Model portfolios like those I recommend are ideal for investors who have a single RRSP account. But life isn’t so simple once you’ve accumulated a significant portfolio: chances are you’ll be managing two or three accounts, and if you have a spouse there may well be a few more.

In most cases, it’s most efficient to consider both partners’ retirement accounts as a single large portfolio. In other words, there’s no my money and my spouse’s money: there’s only our money. This strategy has a couple of advantages: first, it allows the family to make the most tax-efficient asset location decisions. Second, it keeps the overall number of holdings to a minimum, which reduces transaction costs and complexity.

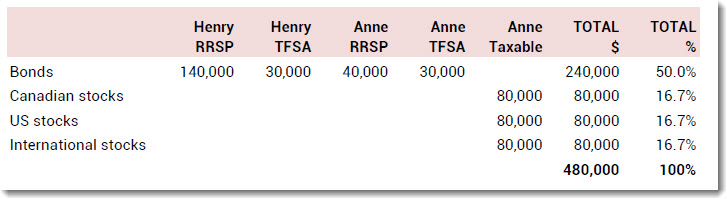

Meet Henry and Anne, who have a combined portfolio of $480,000. Let’s assume they are the same age and plan to retire at about the same time. Their financial plan revealed that a mix of 50% bonds and 50% stocks is suitable for their risk tolerance and goals. Anne has a generous defined benefit pension plan and therefore has little RRSP room: most of her personal savings go to a non-registered account. Henry has no pension plan and makes regular RRSP contributions.

If we treat all their accounts as a single portfolio, here’s how one might set it up for maximum efficiency:

With this setup, all of the bonds are in tax-sheltered accounts and the equities are in Anne’s non-registered account, which is likely to result in a lower tax bill. Moreover, the whole portfolio can be built with just seven holdings (six if they use an ETF that combines US and international equities). Nice and tidy.

Keeping it in balance

But there are potential problems here. For starters, if Henry and Anne view their accounts separately, they’ll notice his accounts are 100% bonds, while hers are over 77% equities. Although the overall mix is a balanced 50-50, the individual spouses are taking dramatically different levels of risk. This is purely behavioral, and there’s no need to make any changes if Henry and Anne are comfortable, but it’s an issue that frequently comes up with couples.

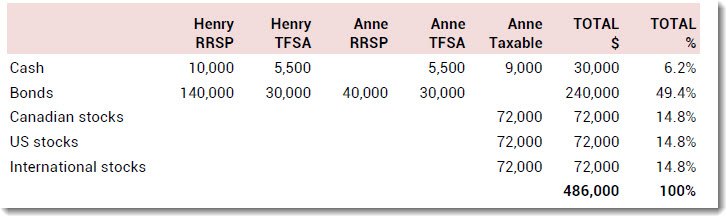

More daunting problems can arise when it’s time to add new money and rebalance the portfolio. Fast-forward a year and assume stocks have fallen in value by 10%. We’ll also imagine that Henry and Anna have made their TFSA contributions for the year, Henry has put $10,000 in his RRSP and Anne has added $9,000 to her non-registered account. Now the portfolio looks like this:

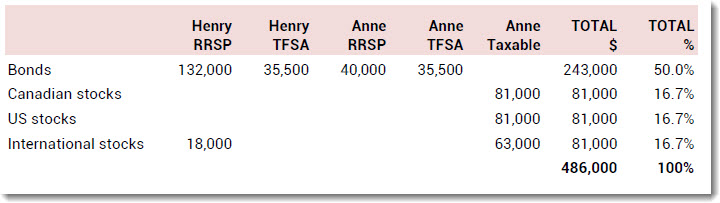

We need to rebalance to get back to the 50-50 target, but we can’t do that by simply adding to the existing holdings. The equity allocation needs to be $243,000 (50% of the total), but we only have $225,000 in the non-registered account. So we’ll have to sell some bonds in one of the registered accounts and use it to buy equities. International equities are the least tax-efficient (because they are not eligible for the dividend tax credit and they have a higher yield than US equities), so they should be the first candidate. Here’s one solution:

In many ways it would be simpler to just use a 50-50 asset mix in each individual account: that would certainly make rebalancing easier. But it also mean a lot more transaction costs and probably a higher tax bill, especially if Anne used bond ETFs in the taxable account. Using the above strategy takes a little more planning and experience, but it should produce the best results.

@ Justin Bender:

“4. Our analysis assumed no tax loss selling strategy was implemented. This would have also allowed for a further deferral of capital gains taxes from rebalancing.”

Yes. This aspect is too often ignored.

The opportunity to harvest taxable capital losses from taxable account holdings, and thus reduce future tax liabilities, is a valuable free option provided by the legislator.

As usual, the greater the volatility of the underlying, the more valuable an option – so if one assumes equity returns will be more volatile than fixed income in future, one would prefer to hold equities in taxable accounts to maximize the value of the tax loss harvesting option.

@Justin: Interesting point, #5. Do you suggest doing that rather than using GICs/ZDB in your taxable account as a routine, or just in particular circumstances?

@Tristan: Although each investor’s situation would be different, I tend to hold most of our clients’ equities in their taxable account (Canadian first, then U.S., then international), and if there is still room, I would allocate the rest of the account to GICs or the DFA Five-Year Global Fixed Income Fund (DFA231), which currently has an extremely low weighted-average coupon (about 1.25% as of the end of 2013).

Which account I rebalance from would depend on a number of other factors. For example, if they are a relatively new client, they would most likely have capital losses that I could realize in the taxable account first – if this were the case, I would be less concerned with the future potential capital gains from rebalancing as the markets recover later on, so I’d probably just rebalance in the taxable account using the DFA231 or maturing GICs.

If they’ve been clients for awhile and have large unrealized capital gains on their equities even after the downturn, I would be more likely to rebalance using fixed income in the TFSA and RRSP accounts (as the future rebalancing in the taxable account as the markets recover would cause additional capital gains taxes).

(a) The % tax rates that should be used in any analysis are not the statutory rates. Thy should be the effective rate that included pro-rata income from different sources (div, int, capgains, roc) and include the effects of dividend tax credits and holding periods before realizing capGains, etc, There are tabs on the spreadsheet to allow you to calculate this.

(b)The rates of return expected should included years of losses as well as gains. The returns should be averaged over all your holdings in an asset class.

Justin’s #1. If Treasury yields are higher now than expected total returns that means you expect capital losses. So your assumed inputs should be adjusted for both (a) and (b).

Also. the benefit you are tying to maximize is not the $tax you would pay in year1. Time’s compounding effects change everything. See the first graph at http://www.retailinvestor.org/rrsp.html#taxfree

Justins #2 No argument there. Given the same tax rate, the asset with the lower rate of return should be held in the taxable account. But that issue has nothing to do with the general AL presented in this article.

Justin’s #3 Yes additional savings reduces the need for rebalancing-by-sales. But this effect is small an can easily be included in your estimate of holding-period-before-capital-gains-are-realized.. (a) above.

Justin’s #4 If you are talking about basic tax-loss realization, then there is some validity to the claim that highly volatile assets do worse in tax-shelter accounts than in taxable accounts. See http://www.retailinvestor.org/RRSPmodel.html#losses But note the limitations mentioned.

Personally I have always found that big losses in one stock are almost always offset by gains realized in other stocks so I never actually get to claim a tax refund. It is only the rare time with the market as a whole gyrates that you gain from being taxed. And as stated in (b) your assumed returns are averaged across all the securities in the asset class.

Conclusion – These points are very minor. Even with adjusted inputs the benefits of RRSP’s with equity are greater than the benefits with Treasuries.

Another problem with this article has to do with it’s procedures for rebalancing. It weights the assets in all three accounts at face value. But the assets within an RRSP are partially ‘owned’ by the government. You only asset allocate the portion of the account that is ‘your money’. Watch the 2nd video of this series https://www.youtube.com/channel/UCYf70uCj5q4GRWYC0wVtdxg to understand what goes on. And read the AA procedure at http://www.retailinvestor.org/rrsp.html#aa

Interesting discussion. I am curious on the allocation between accounts, within the registered realms based on expected date and flow of withdrawal. First on my side I have funds held in RRSP, LI-RRSP, and a DC Pension which will likely have to be annuitized, due to DB Component.

In addition my spouse has RRSP but will be expected to draw money starting 7 years later than me.

Is there considerations to put higher variability assets in further withdrawals accounts, and rebalance when those are taken off, or should the asset risk be spread across?

Hi all, this issue of taxable vs. non-taxable accounts for equities is definitely an interesting one as pointed in the various comments above. I thought I would point out the following quote from William Bernstein in his recent book “Rational Expectations: Asset Allocation for Investing Adults”, precisely on the same page that CCP quoted earlier regarding whether the future tax on RRSP deductions should be taken into account when re-allocating (the answer being no). The quote says (referring to the traditional advice of putting bonds in the non-taxable accounts): “While this is a useful rule of thumb, it can be taken too far. To the extent that you wish to rebalance the asset classes in your portfolio, all sales should be done within a sheltered [i.e., non-taxable] account. If possible, you should house enough of each stock asset class in a sheltered account so that sales may be accomplished free from capital gains taxes.”

Interestingly this is precisely what I had suggested in a prior comment above. I agree with Retail Investor generally on this issue, and particularly that looking only at the last 10-year of data in the CCP/Bender article on this topic is fairly meaningless in making that decision. While I usually agree with the recommendations from CCP, my preference for the future on this issue is for the approach outlined at retailinvestor.org.

@ Phil:

When referring to Bernstein, do not forget that he is writing for US investors, and therefore:

1) he is advising a course of action within the context of US tax law, which can be substantially different than Canadian tax law in how it treats investment income (cf for example the US treatment of “short-term capital gains” vs “long-term capital gains”, a distinction that does not exist in Canada) – you need to account for those differences to judge how relevant his advice is in a Canadian context;

2) his readers’ transactions will all be in USD, thus no forex issues – for Canadian investors, housing “enough of each stock asset class in a sheltered account so that sales may be accomplished free from capital gains taxes” (where US domiciled ETFs are used for foreign equity exposure) may entail additional avoidable CAD -> USD (and later -> CAD) forex that could more than offset any tax advantages gained by not rebalancing equity in an unregistered account (and using Canadian domiciled “wrap” ETFs in a registered account to avoid forex means losing all foreign tax credit).

Finally and with all due respect, referring to the deficiencies of using “the last 10-year of data in the CCP/Bender article” is a red herring. The past data serves a useful pedagogical purpose to illustrate the concepts, but it is not relevant to making principled decisions. For example, I used an option valuation analogy above that would strongly favour the most volatile assets held in unregistered accounts (thus equity, if you believe your equity holdings will be more volatile than your fixed income) – which agrees in the result with the CCP/ Bender article, but gets there by a different route. The point is that argument is based on finance theory, without any reference to returns data at all.

@ Retail Investor:

“Personally I have always found that big losses in one stock are almost always offset by gains realized in other stocks so I never actually get to claim a tax refund …. And as stated in (b) your assumed returns are averaged across all the securities in the asset class.”

The discussion on this blog is by and aimed at investors who would typically only hold a single security – one index fund/ ETF – per asset class, so this point is irrelevant.

“It is only the rare time with the market as a whole gyrates that you gain from being taxed.”

In my own short investing lifetime I have personally lived through 3 events where I gained from holding my equities in unregistered accounts, thus being able to harvest taxable capital losses: 1997-8 in emerging markets, 2000-02 across all equity asset classes, and again in 2007-08 across all equity asset classes.

I have the feeling some of the confusion on this subject by others in this thread may in part be due to newer investors never yet experiencing the contrarian pleasure of exercising the taxable capital loss harvesting option, and thereby offsetting part of the equity losses inflicted by the market. YMMV

The issue of tax-loss-selling came from Justin’s claim that it supports holding equities in the taxable account because .. “Our analysis assumed no tax loss selling strategy was implemented. This would have also allowed for a further deferral of capital gains taxes from rebalancing.”

How much of a deferral do you need? The example pasted into http://www.retailinvestor.org/rrsp.html#taxfree assumes a 30 year holding period before capital gains are realized. And still it is better to hold equities in the registered accounts.

When buy and hold investors own a market ETF that doubles in value during (say) 5 years, and then crashes 50%, they don’t get to claim any tax loss for the current year or for carry backs/forward. The price is still at or above the purchase price.

Also index ETFs are just a combination of all those individual stocks where some rise and some fall and it is only the net of all together that counts – just like for stock pickers.

So arguing that passive buy-and-holds should Asset Locate differently isn’t supportable.

@ Retail Investor:

“When buy and hold investors own a market ETF that doubles in value during (say) 5 years, and then crashes 50%, they don’t get to claim any tax loss for the current year or for carry backs/forward.”

Few investors purchase their entire portfolio in a single lump sum, never to add anything else or even reinvest distributions, so that their ACB is exactly the same as the initial purchase price – so this example is irrelevant.

The average investor would have contributed each year of the 5 in the bull market in your example, as well as reinvesting distributions, resulting in an ACB significantly higher than the price in year 1 – and thus significant taxable capital losses to be harvested after your 50% market crash.

Nice example to make my point about the value of holding equities in an unregistered account!

“Also index ETFs are just a combination of all those individual stocks where some rise and some fall and it is only the net of all together that counts – just like for stock pickers.”

Holding an index ETF is functionally equivalent to holding a SINGLE stock for the purpose of tax loss harvesting – thus your argument that: “Personally I have always found that big losses in one stock are almost always offset by gains realized in other stocks so I never actually get to claim a tax refund” – is irrelevant, as I pointed out.

“So arguing that passive buy-and-holds should Asset Locate differently isn’t supportable.”

No one argued that.

Great article. I agree that simple is better for many people.

However, this article should come with this disclaimer:

BEFORE EMBARKING ON A COMBINED FINANCIAL PLAN, SEEK INDEPENDENT LEGAL ADVICE

Specifically, ALL couples should have a proper binding “agreement” of some sort in place. E.g. a prenuptial agreement if married or a cohabitation agreement if living common law. Even if you are already married or living common law, you can create or update an agreement. To ensure it’s an enforceable agreement, you will need to both have independent legal advice. Just ensure you use family lawyers that can represent your interests while not making it adversarial. Remember that you and your partner own the process and the agreement; lawyers are just resources to help you understand your rights and to make it all legal and good. Lots of family lawyers can stay non adversarial, but not all so ask upfront about what you want. To save time and money, my advice is for you and your partner to talk it through and reach a draft agreement by yourselves then involve lawyers to make it all legal and good.

Why do you need an agreement? Why not just rely on statute laws? The short answer is that with an agreement you can customize it to your specific situation and make it be what you want it to be. It’s much like the same reason why most employers/employees have a custom employment agreement vs. just using statute law.

Some may think this isn’t romantic, etc. but my experience is that things are likely to go better the sooner you talk about things like money. I also think that relationships are more likely to last if you can reach an agreement over issues like this because once you have an agreement you know a) you agree on how things should be done b) the bulk of uncertainty is gone.

Most people who get married know their situation fairly well. However, most common-law or cohabitating couples don’t know their legal situation. Laws have in this area vary by province and are dynamic. This is why you need seek independent legal advice.

Secondly, all couples should have a wills in place, beneficiaries that are properly designated and accounts set up appropriately so the other can easily get assess to that account in case of a death (e.g. a joint account in most cases is best.) You should also consider setting up a power of attorney and living will if appropriate.

Life insurance may also be appropriate in certain circumstances.

Once you have an agreement, wills, beneficiaries designated, a joint account and insurance in place THEN implement a combined financial and tax plan. Don’t reverse the order!

Finally, I highly recommend that you involve your spouse and invest as a couple. Ideally you should alternate roles every so often so both of you know how to do everything needed to keep the investment strategy working. Both of you must know how to management your investments. You don’t want to leave your partner high and dry in the event you become incapacitated or die.

Good luck. You’ll sleep better if you have everything in order.

I agree with Brian G’s comments on the legal agreements – I am always in favour of dotting the i’s. But even WITHTOUT a combined Asset Allocation couples can still be up —creek and all he says still applies.

On all forum websites eventually the problem of couples with different attitudes to risk comes up. And there is always a large contingent of participants who advise ….”We disagree, so I manage my money and my spouse manages hers. I think she is too risk adverse so I compensate with all the high risk/return assets in my portfolio. Together our portfolio is appropriate.” In other words one spouse is subverting the efforts of the other.

Based on this post, I have modeled a combined portfolio for me and my wife and tried to make projections for various return scenarios. Effectively, a combined portfolio seems better. But, in the end, I think that I am unable to get over the behavioral barrier.

By having separated portfolios, we were able to get simillar returns until now. While in theory it should be easy to look at our combined portfolios as a single portfolio, there’s something unsettling about having the portfolio of one spouse significantly underperforming the portfolio of the other spouse (for the good of the couple); it could definitely become a source of tensions.

It might be silly financially, but I prefer to invest in the peace of my couple by paying the behavioral tax.

In Phil’s post above he references William J. Bernstein opinion ” regarding whether the future tax on RRSP draws should be taken into account when re-allocating (the answer being no)” That agrees with this article but contradicts my post above saying that you should make your Asset Allocation calculations based on only the portion of the RRSP account that ‘is yours’, ie with the government’s portion deducted.

Bernstein’s POV is at http://www.efficientfrontier.com/ef/704/where.htm I cannot see how anything there proves his point. He sets up a 50:50 allocation example (without discounting the RRSP) that I would call 60:40 (with discounting). He then presents a change and the necessary rebalancing to get back to his 50:50 (but not my 60:40 which he makes no mention of). So what? He uses the 50:50 calc as a given.

The point of AA is to set your exposure to different asset classes. His example makes no attempt to show how that exposure was provided by his AA calc, much less by the rebalancing after a change. His example talks is of someone wanting to CHANGE their AA but his math puts them right back at the same 50:50, To me the whole page is just nonsense.

A related “problem” I have is that my company still has a defined benefit pension plan where a good chunk of my retirement “savings” are accumulated. By directing some of my pay (i.e. a portion of my savings) to the pension plan I get a future pension promise that looks a lot like a bond to me. When piecing together my asset mix as per the model portfolios, I struggle with whether or not I should try to put a value on that and consider it a piece of my fixed income allocation. I think that’s theoretically correct, but it complicates what is supposed to be an easy process.

@RetailInvestor: Can I allocate the government part my RRSP differently from my own part? I guess not. So, it is not so obvious that one’s asset allocation shouldn’t include the government’s share. You could also consider the big uncertainty of the bonus/penalty due to the timing of withdrawals (and difference in tax rates), making it near impossible to know, before withdrawal, what the bonus/penalty might be (you definitely want to asset allocate your bonus according to your AA, and you don’t want to consider the penalty as your own money for asset allocation).

If for example, you were to take advantage of an early retirement (or a year off work) to get some money out of RRSP at near 0% tax rate, then it would have been wrong not to include the government loan portion of the withdrawal as money you own, for asset allocation, as this portion of the loan is actually yours (transformed into a bonus).

@ccpfan :

* You can see how to AA the government’s portion of the RRSP (after you calculate the AA on only your own money) in the example shown at the link I provided above http://www.retailinvestor.org/rrsp.html#aa

* The amount by which you discount the total $RRSP is determined by your expected tax rate on withdrawal. If you believe it to be 0% then discount by 0%. It does not have to be exact. Any ball-park %% is better than none at all. If you believe parts of your account will be withdrawn at different tax rates then pro-rate those rates.

* It really is obvious that you should AA only the RRSP portion you own after discounting the government’s share. Watch the 2nd video at https://www.youtube.com/channel/UCYf70uCj5q4GRWYC0wVtdxg You can see that your personal outcomes are determined ONLY by the “TFSA portion” of the RRSP. Your personal exposure to different asset classes is determined only by the AA of that “TFSA portion” of the RRSP.

My wife and I treat our separate accounts as “our money” . . . however, we do separate asset allocation within each account. This is due to the fact that all our accounts are either RRSP, LIRA, or retirement accounts through work. Therefore none of the accounts can have money withdrawn, and only about half the accounts can have money added at rebalance time. We find the cost of a few extra $10 trades worth the ease of management keeping each account self-contained (for asset allocation purposes).

@CCP,

was wondering if you can answer below…

1. Can I convert RRSP to RRIF partially, thus that I will have the same time RRSP and RRIF and will continue to contribute to RRSP if I have excees $ from RRIF?

2. If not, can I have 2 RRSPs and convert only 1 to RRIF and again continue to contribute to RRSP if I have excees $ from RRIF?

3. If I have personal and spousal RRSP, can I convert personal RRSP to RRIF and leave spousal one and my spouse will continue contribute to SRRSP?

@gibor: In general you can have a regular/spousal RRSP and a RRIF at the same time, and you can contribute to the RRSP as long as you are under the maximum age limit (i.e. the year you turn 71). This can be a useful strategy if you want to split pension income with a spouse, since RRIF withdrawals are considered pension income by RRSP withdrawals are not.

@RetailInvestor wrote “But even WITHTOUT a combined Asset Allocation couples can still be up —creek and all he says still applies.”

Correct, but combining assets can change things subtlety but materially for some couples in some jurisdictions. For instance, for some common law couples if they have not comingled finances and then do, this change can be seen later as intent when combined with other factors. What that “intent” is or was is anybody’s guess if it’s not documented. I can get really complicated and you need to talk with a lawyer for your specific circumstances but rather than guessing, why not make an agreement to ensure it reflects your actual desires and eliminates the guessing game.

Regarding your comment about some couples disagreeing on risk and investment strategies and then managing money independently. My thought here isn’t that these people are wrong or doomed for disaster but instead my thought is that everybody is unique and I hope they’ve captured their personal desires in an agreement that works best for them so they both have certainty. Having each person manage “their” money independently is fine if that’s what both parties want but without an agreement that’s almost certainly not actually the case and their efforts to keep things bifurcated will be futile.

Just like it’s so silly that most people in Canada don’t know how to manage their investments as well as this website teaches, I find it equally sad that most couples don’t have an agreement that captures their personal desires for how they want to live their lives.

From a practical perspective, the largest financial uncertainty that anyone living as a couple has is not how well their investments do, or what insurable perils they are exposed to but the single biggest financial uncertainty is what will happen if they cease to live as a couple.

I recently read of a woman who lost her house because she lived with a slacker boyfriend for a tad too long and after they separated after only few years living together, he got a large chunk. Seems unfair, and she was financially devastated for one mistake but that’s how the laws are written if you don’t have an agreement. All the careful investing wouldn’t have saved her and that’s why I say eliminate this huge uncertainty and have an agreement that captures what you want.

Under what circumstances would a person not need to have a RRSP? I am thinking that a RRSP would be unnecessary if the tax bracket you are in when you are in the accumulation of wealth stage and might be contributing to a RRSP will be the same tax bracket you will be in when you are retired and withdrawing from your RRSP perhaps due to a company pension, CPP and OAS. I get that you defer taxes but you may also have to withdraw at a rate that puts you into a higher tax bracket in retirement and also triggers OAS clawback. Perhaps it would be better to accumulate in a TFSA and then an unregistered account only contributing to a RRSP in the years when your tax bracket for some reason is higher than your expected retirement tax bracket. Please comment.

# SB McManus

The way I handle this is twofold. First, because a DB value behaves similar to a bond, I allocate a higher proportion of my portfolio to equity. Theoretically, someone could argue to go 100% into equity, but I always want money to buy or rebalance equity when appropriate. For example, should there be a major market fall, I would rebalance to my target allocation using the fixed income and cash. Second, the fixed income component has a short duration because a DB value is sensitive to long term interest rates.

Once the lower and higher boundaries of the fixed income determined, I do not consider the value of the DB anymore making it an easy process. For example, I recently rebalanced fixed income and cash having reached my lower boundary trigger. Hard thing to do in a everlasting bull market but discipline is critical to make this work.

@Darby: I’m going to be in the same tax bracket when I retire (DB pension), so I’ve been doing that same analysis. I won’t be close to OAS clawback though, so that’s not something I need to take into account.

IMO the TFSA is the first thing to fill up (given it doesn’t effect the OAS situation).

Other than the OAS clawback, I think the RRSP route is clearly better than non-registered for all dividend or interest producing products; I guess age is also a factor: I’m looking at 25+ years of compounding, so avoiding taxes at this stage has a huge impact. The math for someone closer to retirement would be very different.

@Darby: I tend to agree with Paul G’s comments. Certainly the TFSA is the first thing to fill up if you expect your tax bracket to be the same or higher in retirement. But that will fill up pretty quickly. Early on in the accumulation stage the RRSP still makes sense, for behavioural reasons if nothing else: most people are loath to withdraw from their RRSP, which is a good thing. Closer to retirement, when you are in a better position to estimate your future tax bracket, OAS clawbacks etc. you would need to do a more detailed analysis to see if a non-registered account makes more sense.

Curious on allocation between TFSA and RRSP, based on the preferred tax treatment of withdrawals from TFSA vs RRSP, do you recommend more or less volatility allocated to it?

@Jeff: I’m afraid I don’t understand your question. What do you mean by “do you recommend more or less volatility allocated to it?”

@CPP Sorry. Since TFSA will not be taxed at withdrawal, should they have more risk (ie variability) in them (when viewed in isolation) or less? Do you tilt in early years, and aim to crystalise later?

@jeff: Remember that if you are planning to withdraw money from any investment account to meet your income needs (i.e. in retirement) then it should never be in a volatile asset class to begin with.

That said, asset location decisions can certainly evolve over time, as you suggest. While I have made an argument for holding equities in non-registered accounts, investors near or in retirement will likely need to keep fixed income (probably GICs) in taxable accounts if they plan on using the proceeds to fund their living expenses.

@ccp, I live off of my investments and your statement to “never be in a volatile asset class” once you need income perplexes me. That just seems too conservative and opens me up to other problems. E.g. running out of money, inflation erosion, higher tax rates, lower standard of living, etc.

My simple rule is to not invest any money in equities that I will need in less than 10 years. This gives me an upper equity limit of what I would feel comfortable “safely” holding. The actual percentage of risky assets I hold is determined by my need to take any equity risk based on my level of savings vs. life expectancy/age.

Other than that upper limit, even for the most conservative investor, history shows the lower limit of equities you should hold is around 15% because a 15% equities + 85% fixed income portfolio has been shown to be less volatile than a 100% fixed income portfolio!

You may also be interested in this paper: Reducing Retirement Risk with a Rising Equity Glide-Path http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2324930

Investing during retirement is the most complicated time to invest! :)

@CCP. thanks for your input. Slightly OT, but i am curious if there is any of the discount brokers that actually provide reports that are helpful in getting these mixes? I know my pension administrator provides my with a nice 360 view of allocation, splitting the components of each funds… but when i look at my TD-direct account, all the EFTs end up being Canadian Equity, regardless when they are invested in, and of course each account is separate

@jeff: I believe RBC and BMO do a better job of this, i.e. a Canadian ETF holding international stocks is not deemed to be “Canadian equity.” But in general I think it’s best to track this on your own using Excel.

@CCP. thanks. sad that none of them do a better job, to me it would be the one added feature that would have made me move, especially when adding international components that have different exposure like having RWO Canadian component combined with ZRE to make sure I have my 50%/50% split. I know it’s immaterial and am using 50/50 MV split (which mean I am 52/48), but since my pension statement provides this, I wondered if I was missing out on something.

again thanks for all the great work

On the subject of multiple acccounts, is there any real benefit to contributing to RDSP (Registered Disability Savings Plan) accounts in amounts in excess of the matched government grants? I understand that there is a lifetime contribution limit, but also that any withdrawals are taxed as income in the year of withdrawal. With a couch potato strategy, wouldn’t that mean the only benefit to contributions in excess of government matched amounts would be the tax-sheltering of distributions during the holding period of a fund, and that this would come at the expense of a taxation as income versus capital gains when the fund is sold (and withdrawn from the account)?

@James: First off, I don’t think your investment strategy (i.e. Couch Potato or otherwise) is really relevant to your question. You’d need to set up a rather complicated model to determine whether there’s a benefit to additional contributions, and it would involve making assumptions about tax rates and expected returns. That’s a job for a financial planner, or at least someone is very good with a spreadsheet.

@CCP: I’m wondering why in this example you don’t discount the RRSP since it is pre-tax money, as RetailInvestor was saying. With a 35% tax rate on withdrawal, the asset allocation in this example becomes something like 42%bonds, 58% stocks, instead of 50/50. Is it because the difference is not large enough to matter for you, or is there a reason why you don’t think discounting the RRSP for expected taxes is appropriate?

@BG: First off, this post was simply intended to encourage investors to think of their family accounts as single portfolio rather than individual pieces. The comments took things in a very different direction. The idea that RRSP assets should be adjusted for their future tax liability is a valid one, to be sure. But there are very significant practical and behavioural obstacles to overcome if one is manage a portfolio like this. Perhaps one DIY investor in a thousand could capably do it.

Certainly as one approaches retirement and plans to start drawing down the portfolio it becomes critical, and any retirement plan will take it into account. But if you’re many years away from retirement and you’re still adding to your portfolio it’s much less important. Remember all of this evolves over time as RRSP and TFSA contribution room gets used up, and investors will likely adjust both their asset allocation and the asset location over time.

I love it that some of the CCP readers are so technical but for me this blog was reinforcement for what I tell clients. Look at your whole net worth , not just yours but your partners as well.

Get away from multiple accounts with different institutions you have collected over your lifetime, those statements with little pie charts don’t really tell you your allocation.

Get a plan and rebalance!

Kathy ………….fee for service planner Regina, Sask.

I tried to get an answer from CRA regarding the TFSA rules governing attribution between spouses and the rep said attribution is not applied, so I am wondering if the TFSA can be a legal and effective method for relocating non-registered assets between spouses. RRSP and TFSAs are full and employed spouse has greater non-registered assets and is in higher tax bracket. So the strategy would be that Hightax spouse gives Lowtax spouse money for TFSA. Lowtax spouse removes all of it in December (to own non-reg account) and in January regains the withdrawal room plus the new year room and Hightax spouse again gives Lowtax spouse money to fill the TFSA. Repeat as desired. TFSA guide says money can generally be removed for any reason with no tax consequences. Looks like easy income-splitting. What am I missing? Would such transactions be considered taxable “advantages” per CRA definition?

@W AIM: It’s usually a bad idea to taunt the CRA. I’m not qualified to give you tax advice, but I would be concerned about the General Anti-Avoidance Rule (GAAR), which targets transactions that are done solely to avoid or defer taxes:

http://www.cra-arc.gc.ca/E/pub/tp/ic88-2/ic88-2-e.html

Thanks for the quick response. Yikes! No CRA taunting was intended. I just didn’t want to miss what could have been a simple/easy opportunity to improve income stream balancing across our multiple family accounts and holdings. If it looks too good to be true, it probably is. Thanks again.

@W AIM: “If it looks too good to be true, it probably is.” Definitely a good rule of thumb! One strategy that can work well is a spousal loan: this is an entirely legit way to for couples to shift taxable investment income from a high-earning spouse to a low-earning spouse. But it does need to be set up and maintained carefully:

http://www.raymondjames.ca/steelewealthmanagement/pdfs/SpousalLoans.pdf

Hello CCP,

My spouse has her full TFSA ($35.5K+ plus interest) with a bank that is currently offering 1.8% interest. Not terrible for a savings account but she’s not completely thrilled either. She has TD e-series mutual funds in an RSP account (30% Canadian Index, 30% US Index, 30% International Index, 10% Canadian Bond Index; total amount combined is approximately 40K). We’re considering withdrawing her full TFSA from her bank in December and opening another TD e-series mutual funds account for her TFSA. However, we’re concerned that if we purchase the same investments noted above, it would be counterproductive as she’s already invested in those indexes in her RSP. I don’t believe anything else from TD is worth investing in index-wise for a couch potato. She prefers the simplicity of Mutual Funds over ETFs.

To give you a little more information to work with, she’s entering the prime years of her career with a modest salary and has no plans to use the money (long term horizon of 15-20+ years). We’re both saving for a down-payment on a house (who really knows when that will happen?) but that is getting saved in our regular high interest savings accounts. Other than that, no intention to touch any money. Her desired asset allocation (comfort zone) is probably closer to 70% stocks and 30% bonds–so her RSP is a bit off-target because of how safe her current TFSA is. We would make overall adjustments if she changed her TFSA situation.

I have TD e-series funds myself for both TFSA and RSP…and they’ve split 85/15 in the TFSA as Canadian Index/Canadian Bond Index…and 50/50 in my RSP as US Index/International Index. Since I’ve accumulated more assets than her, I’m considering entering the ETF world but I’m quite ready yet (need to do a little brushing up still).

What are your overall thoughts about my spouse’s situation?

I have a part 2 question that I’m squeezing in here! Do withholding taxes apply to mutual funds for Canadian products? I’ve seen examples in this site on how they do & don’t apply for Canadian/US listed ETFs but not really for mutual funds.

Forgot to add…incredible site. Keep on posting new articles!

@Jason: Thanks for the comment. RE: “We’re concerned that if we purchase the same investments noted above, it would be counterproductive as she’s already invested in those indexes in her RSP.” Well, that’s like saying there is no point in investing another $40,000 in your RRSP because you already have $40,000 there. You don’t need to worry about adding new funds or new asset class every time you add more money. If you want to invest the TFSA money rather than keeping it in cash, then it makes sense to simply use the same asset allocation you use in your RRSP. Assuming your TFSA and RRSP are both earmarked for long-term savings, you should think of both accounts as part of a single large portfolio.

As for part 2 of your question, yes, foreign withholding taxes apply to Canadian mutual funds holding US or international stocks. They work the same way as Canadian-listed ETFs that hold their stocks directly.

@CPP: Thanks for the feedback! RE: “If you want to invest the TFSA money rather than keeping it in cash, then it makes sense to simply use the same asset allocation you use in your RRSP.” Just curious if you meant mine or my spouse’s RRSP asset allocation. So since her desired asset allocation is 70% Equity and 30% Bonds, should she purchase the four index funds for her TFSA similar to her RRSP allocation…or should she adapt my approach of separating the indexes as per registered accounts? In either scenario, she could still adapt the 70%/30% approach.

Yes, I understand that we should look at all of our assets as a single large portfolio but it’s trickier when we have different risk tolerances.

Thanks again for your knowledge!

@Jason: Sorry, I meant that she could use the same funds in her TFSA and her RRSP. That is, she could just hold 70% equities and 30% bonds in both accounts, using the same funds in the same proportions. Asset location (i.e. holding different asset classes in different accounts for maximum tax efficiency) is not much of an issue if you use e-Series funds and all of the accounts are registered. It’s really only important for large portfolios that include taxable accounts. Hope that helps!