

VAB.TO – – – 30% – – – $420k~

PDC.TO – – – 10% – – – $140k~

1-RRSP/LIRA

All Dividends paid out by all ETFs.TO holdings would be subjected to both US and foreign withholding taxes that will NOT be recoverable at tax time? However, the minimum 10% withholding tax imposed by CRA on Dividend payout is deemed recoverable (assuming your household is at zero-rated tax level at year-end)?

2-TFSA

All Dividends paid out under ZRE.TO would be subjected to the withholding taxes that will NOT be recoverable at tax time but the Dividends is TAX FREE (vs if it was under Non-Reg, withholding tax on ZRE.TO is refundable but Dividend counts as regular income taxed at marginal rate)? Essentially, I am trying to quantify PROS vs CONS.

3.Non-Reg

a) All Dividends paid out by XUS.TO would be subjected to the US withholding taxes but will be recoverable at tax time?

b) All Dividends paid out by both XIU.TO and PDC.TO would be subjected to the withholding taxes but will be recoverable at tax time? They are also classified as Canadian Dividends and will be eligible for the DTC at tax time?

c) All Dividends paid out by VAB.TO would be subjected to the withholding taxes but will be recoverable at tax time?

4. Do you see a different configuration (than what I have listed above) that you would either proposed or consider to achieve the desired end-result of funding a $40k annual living expenses via dividend yield payout and executing the plan in a very tax-efficient ETF placement or ETF allocation structure between the three vehicles being used (being RRSP, TFSA, Non-Reg)? Essentially, I am wondering if I am even placing the correct ETFs in their proper slots to achieve the objective?

Hope I am not too far off and if I am, please do offer some insights for consideration. Thanks.

The foreign withholding tax on a typical S&P 500 index ETF is about 0.02-0.04 per dividend, placing the ETF on a margin account solely for the purpose of recovering withholding tax but to pay capital gains tax, which is significantly higher than the withholding tax, when you sell 20 years later seems to defeat the purpose of tax reduction.

Am I missing anything?

@Kylie: I think you’re identifying the issue I write about here:

https://canadiancouchpotato.com/2015/01/30/the-wrong-way-to-think-about-withholding-taxes/

If so, you’re correct that choosing to hold a foreign equity ETF in a taxable account instead of an RRSP or TFSA just to recover the withholding tax is short-sighted and counterproductive.

In the article you mention that foreign withholding taxes apply to a canadian etf that holds US and international stocks directly and are not recoverable in a RRSP RESP or TFSA. I read elsewhere an RRSP is exempt from US withholding taxes. What am I missing? Thanks.

@t: Foreign withholding taxes are only exempt in an RRSP if you hold a US-listed ETF. If you use Canadian-listed ETFs the withholding tax is not recoverable.

What would you recommend for a student who only has a couple thousand to invest. I am just starting out and have only opened a TFSA account so far. I am still looking to diversify with around three ETFs. I was wondering since I am starting out small if It would make a difference If I invest in a S&P500 fund in my TFSA since the taxes would be negligible or if I should open a RRSP for this purpose.

@Aj: If you have a few thousand dollars to invest, I would highly recommend using a single ETF as outlined in my model portfolios. Using multiple ETFs to invest a small dollar amount is very inefficient. And it does not make sense to open an RRSP simply to avoid foreign withholding taxes:

https://canadiancouchpotato.com/2015/01/30/the-wrong-way-to-think-about-withholding-taxes/

I urge you to keep your investing life as simple as possible!

If I hold EWC in my TFSA, RRSP, or taxable accounts, will there be any FWT?

It’s a unique situation not covered usually, because it’s a US-listed ETF that holds Canadian stocks.

Hi,

If I wanted to invest exclusively in U.S. stock market via a US broad market index (i.e. S&P 500 or a Total Stock market index) via a Canadian-listed ETF (i.e. VSP, VFV, VUS, VUN, XSP, ZUE, HXS, HSH, etc) – in a CAD-hedged or un-hedged variant, for a quite large portfolio (350K CAD), and purchasing with CAD funds, in a taxable / non-registered account, and assuming a below 10% (or zero) Canada income tax rate, what would you advise me to do?

– Being under 15% Canadian income tax rate, obviously the Foreign Tax Credit will not recover the IRS 15% Withholding tax on US dividends, fully! Is there a way to recover the remaining part that the FTC would not be able to recover?

– Would you advise using Horizon US S&P 500 ETFs such as HSX or HSH? In other words, relying on their “financial mavericks” to stay on top of the taxman game, and translate those US dividends into re-invested strategy and whose final outcome would be pure Capital Gains (and taxable only upon selling, that is when getting crystalized / realized)?

– Should we assume that CAD parity against USD will begin to grow and hence a CAD-hedged Canadian-listed ETF holding US ETF would be the better strategy, instead of unhedged?

I would gladly focus on US securities (which are a MUST to be Canadian-listed, because I wish to pay in CAD and not do the Norbert’s Gambit to convert them to USD) that are not producing dividends. But is there such thing, and which MUST be a Broad US index, not a sector or a handful of individual US stocks?

Maybe I should start with describing my overall situation and main objective: I was keeping this CAD money since 2013 (when I’ve sold my house) and the intention was to convert all of them to USD. But right after end of 2013, the CAD started to weaken.

So I’ve waited and waited, hoping that it will get back to 1:1 parity with USD.

So here I am: At the end of 2021 still holding the CAD with a 1% pesky interest rate from a savings accounts. And I became so disillusioned with any hope of CAD getting back to 1:1 parity with USD, that I suddenly decided now a radical change of strategy. Which is: Bet it all on the stock market (Canadian market or US, but I would favor US due to higher diversification and upwards opportunity in growth), keep the money there for 1-2-3 years, even with the CAD still weak (I define weak CAD when 1 USD >= 1.20 CAD). And then after that max 3-year time period (or as soon as I see CAD reviving significantly), sell it all, get my CAD back but with a bit of growth to compensate the bad Forex conversion rate, then move it all to TD Web Broker (since my current discount brokerage which is WealthSimple Trade, doesn’t seem to support Norbert’s Gambit), do a Norbert’s Gamit with TD Web Broker, and then finally convert to USD, and then transfer it out thru other means.

So, what would you advise to do if you were in my shoes? Am I foolish trying to enter the stock market just for 3 years, hoping to make enough profit to make up for a bad CAD => USD conversion rate?

Thank you.