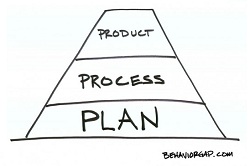

When I wrote the MoneySense Guide to the Perfect Portfolio [now out of print], I waited until Chapter 5 before I started discussing specific ETFs and index funds. That was a deliberate decision, because I feel strongly that we put far too much emphasis on investment products, and too little on the investing process.

When I wrote the MoneySense Guide to the Perfect Portfolio [now out of print], I waited until Chapter 5 before I started discussing specific ETFs and index funds. That was a deliberate decision, because I feel strongly that we put far too much emphasis on investment products, and too little on the investing process.

Carl Richards agrees. As he explains in his book, The Behavior Gap, selecting investments should come at the end of the planning process, not the beginning: “You would never spend time researching and debating whether to travel by plane, train, or car until you figured out where you are going.”

During our recent interview, Carl elaborated on this idea. “The reason this is so important is that if we start with the product, we are inevitably going to be disappointed. And that leads to buying things high, and selling things low.” Instead, he says, start by giving your investing a context. “For instance, you may think education is really important for your kids and you want to save enough to send all of them to school. So how much will that cost? There are online calculators that can help you figure out you need to save, say, $200 a month for this long. Then you figure out when you will need the money, and how much risk you’re prepared to take. That’s the plan. Then you go and find products or investments to populate that plan. It’s the last step, but we get it all backwards.”

Are financial plans worthless?

Ironically, even if investors do recognize this, they may view their financial plan as just another type of product, Richards says. One of the chapters in The Behavior Gap has the provocative title, “Plans Are Worthless,” which might seem surprising in a book by a Certified Financial Planner. But in our interview, Carl explained what he means:

“A lot of times when people think about financial planning, they think about this two-inch-thick book they paid a lot of money for, and then it sat on the shelf and they never looked at it. That’s what I’m talking about when I say plans are useless. We need to get away from this idea of financial planning as an event—or even worse, a product.

“We have to realize that financial planning is nothing more than a series of guesses. We use a more official-sounding word: we call them assumptions. But they’re just guesses, and we’re never going to get them all right: expected rates of return, how much you’re going to make, when you retire, when you’re going to die. You still need to make those assumptions, but let’s get rid of that false sense of precision. And next year, let’s update those guesses. That’s the important part. So financial plans are worthless, but the process of planning is valuable.

“I like to compare it to a cross-country flight. Every pilot I’ve ever flown with has a very detailed flight plan, and they put a lot of time into it. But they will tell you that the moment they leave the ground, that plan is not going to be right. The wind speed is going to be a little bit different, so they’re going to have to make adjustments along the way. And it’s these course corrections that are important, not the flight plan itself.”

Another advisor I know makes a different analogy. He compares a financial plan to a compass rather than a map: it can’t tell you what’s over that next hill or around that next curve, but it can keep you pointed in the right direction.

@Melissa.

I did the NG at MDM once. Pain in the neck. Given that their forex fees are “only” 0.5%, I just bit the bullet and went with their forex rate. Given that I will only convert once to buy and back to $CDN when I sell in 20 yrs, it seemed the simplest course od action. Bought VTI, VXUS.

Since then, have used HXS for US exposure and ZEA for international. I like HXS as my holdings are in a Prof. Corp. where foreign witholding taxes are only partially recovered, and more importantly, foreign dividends which would be taxed as ordinary income, are now reinvested automatically and taxed as capital gains when I sell. Furthermore, no concerns about ACB tracking as no distributions are made. Alsono more need for NG. I left the VTI and VXUS in my USD acct. as I have been using the distributions which are in USD for spending money on vacation.

ZEA invests directly (almost 100%) directly in the international stocks themselves, so witholding taxes are only paid to the home country and not also to the USA as is the case for some other ETFs that are CDN versions of a US ETF. ZEA is tax efficient in a corporation where only a part of the foreign witholding taxes are recoverable. (Irrelevant for int’l ETFs held personally wher the US portint of the FWT is fully recoverable)

If you have filled up your registered accts. and your asset allacation model still requires fixed income that needs to be held in a taxable acct. a GIC ladder or HBB would be best.

I do all of this on the MDM online platform. Only meet my advisor once a year. She is pretty good about bouncing around ideas about asset allocation, estate planning, etc. Understandably, not happy that I don’t use her in house products, but she tolerates it as she only has one other client who does this. All the best with your Couch Potato strategy. Strongly recommend you download and use Dan’s rebalancing spreadsheets.

@MD, @Melissa: My advisor has not expressed any unhappiness at all and in fact fully supports my efforts w passive index ETF investing. I truly believe in his sincerity. After all, his salary is paid eventually from association funds, so his mandate is to act in my best interests. The whole organisation has been magnificent in organising and advising w retirement and estate planning etc. The lack of availability of slick NG options on their on-line platform is hardly his fault. I have my TFSA and Non-Registered portfolios entirely in ETFs (I use Canadian equity VCE, ZCN, FXM US equity swap HXS, International Equity ZEA, XEC and Canadian bond swap HBB and a small holding of US$ small cap value VBR in my Non-Reg). My wife doesn’t trust my new-found investment expertise, so our RRSPs /RRIF remain managed by their in-house management companies. Sigh.

@MD, @oldie

Thanks for your prompt replies!

I’ll have to pore over your listings and figure out what works for me. We already have some holdings in VTI, VUN, VXC & now XEF, but I never heard of HXS & ZEA. But I did find this amazing white paper co-authored by @CCP: https://www.pwlcapital.com/pwl/media/pwl-media/PDF-files/Justin%20Bender%20Assets/PWL_Bender-Bortolotti_Foreign-Withholding-Taxes_v04_hyperlinked.pdf?ext=.pdf

My MDM advisor is nice, but keeps trying to push me toward their investment council. At least @oldie’s wife didn’t join them! (I’m assuming.)

@Oldie @Sleepydoc @ MD and others:

Thanks for sharing your experience with MDM. I decided to use a different discount broker (TDW) for many reasons , but I still use their advisor service to review my financial and insurance planning once a year.

I am pretty sure their ACB tracking service doesn’t keep track of re-invested capital gain distributions since this information is only available from the ETF providers website and/or CDS innovation database. For what it’s worth, my accountant does calculate my ACBs the same way as MDM, by omitting to keep track of reinvested distributions. I also think that most advisors/accountants don’t adjust their ACB according to the CDS innovation database since it is a bit cumbersome and most advisors/accountants aren’t even aware of the problem. Also, I wonder if the CRA really cares about this, otherwise they would make sure it is obligatory to report hidden distributions on the T3 (like they do for the Return of Capital for example). If you don’t adjust your ACB for hidden re-invested distributions, the CRA must be happy to collect more capital gain taxes when you sell your ETF.

As I mentioned previously, I invest mainly in my profesionnal corporation. I decided to use HXT for canadian equities to make ACB tracking easier, as well as HXS for US equities for the same reason (+ greater tax efficiency) and I use TD e-series international index fund for international equities. For fixed income, I use HBB but I may consider using also GICs when I am older.

I also decided to invest a part of my portfolio in Mawer Tax effective fund.This fund has a low MER 1%, which like any mutual funds or ETF, is tax deductible:

https://www.steadyhand.com/industry/2010/07/08/management_fee_deductibility_clearing_the_air/

As explained on Mawer prospectus, this fund minimizes taxes through the application of a tax overlay strategy, with the objective to minimize taxable distributions. T

“In equities we search for wealth-creating companies whose equities can be purchased at a discount to their intrinsic value. We then apply a tax overlay strategy, with the objective to minimize taxable capital gain distributions. The philosophy of the Firm is that the security will not be sold to harvest a capital loss unless it can be replaced with a highly correlated substitute (such as other names in the same industry and sector exchange-traded funds). If a capital loss is harvested, these trades are normally reversed after 30 days (to avoid the ‘wash sale’ rules). Wherever possible, asset mix changes are implemented using cash flows in order to minimize the tax implications from trading. Bonds are chosen with a view to the appropriate term, credit quality, and issuer depending upon the expected direction of interest rates, the interest rate spreads between different sectors of bonds, and the expected state of financial conditions for the issuer. Bonds trading near par or at a discount are preferred, all else being equal, given their better tax efficiency versus premium bonds.”

http://www.mawer.com/mutual-funds/fund-profiles/mawer-tax-effective-balanced-fund/

@Oldie @Jas @ MD and others:

it has been quite nice to hear your experience and in some ways reassuring to see that I have similar portfolios to you as well. One of my biggest fears as I embarked on passive investing was that somehow I could be making a major mistake investing in a professional corporation because of difference in taxation etc. It took a while, but I found a firm that shares the same investing philosophy selling mainly DFA and ETF products, and I pay them an annual retainer and hourly fee to answer specific questions regarding my portfolio, similar to consulting an accountant or lawyer. While I regularly discuss generics with my “general practioner” MDM advisor, I take ETF comparison and taxation questions to this other firm for a second “specialist” opinion. I view MDM as my financial planner, but the second firm as my investment counsel. I spend a couple thousand a year on this advice and portfolio review, but the cost is a fraction of what I would pay for a more traditional AUM fee based structure. I also sleep much better and my wife actually is ok with me managing the whole portfolio!

For what it is worth, I too use HXS and HXT, though due to the absolute dollar value I have offset the counterparty risk with VUN and XMD for a portion of of the allocations. I also hold VEA, and then a little “play” money in each sector with some small and value funds similar to the original UberTuber portfolio. I hold XRB and XBB in our RRSPs and round out the fixed income with some whole life insurance – but I guess that is a topic for a whole other website I suppose. I view it is a very tax efficient fixed income vehicle for professional corporations.

@sleepydoc: “… and then a little “play” money in each sector ”

I hope this does not amount to ad hoc active management or, even heaven forbid, quasi market timing. Otherwise we’ll have to stop corresponding with you :-)

@Sleepydoc:

Do you know this website : whitecoatinvestor.com ?

The author of this blog, about index investing for doctors and other professionals, as many arguments against using whole life insurance for investment purpose.

http://whitecoatinvestor.com/8-reasons-to-avoid-whole-life-insurance-and-4-reasons-to-consider-it/

http://whitecoatinvestor.com/debunking-the-myths-of-whole-life-insurance/

@Jas

thanks for letting me know about the that site – very interesting! I think for my purposes and some key differences in Canada with capital dividend accounts and holding companies as policy owners it makes sense for me – but it was nonetheless an interesting read! Thanks.