The Couch Potato strategy calls for a significant allocation to US and international stocks. When you live in a country with a small, poorly diversified stock market, global diversification is extremely important. But it does carry a price in the form of foreign withholding taxes.

Many countries levy a tax on dividends paid to foreign investors: the rate varies, but for US stocks it is 15%. (Foreign withholding taxes do not apply to capital gains.) With broad-based US index funds now yielding about 2%, the withholding tax amounts to an additional cost of 30 basis points. As you can see, the impact of withholding taxes can be far greater than that of management fees, which get a lot more attention.

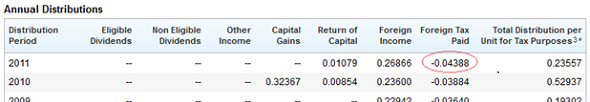

To learn how much tax is withheld by your fund, click the “Distributions” tab on its web page and look under the heading “Foreign Tax Paid.” Here’s what the table looks like for the iShares S&P 500 (XSP). Notice the amount of tax paid for 2011 ($0.04388 per share) is approximately 15% of the foreign income received ($0.26866):

Investors and advisors are often unaware of how foreign withholding taxes affect returns, and the reason is simple: they’re damned complicated. The amount of tax you pay varies with the type of account (taxable, RRSP, TFSA) and the structure of the fund.

What type of account?

Let’s start with account types. If you hold foreign stocks in a non-registered (taxable) account, withholding taxes always apply: if a company pays a 20-cent dividend each quarter, only 17 cents ends up in your account. The good news is the amount you paid will appear on your T3 and T5 slips and you can recover some or all of it by claiming a foreign tax credit on your return.

The other key point is that Canada has tax treaties with the US and many other countries that have agreed to waive withholding taxes on stocks held in registered retirement accounts, including RRSPs, RRIFs and Locked-In Retirement Accounts (LIRAs).

Note this exemption does not apply to Tax-Free Savings Accounts (TFSAs).

What type of fund?

The structure of the fund you’re using for your foreign investments is also extremely important—and even more confusing.

First consider Canadian funds that hold foreign securities directly, which includes mutual funds such as the TD e-Series and some (but surprisingly few) US and international equity ETFs on the Toronto Stock Exchange. Because these funds hold the individual stocks directly, the managers can track the withholding taxes and report them (through a T3 slip) to investors who hold the funds in a taxable account. That allows the investor apply for the foreign tax credit.

However, if you hold these funds in an RRSP, you forfeit the exemption you would otherwise receive on foreign withholding taxes. That’s because the fund itself pays the withholding taxes: you don’t pay it directly. And because you’re investing in an RRSP, the fund won’t issue a T3 slip that would allow you to recover it.

With US-listed ETFs the US withholding tax is recoverable in a non-registered account: you’ll receive a T5 slip that specifies the amount paid. Better yet, if you hold these ETFs in an RRSP, you’re exempt from US withholding taxes. The downside is that when a US-listed ETF holds international stocks there’s an extra layer of withholding tax applied by the stocks’ native countries. There is no way to recover that tax.

The final category is Canadian-listed ETFs that hold US-listed ETFs. These include a number of Canadian iShares and Vanguard funds. Rather than holding their underlying stocks directly, they simply hold units of their New York–listed counterparts.

When you hold these in a taxable account, you can recover taxes withheld by the US-listed ETF, but those withheld by non-US countries are not recoverable. In an RRSP, you may incur two levels of withholding tax and neither is recoverable, which makes this structure particularly tax-inefficient for international equities.

Confused yet? You’re not alone. To provide you with a handy reference I’ve broken down all of the categories, provided examples of common funds in that category, and summarized the tax implications in each type of account.

A. Canadian fund that holds US or international stocks directly.

TD US Index Fund e-Series (TDB902 and TDB904)

iShares US Fundamental (CLU and CLU.C)

BMO S&P 500 (ZUE and ZSP)

TD International Index e-Series (TDB911 and TDB905)

iShares International Fundamental (CIE)

BMO International Equity (ZDM)

iShares MSCI EAFE IMI (XEF)

- In a taxable account, US or international withholding taxes apply, but are recoverable.

- In an RRSP or TFSA, US or international withholding taxes apply and are not recoverable.

B. US-listed ETF that holds US stocks.

Vanguard Total Stock Market (VTI)

iShares S&P 500 (IVV)

- In a taxable account, US withholding taxes apply, but are recoverable.

- In an RRSP, US withholding taxes do not apply.

- In a TFSA, US withholding taxes apply and are not recoverable.

C. US-listed ETF that holds international stocks.

iShares MSCI EAFE (EFA)

Vanguard FTSE Developed Markets (VEA)

iShares MSCI Emerging Markets (EEM)

Vanguard FTSE Emerging Markets (VWO)

Vanguard Total International Stock (VXUS)

- In a taxable account, international withholding taxes apply and are not recoverable. US withholding taxes apply, but are recoverable.

- In an RRSP, international withholding taxes apply and are not recoverable. US withholding taxes do not apply.

- In a TFSA, international and US withholding taxes apply and are not recoverable.

D. Canadian ETF that holds a US-listed ETF of US stocks.

Vanguard US Total Market (VUS and VUN)

Vanguard S&P 500 (VSP and VFV)

iShares S&P 500 (XSP and XUS)

- In a taxable account, US withholding taxes apply, but are recoverable.

- In an RRSP or TFSA, US withholding taxes apply and are not recoverable.

E. Canadian ETF that holds a US-listed ETF of international stocks.

iShares MSCI Emerging Markets IMI (XEC)

iShares MSCI EAFE (XIN)Vanguard FTSE Developed ex North America (VEF and VDU)

Vanguard FTSE Emerging Markets (VEE)

- In a taxable account, international withholding taxes apply and are not recoverable. US withholding taxes apply, but are recoverable.

- In an RRSP or TFSA, US and international withholding taxes apply are not recoverable.

For tables suggesting the most tax-efficient account for each type of fund, see this post.

Many thanks to Justin Bender at PWL Capital for verifying the accuracy of this post. For more information, I also recommend this document from Dimensional Fund Advisors, which discusses international (non-US) withholding taxes in detail.

This post is intended for educational purposes only and does not constitute tax advice for any individual. You should always consult with a specialist before making any investment for tax reasons.

@Art: It’s impossible to say too much without knowing the details of your situation, but your plan sounds generally fine. A couple of observations: If you want to hold equal amounts of US and international stocks, you won;t be able to do that with a Us equity ETF in one account and VXC in another (you will always be overweight US stocks). So you might want to use separate ETFs for US and international in the RRSP. Similar issue with the 50/50 mix of REITs and bonds in the TFSA. The proportion of each asset class in the TFSA doesn’t really matter: it’s the proportion in the overall portfolio that is more important.

https://canadiancouchpotato.com/2012/03/12/ask-the-spud-investing-with-multiple-accounts/

https://canadiancouchpotato.com/2014/08/13/managing-multiple-family-accounts/

My reasoning was that although the lira is 30% of the portfolio right now, i will never cobtribute to it. Therefore, as my canadian (tfsa, nonregistered) and us +international (rrsp) holdings grow, i will rebalance the portfolio. Is it really that bad to have some initial skew in %, if you know that cashflow rebalancing is imminent?

The lira is my army pension and i just wanted to put an efficient fund into it and not worry as it becomes much smaller portion of the portfolio.

As for tfsa, the 50/50 would give me a rough allocation of 15%/15% of the portfolio for now, but how would i maintain the proper ratio? Contribution room doesnt increase that quickly and tfsa seems to be the most efficient account for fixed income and reit.

Thoughts?

@art: Again, impossible to say more without knowing all the details. Your asset location (i.e. which fund goes where) will have to evolve over the years, since the contribution room will increase at different rates in the RRSP and TFSA, and not at all in the LIRA. As you’ve discovered, managing multiple accounts like this is probably the hardest part of DIY investing. It sounds you’re on the right track so far.

Hello,

if i wanted to invest equally in a US-listed ETF that holds US equity vs. US-listed ETF that holds international equity, which would go in RRSP and which in taxable account then?

or should I just go half-half for each?

thanks!

@dan: Currently the yield on international equities is higher, so it would likely make more sense to keep that asset class in the RRSP to reduce the amount of tax you’d pay on foreign dividends.

Hello, I am thinking about adding VFV to my portfolio. I currently trade with TD Waterhouse and use their platform to purchase these shares.

I’ve read your posts over many times, and still dont fully understand about the tax implications I may face.

I dont have an RRSP or TFSA acct set up, I would just hold this fund in my trading account.

So lets say I bought 100 shares of VFV a year ago for $3496. The stock is valued at $42.97 today, and would have received $43 total in dividend pymts since buying.

If I were to sell it now for $4297, would their be any tax I would be required to pay on the $801 increase in value? or will i be only taxed 15% on the $43 dividend pymt recieved since buying?

Do you have any input on choosing between VFV or the TDB902, would I be better off either one or is it same etf, different pile?

thanks alot for this awesome site!

@Andre: Foreign withholding taxes do not apply to capital gains, only dividends. So if your holding of VFV paid $43 in dividends, that money would be subject to withholding tax of of $6.45 ($43 x 0.15). That amount would appear on the T3 slip you receive at tax time and you can claim a foreign tax credit to recover it.

You would still have to report an $801 capital gain on your tax return, and half of this would be taxable at your marginal rate. But this has nothing to do with foreign withholding tax. It’s just plain old Canadian capital gains tax.

http://www.taxtips.ca/filing/capitalgain.htm

The holdings and the tax treatment of VFV and TDB902 are virtually identical. The decision comes down to whether you prefer the lower management fee (advantage ETF) or avoiding all trading commissions (advantage mutual fund).

https://canadiancouchpotato.com/2012/07/30/comparing-the-costs-of-index-funds-and-etfs/

Dan,

What is the % for withholding tax, if any, charged for holding UL and GSK ADRs in an RRSP account? I am referring to dividends paid.

Thanks

@Alex: I wish there was a straightforward answer, but there doesn’t seem to be. See this article on withholding taxes as they apply to ADRs:

http://www.theglobeandmail.com/globe-investor/personal-finance/taxes/global-dividend-hunters-must-beware-tax-trap/article9840189/

I use a program called plus 500 out of London England I am Canadian. do I have to pay tax on any earnings from this cfd company?

I own XUS.

“In a taxable account, US withholding taxes apply, but are recoverable.”

Am I right that if I didn’t pay any Canadian tax, then it is NOT recoverable? I’m a student with not enough taxable income to pay any taxes to the CRA. I’m filing my taxes and from what I can see, the foreign withholding tax credit can only be used to reduce taxes (the amount on line 405 must not be above line 429). Does this seem right?

@Max: You’re correct: the foreign tax is non-refundable, so if you did not pay any Canadian tax then you will not receive a refund.

Hi,

1. I’m not sure which of the couch potato portfolio’s I should choose.

Option 1: VAB, VCN, VUN, VDU (Developed Excluding North America), VEE (Emerging Markets)

Option 2: VAB, VCN, VXC (World excluding Canada)

Is the obvious one to choose option 2 just to save MER fees? Or is there more diversification in option 1? Less tax implications in one of them (I could not find VXC in the article of “foreign withholding tax:which fund goes where”). Or taking into consideration MER and taxes which would be the best option in the long run?

2. I was also planning on investing in a real estate ETF. CCP recommends two but one of them is using an equal weight strategy with a higher MER and the other is using a cap weighted strategy with a lower MER. Which is more beneficial in the long run?

Thanks CCP

@Jon: the tax implications and diversification are virtually the same. Option 1 is just so much simpler, especially if the whole portfolio is in a single account.

The REIT decision is really up to you. I like the equal-weighted strategy in a sector fund that would otherwise be dominated by a few big names. But the lower cost also has advantages, obviously. Just understand that the performance may be quite different from year to year:

https://canadiancouchpotato.com/2013/12/19/why-has-vre-outperformed-its-rivals-in-2013/

Thanks for the reply I just have a couple more questions.

1. I just read Justin’s tax efficiency example for ETFS and want to make sure I have this down.

-For bonds and REITS I will have them in my TFSA to prevent tax implications on interest and capital gains

-For U.S. or international ETFs I should look at which ETF has the higher dividend yield and put whatever I can in my RRSP first. Anything leftover will go to my TFSA (if I have room) because it’s more advantageous to NOT get taxed in a TFSA on foreign income at my marginal rate than recoup foreign tax withheld.

Would you agree with the above?

2. I am 27, I have a total $100K right now, $50K in non registered and $50K in TFSA just cash in the account.

Unfortunately, the past 2 years I have $50K invested equally in a NON-registered account in CDN banks (BMO, TD, BNS, NA, RBC) in DRIP, before I came across this website and I cannot sell them because I don’t want to deal with the tax implications of capital gains, etc.

My question is if I want to split like one of your portfolios: $30K (CDN), $30K (US), $30K (International), $10K bond/REIT, which is impossible at the moment because 50% is allocated to CDN banks, should I try to split the remaining $50k between US,International, and bonds and NOT invest in anything in CDN ETF. My thinking is since banks hold majority in CDN ETF then I will treat the 50K I have right now as a CDN ETF and only purchase a CDN ETF only to commit to the 30% split I would like in my portfolio in the future. If you do not agree with this, I would really like your opinion on a proper split as from reading up on this website and other forums your method seems to be working for a lot of investors.

Really appreciate it, thanks CCP

@Jon: Your suggested split between TFSA and non-registered accounts sounds about right.

As for the second question, I can’t recommend you sell or buy anything specifically. But I will say that if you want to avoid paying capital gains taxes on your bank stocks you will probably hold them for the rest of your life. So I would ask whether it makes more sense to consider realizing a pretty small gain now and building your portfolio properly rather than continuing to let that one past decision drive your future strategy.

If I keep US stocks in my RRSP and I get the tax form from the company requesting me to submit it to IRS, do I need to do it?

Can you please explain the difference on when one from Canada should be submitting these type of forms if he/she is purely a resident of Canada (not USA); just owns US stocks.

Does it depend on which accounts one keeps US stocks or is it regardless of the account we need to submit the forms to IRS?

@Jim: You will not get any tax slips for US stocks or ETFs held in registered accounts. And unless you are a “US person” you don’t need to report anything to the IRS. Even if you are a US person you should not have to report holdings in an RRSP, provided to you file the proper paperwork:

https://canadiancouchpotato.com/2014/06/18/us-investors-in-canada-what-to-watch-for/

Hello -I’ve some questions about US withholding tax on US dividends to Canadians. Would appreciate very much for your help.

(1) Recently I purchased some shares in a US company and received its dividend payment. Total gross payment in Cdn. funds is about $1,200 and a w/holding tax of Cdn.$500+ was deducted. Even considering the US/Cdn. conversion, this rate (almost 40%) seems extremely high. I purchased the shares thru’ a Cdn. discount brokerage firm and am following up with it. But I worry this could be a long, circuitous process to go thru’. In the meantime can you advise if:-

(a) in your experience there might be a reason for this high rate; and

(b) how best one can follow up such cases.

(2) I understand in general the Foreign Tax Credit concept in Cdn. tax returns but just am curious to know if a Cdn. resident (not residing in USA) can recover the US W/holding tax by filing a US tax return -Have no income from US sources other than the dividend income from this stock (just a thought, probably not worth the effort anyways).

Thank you so much for your help!

@Stephen: You should consult a tax specialist about this question. But in general:

1) The normal US withholding tax on dividends is 30%, but that is reduced to 15% if you file a W-8BEN form through your brokerage. That would be the first thing to investigate. Note that some US investments (such as master limited partnerships) have higher withholding rates on distributions than conventional company dividends.

2) It’s not possible or necessary to reclaim the foreign withholding tax via the US. You receive a credit for this amount when you file your Canadian tax return, so you are paying the fair amount.

Hi -Thank you for your reply. Very much appreciated.

I still have a question about (2) in my earlier e-mail. That is, if a higher rate of US withholding tax has been applied to the 1st dividend payment (because of non-filing of W8BEN or even for other whatever reasons) and later problem rectified (e.g., by filing a W8BEN now), is there any way to recover the over-deducted tax on the 1st payment?

As always, thank you for your advice.

@Stephen: The amount of foreign tax paid should appear on your T-slip next year. If it does, you can claim the foreign tax credit.

Which is more advantageous the dividend tax credit for canadian stock or foreign divident tax credit for foreign stock?

Or which provides more of a refund % wise?

Thanks

@Jason: The foreign tax credit doesn’t really offer any true refund: it simply makes sure you’re not taxed twice on the same dividend. Let’s say you are in a 40% tax bracket and you receive $100 in US dividends. The withholding tax takes 15%, so you will actually receive only $85 in your account. However, your T-slip will report $100 in foreign dividends, which will be taxed at 40% in Canada. So now you have paid 55% tax. But the T-slip will also report $15 in foreign tax paid, which you can recover with the foreign tax credit. In the end you only pay 40% tax.

The Canadian dividend tax credit is quite different, though it is also designed to eliminate double taxation. It simply recognizes that your dividends have already been taxed once at the corporate level before being paid to you, and so the tax you pay is reduced accordingly.

Regarding:

A. Canadian fund that holds US or international stocks directly.

Is it that foreign dividends get taxed at the fund level? If so, then why should there be a difference in the tax treatment based on the type of account in which the investor holds the Canadian fund (recoverable for taxable account, but nonrecoverable for RRSP/TSFA).

If it’s that foreign dividends get taxed at the investor level, then why is there a difference in treatment of US stocks held in a Canadian ETF vs US ETF in an RRSP? (nonrecoverable in the former but recoverable in the latter)

In a website called taxtips.ca, they say there is no 15% U.S. withholding tax on dividends of U.S. stocks held within the RRSP because there is a tax treaty between Canada and the U.S. You say there is withholding tax. Who is right?

@Donald: We’re both saying the same thing. The key idea is that you must hold US stocks or ETFs directly in your RRSP to be exempt from the withholding tax. If you use a Canadian ETF or mutual fund that holds the US stocks, then you will pay the withholding tax even in an RRSP.

With the changes the index that VEA tracks such that it now has 8% Canadian stocks I am debating whether to make any changes to my portfolio which consists of VEA, VTI, VWO and XIC. VEA currently represents 40% of my equities and all are in registered accounts.

One the one hand I prefer to have fewer holdings and I am reluctant to switch VEA for VPL and VPK as it increases complexity and the MER is three basis points higher.

On the other hand I do not like paying withholding taxes on the Canadian portion of VEA. I am wondering how I would calculate the impact of level 1 and 2 withholding taxes on the Canadian portion of VEA in an RRSP and RESP?

Also I wonder if overtime rebalancing bonus is likely to offset the increased MER cost of holding VPL and VGK.

Note my accounts allows me to buy ETF without commission.

Do you have any comments on the impact of withholding taxes on the Canadian portion?

@RJ: In principle your concern is valid, but in practical terms I suspect we’re talking about a trivial cost that isn’t worth worrying about. It’s always important to do the calculations so you know the dollars involved and not just the percentages. Using a few assumptions:

– Your holding in VEA is $50,000.

– 8% of that is Canadian stocks, so that’s $4,000.

– The current yield on the broad Canadian market is about 3%.

– That means the amount of Canadian dividends is about $120 a year.

– If the withholding tax is 15%, that’s $18 a year.

After doing the math, is it worth it to switch?

Thanks CP. So continuing to work with those assumptions the difference in MER is 3 basis points on the international portion or .0003 x $46,000 or $13.80 and -.0004 x $4000 or ($1.20) on the Canadian difference between VEA and XIC. This means the net cost in increased MER from going to VPL and VGK is .$12.60 on $50,000 vs. the $18 you calculated. The difference of $5.40 on $50,000 is the equivalent of one basis point. Certainly not especially significant, but I still like understanding the math so that I can understand what the optimal decision would be.

Honestly the biggest reason I might not use VPL and VGK even if I was starting fresh is the increased complexity and the necessity of of deciding what asset allocation to make to each.

The one question I still have is would you still end up paying the full $18 in withholding taxes on the Canadian portion of VEA if it is held in a RRSP or only one of the levels?

@RJ: In an RRSP, Level I withholding taxes would apply with VEA, but Level II would not. The presence of Canada in the fund will not change that. Have you seen our white paper?

https://canadiancouchpotato.com/2014/02/20/the-true-cost-of-foreign-withholding-taxes/

How does the 15% dividend foreign credit work if you use margin loan?

The broker withholds the full 15% on the total dividend but when you report your income you substract interest expense. So this means you can’t recover the full amount?

E.g. $1000 dividend * 15% = $150 withheld. Normally I’d get the $150 tax credit. But if I borrow and have $500 interest expense, my net income is $500. My normal tax would be say $75 on this. But I paid $150. I read that they never give you back more than you would have paid so do you just lose the other $75? That would seem to be a form of double taxation. Thanks.

@Bill: I don’t have any experience with investing on margin, but I don’t think it changes anything. The only factors are the number of shares you own and the dollar value of the dividend. So if you own 1,000 shares and they pay a $1 dividend, you would receive $850 and the brokerage would withhold $150. Your T-slip would then report that you received $1,000 in dividends (which you must report) and paid $150 in foreign tax (which you can reclaim). Whether you borrowed the money to buy those shares should not make any difference: the deductibility of any interest you pay is a different calculation.

As always, check with your accountant or tax preparer.

CRA requires that you break down the foreign tax paid by countries if it is more than $200. How can you come with that information when your ETF provider does not give you that information on the T3? I phoned my ETF provider and was told that it only provides distribution information and it is not required to provide the break down by country.

@Gary: This is a great question we have encountered, too, and there really isn’t a satisfying answer. You can’t report what you don’t know, and I am not aware of CRA ever coming down on this issue. For US-listed ETFs (even if they hold international equities) you can make a good argument for putting “United States.” For Canadian ETFs of international equities you could put “Other” and explain the predicament if challenged.

Hi CP,

I have a question about US LPs securities held in RRSP account and dividend distribution. I thought that all tax withholdings are exempted if US securities are held in RRSP account. Since I received less then the full amount for dividend distribution, I inquired about it with my broker. They are saying that tax withholding on dividend distributions by US LPs are not exempted.

I searched on-line and so far I couldn’t find the confirmation. That’s how I came across your website.

If what broker company is telling me is true, is there a way to get tax withheld amount back via tax return?

If that is not true, what is it that I could do to receive this tax withheld amount?

Thanks,

Zoran

@Zoran: As I understand it, distributions from LPs are not considered dividends, so they are not included in the exemption to withholding taxes in an RRSP.

According to Jamie Golombek in a Globe and Mail article:

Source: http://www.theglobeandmail.com/globe-investor/investor-education/answers-to-your-tangled-tax-questions/article1372575/

Hi,

Concerning Zoran’s question, I think distributions from a US-listed MLP ETN (such as AMJ) inside an RRSP would have no tax withheld.

But I have a question on the issue:

The Canada-US tax treaty says US interest payed to a Canadian resident can only be taxed in Canada. So considering distributions from US-listed ETNs and US-listed US-bond ETF (such as SJNK) are made of US interest, would there be withholding tax inside a TFSA?

Thanks!

Dan

@Dan: Interest from US bonds is generally not subject to withholding taxes, but there are some exceptions. If you hold a US-listed ETF in a TFSA I would definitely look closely at your statements to see whether you receive the full distribution.

I am an individual who own stocks of corporation from many countries outside North America. My stockbroker (HSBC InvestDirect) is inept when it comes to ensure the adequate foreign withholding tax on dividends is applied. The general problem is:

1-My stockbroker does not want to handle neither the Claim of Tax Treaty Benefits nor the Tax Refund Claim forms.

2-The country where the company is located (for instance Korea) keeps telling me to go to my broker as they are suppose to handle it.

3-My domestic country does not want to be involved and their tax agents have no clue.

This seems to be a problem many investors face. I do not want to get too much into the specifics of my case at this point since it could be easy to get lost into the details.

Questions 1- Is there a way for me to ensure I get the refund for the excessive foreign withholding tax, meaning above the tax treaty rate?

Questions 2-Is anyone aware of a global stockbroker which will handle the paperwork as in #1, as opposed to simply give their customers the brush off.

Regards,

Hello,

I have two questions:

1. Does foreign withholding taxes apply to foreign (including US) bonds?

2. Where to put foreign bonds, in RRSP, TFSA or taxable accounts?

Thank you!

Michael

@Michael: There is no foreign withholding tax on bond interest. As for where to hold them, it depends on the characteristics of the fund. If the fund is filled with premium bonds (which is likely) then it will be extremely tax-inefficient and therefore best held in an RRSP. It’s generally unwise to hold bonds in a TFSA in this era of low expected returns on fixed income. Better to hold high-growth assets in the TFSA to take advantage of its tax-free status.

I am aware when being hit with the 15% withholding tax by the IRS in a non-registered account you can recover this when filing taxes with the foreign dividend tax credit, but I’ve always wondered, what percentage of the 15% do you recover? OR do you recover the full 15%?

Cheers!

@Vito: You can recover all of it. The specific amounts will be reported on your T-slips.

Hello,

Love your website :)

Under which category would you classify XAW?

Would you recommend it for a 35K RRSP account with ZAG and VCN?

Thanks,

Claire

How are RDSP’s treated in relation to withholding taxes?

@Susan: RDSPs (and RESPs) are treated the same as TFSAs.

Hi, I am currently using a Robo Advisor (Wealthsimple) and I’m interested in making the switch to Questrade and your model portfolio. I was comparing the assets I’m currently holding and figured I have numerous US Listed ETFs that hold US stocks, namely VTI. If I understand well, holding those in my RRSP account is the most efficient way of doing business tax wise (not taxed), but I figured I might be exposing myself to conversion fees, since my account is in CAD. Do you think those fees are included in the management fee or am I likely getting hosed on conversion rates without knowing?

Also, I like the idea of holding a little more emerging market ETFs. Is IEMG or XEC the best option for RRSPs and TFSA and would it be a good option when coupled with your model portfolio? My wealth simple portfolio currently holds 10% IEMG

Thanks !

JP

How does withholding tax affect Canadians who own a property in the USA when they sell and live in Canada.

@Gary: This situation (selling real estate) is unrelated to the foreign withholding taxes levied on dividends from US stocks.