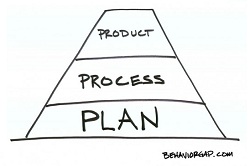

When I wrote the MoneySense Guide to the Perfect Portfolio [now out of print], I waited until Chapter 5 before I started discussing specific ETFs and index funds. That was a deliberate decision, because I feel strongly that we put far too much emphasis on investment products, and too little on the investing process.

When I wrote the MoneySense Guide to the Perfect Portfolio [now out of print], I waited until Chapter 5 before I started discussing specific ETFs and index funds. That was a deliberate decision, because I feel strongly that we put far too much emphasis on investment products, and too little on the investing process.

Carl Richards agrees. As he explains in his book, The Behavior Gap, selecting investments should come at the end of the planning process, not the beginning: “You would never spend time researching and debating whether to travel by plane, train, or car until you figured out where you are going.”

During our recent interview, Carl elaborated on this idea. “The reason this is so important is that if we start with the product, we are inevitably going to be disappointed. And that leads to buying things high, and selling things low.” Instead, he says, start by giving your investing a context. “For instance, you may think education is really important for your kids and you want to save enough to send all of them to school. So how much will that cost? There are online calculators that can help you figure out you need to save, say, $200 a month for this long. Then you figure out when you will need the money, and how much risk you’re prepared to take. That’s the plan. Then you go and find products or investments to populate that plan. It’s the last step, but we get it all backwards.”

Are financial plans worthless?

Ironically, even if investors do recognize this, they may view their financial plan as just another type of product, Richards says. One of the chapters in The Behavior Gap has the provocative title, “Plans Are Worthless,” which might seem surprising in a book by a Certified Financial Planner. But in our interview, Carl explained what he means:

“A lot of times when people think about financial planning, they think about this two-inch-thick book they paid a lot of money for, and then it sat on the shelf and they never looked at it. That’s what I’m talking about when I say plans are useless. We need to get away from this idea of financial planning as an event—or even worse, a product.

“We have to realize that financial planning is nothing more than a series of guesses. We use a more official-sounding word: we call them assumptions. But they’re just guesses, and we’re never going to get them all right: expected rates of return, how much you’re going to make, when you retire, when you’re going to die. You still need to make those assumptions, but let’s get rid of that false sense of precision. And next year, let’s update those guesses. That’s the important part. So financial plans are worthless, but the process of planning is valuable.

“I like to compare it to a cross-country flight. Every pilot I’ve ever flown with has a very detailed flight plan, and they put a lot of time into it. But they will tell you that the moment they leave the ground, that plan is not going to be right. The wind speed is going to be a little bit different, so they’re going to have to make adjustments along the way. And it’s these course corrections that are important, not the flight plan itself.”

Another advisor I know makes a different analogy. He compares a financial plan to a compass rather than a map: it can’t tell you what’s over that next hill or around that next curve, but it can keep you pointed in the right direction.

I need to go out and buy “The Behavior Gap”. I’m also looking forward to your revised and updated GTTPP!

One difficulty I have always had with plans were how determine assumptions or guesses as Carl puts it. I really appreciate the fact that he highlights the false sense of precision. I find the uncertainty quite daunting.

The example of saving for education strikes me as especially difficult. How can I determine the investment goal. I just do not know how much education will cost in 15 years? There seems to be more variables, inflation in education costs may be different, maybe my children will prefer to study in another province…

Am I the only one you feels a plan for children’s education is more difficult? Any advice or resources that you would know of to estimate future education costs in Canada.

Retirement in that respect is easier because we can use typical inflation, life expectancy, and a more typical retirement age to get a reasonable plan. Yet I would still be very interested in knowing of resources for DIY investors to get the best guesses in order to have some confidence in my plan.

P.S. Congratulations Dan on the upcoming second edition of your book!

@Philippe: You ask some very interesting questions. It’s true, we cannot know what the cost of a university education will be in 15 years, but we can make some reasonable estimates. At the very least, take the current cost and increase it by 3% to 5% annually. For what it’s worth, I have two teenagers, one who starts university in September, and we are estimating a cost of about $15,000 per year, which includes living away from home.

But to get back to what Carl is saying, there are some unknowables here: if you live in a big city, your child could end up going to school locally and living at home, or going away, which can double the cost. You just can’t know that in advance. Obviously it’s best to err on the high side, but don’t beat yourself up if you’re not able to save that much.

There are a number of online calculators that will help you determine education costs, but I would be hugely skeptical of the ones that are offered by firms selling RESPs: they have a vested interest in overestimating the costs. The same, of course, is true of retirement calculators, which inevitably tell you that you need $7.9 million to retire comfortably.

There are some practical things to consider here. The maximum lifetime RESP contribution is $50,000, and after $36,000 in contributions you have maxed out the grant. So that places a hard limit on what you are able to save inside that tax-sheltered account. If you can max out the grant, that is an amazing start.

The most important of Carl’s messages is the idea of course correction. He would tell you to just start saving whatever you think you can manage in RESPs today, and then reevaluate every couple of years to see if you are still on track. That’s the best anyone can do. Good luck!

Thank you very much for your thorough answer Dan, it is much appreciated and very helpful.

Beware of financial assumptions.

My father was a comptroller and he explained to me at an early age that assumptions in financial models (any math model) can become dangerous in two contexts:

1. The earlier the assumption is introduced in a decision making process the greater its effect as the assumption spreads through other contexts.

2. Assumed numbers will be compounded over time and can lead to very misleading scenarios the longer out they are assumed.

An example of this is assumed real rate of return. I know planners who are using 7-8% when 2-4% may be more realistic. An 8% return compounds to 987% over 30 years. A 4% return compounds to 237% over 30 years – big difference to your retirement. I imagine some people did not save enough during accumulation years because of such assumed rates of return.

In the late 1990s a bank financial planner used 12% for a friends retirement plan!

@Andrew: Great point about poor assumptions being compounded over time. That’s another reason why those regular course corrections are needed.

For long-term expected returns, it helps to start with good data. According to Credit Suisse, since 1900 and covering 19 developed countries, stocks have returned 8.5% and bonds 4.5%, before inflation. With interest rates way below historical averages, it clearly makes sense to lower the expected return on bonds for the medium term, though you would have to revise that if interest rates rise over the next five years or so. Again, it comes back to the course corrections.

I have no idea what to expect for equities, but I don’t think it makes a lot of sense to assume long-term returns as low as 2% to 4%. If you really believe that’s the expectation, it makes little sense to invest in equities at all. This seems to fall into the same trap as the bank planner who projected 12% because that’s what you got over the previous 10 years.

Everyone was projecting 12% returns in the 1990s—in fact, I have a 1993 book on my shelf that says “it is very reasonable to project 12% to 16% returns.” It’s actually very instructive to read investment books from different eras—everyone assumes that the present is “the new normal.”

I don’t think 2-4% long term real returns from equities is unlikely at all. The 50 year real return of the S&P 500, dividends reinvested but taxes and costs excluded, is only 5.28%. Subtract a half a percent for fees and various costs and another 1% for worsening demographics, and you’re down to an estimate of about 3.78%. I wouldn’t count on anything better than this for equities, unless you think the last 50 years will be better than the last.

@Chris: I was using nominal returns, not real returns. But assuming 3% inflation, you’re right on: the Credit Suisse data show 5.4% real returns for equities over 112 years and 19 countries.

Another reminder that investors should do everything they can to keep their costs low: losing 0.5% to costs is significant drag over the long term.

“5.4% real returns for equities over 112 years” This can not be too reassuring!

Traditional portfolio theory is premised on such very long time horizons, but individual investors have much shorter investment life spans. Such institutional theories of market returns over 20, 30 or 40 years are far too long to reflect the reality of most real life investors. Most investors do not have the bulk of their savings to invest until they are into their 40’s and 50’s. By then their time horizons for real-life purposes are much shorter. One such real life purpose is can I retire at 65? At least the historical fixed income return projection of 2-4% allows for more certainty to answer that question. Therefore to me it then makes sense to abandon equities completely to allow for that reassurance that I know how much I’ll have by age 65 or how much I need to have. Equities cannot give me that kind of road map in the more realistic timeline of one’s short life investment time!

I don’t know about you Jon Evan…but I am 22 right now and I don’t plan on retiring or dying for at LEAST 20 years.

@Jon: A 5.4% real return (about 8.5% nominal) over the very long term is about as good as it gets. No other asset has that kind of track record. And if you look at rolling 20- to 30-year periods, that number is pretty consistent. For example, even if you retired in 2008 (I intentionally picked the worst year in recent history), the S&P 500 still would have given you at least 8.4% annual returns if you had started investing in 1989 or earlier. And if you started investing in 1929, your 30-year return was 8.5%.

And remember that anyone in their 50s in decent health should be assuming another 30 years of life. Your investment horizon lasts until you die, not until you retire.

It’s entirely sensible to stick to fixed income if you can meet your goals with more modest returns. Just keep in mind that right now 10-year bonds are yielding less than 2%, which is a negative real return.

“Your investment horizon lasts until you die, not until you retire.”

Thanks for reminding me of that! I need to think longer :).

About returns over time:

5.4% real return (just over 4% net of fees, tax drag and other friction) may be the best average over a long period of time but remember the following:

Despite the rolling return figures cited by Dan returns do not come in a consistent or even distribution. There are periods (decades) where the performance was well above this and periods where it was well below this average – depending on your allocation to stocks of bonds. For instance were decade plus long periods where the real return just tracked CPI in the 1929 – 87 period. Over time risk assets go up with capital stock improvements, efficiency/productivity and wealth. But if you are in markets during the most favourable periods its just luck.

Forecasting real returns will be higher than 5.4% during the time one is invested is wishful thinking and I wouldn’t base a retirement on this.

This relates to behavioural finance and the tendency of people to be optimistic and to discount negative potential outcomes. For example it is better to anticipate a scenario of losing capital and therefore have a higher savings rate. There will be regrets from this but one is also reducing the chance of a bad outcome.

Read The Economist Guide to Investment Strategy by Stayner for a discussion of this kind of thing.

To me if the return is higher than risk free then it is a bonus to ones life. I like the idea of using excess returns from equities to buy more risk free income.

Not much else to add…excellent post.

@CCP, May I commend you again on your precise and informative blog, which is very accessible even to a Newbie (but Oldie). I am trying to come up to speed rapidly, having discovered the concept of the futility of active fund management only three weeks ago, and am reading every book and blog that I can get my hands on to launch my new career as a passive couch potato index investor. I get the point of this blog’s lead article completely: you cannot predict the actual returns, you can only make the most prudent asset mix that will take care of, hopefully, all the possible economic situations that one can feasibly project might ever happen within your investment horizon.

I am in a somewhat atypical situation compared to others who, I gather, are young investors in the early part of the investment lives. I am at the other end of the spectrum. I am in the process of retiring, and have been lucky enough by very aggressive saving to have amassed a huge portfolio that was managed by my professional associations’s financial arm, despite the boat anchor drag of management fees, (admittedly very reasonable compared to other competitive fund managers) to a respectable profit over the years (although, had I known earlier what I know now, I know it would have been even more, if invested Couch Potato style).

My problem is that my wife, even after reading what I have read in the past 3 weeks, while acknowledging the logic of books such as “Millionaire Teacher” by Andrew Hallam and “The Wealthy Barber Returns” by David Chilton on the merits of passive index driven investing, does not trust the information enough to abandon the excellent advisors at our professional association (who have steered us well over the years with general financial advice as well), despite the exorbitant annual fees that are easily achieved with a relatively small management ratio multiplied by a large amount under management. I have been unable to persuade her that the market (under my own passively invested plan) would match the performance of the current fund managers even without active management. This must be a common problem among couples. Her compromise would be to continue to stay the course (and pay the huge — my characterization, not hers– fees) for the RRSP portion, which is more than adequate enough to finance our retirement, and for me, possibly, to couch-potato (that’s a verb) the Non-Registered portion of about 2 million bucks. My problem is that in the short term i.e. 10 years, it would be difficult to demonstrate the superiority and safety of the compared passive index investment plan to her satisfaction, but I guess that’s a battle I won’t win.

So, my question is, given that I actually don’t expect to need to draw on this Non-Registered component (only $20K of which would be TFSA), how should I set the mix? Given the usual rule of thumb by age, I would allot 60% to Bond Index funds. But I really don’t expect to need most or any of the funds in my lifetime (having enough combined RRSP to be comfortable). And I’m extremely healthy (famous last words). So does it make sense under this scenario to allot 50% or even 40% or less in Canadian Bond Index?. (I would rate myself as pretty fearless, expecting that the equities will randomly fluctuate in value +_ by up to 50%) . If so, should the remainder be allotted in equal thirds to Canadian, US and International (non-US) equities balanced out annually? I don’t anticipate any further external contributions, merely growth from within, hopefully. How best to minimize Canadian tax on revenue and dividends and realized capital gains inadvertently produced? Would a swap-structure Canadian Equity Index fund like HXT be the sort of thing I should use for the Canadian portion? (I have read all your stuff on the forex hazards of incurring US revenue and some of the solutions, so I’ll sort that out later). Oops, these are Product specifics, not Plan specifics, which I have yet to nail down. Any other readers with opinions?

P.S. Andrew Hallam — I’m sure it’s you lurking in the wings — great book! Easy and logical read! I didn’t know how to contact you directly, so please excuse the side-chat, everyone.

Re average rates of return for equties; remember we have to factor in inflation. And then, you can see that you are now making a point or two (possibly) above inflation. Or nothing in real dollar terms, given the mistakes of average retail investors.

As a jaded mutual fund salesman recently told me, no one makes real money off of their investments. No one retires due to their investments, or their investment plan. We retire due to the amount of money that we put into our investment accounts. Meaning that the most important part of any plan is the ‘life’ budget, and living beneath your means – saving.

And that said, the only real money made in equities over the last 70 years was during the two incredible equity bull markets. The rest is negative real returns.

@oldie. I am in a similar situation as you describe. Suspect we may even belong to the same prof assoc. You can stay with your current advisor and still have him/her execute a couch potato type strategy for you. Even salaried advisors will still push their proprietary funds, but they will set up a portfolio of mostly ETFs for you if you ask. I still leave some money in their funds to keep the peace but by far, most of my portfolio is now in ETFs held with th prof assoc.

You should view your non-reg and RRSP funds wholisticlly, rather than trying to have a balance of stocks and bonds in each. It may make more sense to have the RRSPs all in bonds, and I would do this with ETFs as the fees on bond mutual funds are too high for whatever benefit they may have. I have XBB, XRB, and CBO. In my non-reg account, I have almost all eqiuty ETFs with XIU, XMD, VXUS, VTI, and VWO. I still get the hand holding of an advisor. And all the other advice such as estate planning and insurance reviews that are benefits of the prof assoc. Best of Luck.

Hey Oldie:

I know an older lady who is a widow in a similar situation that wanted to invest on her own because of unhappiness with advisors so here’s some ideas that I talked with her about:

If you are currently paying say 1.5% 150BP for advice and 60% of your portfolio is in bonds and equivalents, which should really cost at that level of capital 0.15% 15BP per year or less, then effectively you are paying 1.35% 135BP just for stock selection in 40% of your portfolio. That is quite a bit compared with ETFs and will be a big drag over time unless the manager gets in a streak of good luck or returns are so high that you don’t care.

Here is are several scenarios that you could actually see with a large self directed portfolio:

Bonds have had a 30 year bull market. Yields are at record lows. You have $1200K in bond ETFs. Bond yields start to rise and your bond ETFs start to show capital losses – some of the longer duration ones could lose 10% or more with just a 1% rise in rates. With a couple of percent rise over a couple of years you could be sitting on capital losses of about a hundred thousand in your bond ETFs, offset slightly by their income (5 year avg duration, 2% rise) . What would you do?

Say you have 40% of your unregistered in diversified equity ETFs which is $800K this means you will be putting in buy limit orders with a discount broker for hundreds of thousands per ETF. First of all can you press the mouse for a limit order of $300,000 in shares of XIU or XIC? Or legging in over a year or six months with several orders of $50,000, $100,000 or more per ETF? How would you time your exposure to risk assets?

Another scenario: After some sort of blowout negative event the world markets see Europe fixed, China growing gangbusters, and a strong recovery in USA with some sort of cheap energy technology driven manufacturing renaissance. You are lucky because this is when you begin your investing program in equity ETFs so you are buying mostly near the bottom. Suddenly over 1.5 years you have about a 40% capital gain on your equity ETFs which is over $300,000. It happened in 2009/10. Because conditions are so good and there is some inflation interest rates have been rising steadily and bond fund ETFs have had capital losses. What would you do? Rebalance to the declining bond funds and take capital gains that are taxable at $150,000 on your tax return? Hold steady in anticipation of more gains?

Here is another scenario. You have 40% of your unregistered in equity ETFs which is 800K. There is a banking crisis in Europe with bank runs or some other nasty shock and correlations rise and equity markets tank simultaneously by 50%. You have a $400,000 loss on your books. What would you do? Would you take some of your remaining capital in bond fund ETFs (maybe declining) and put them into equity ETFs?

I am not in favour of advisors for the reason cited at top. But I know there are powerful behavioural biases that can overwhelm financial decision making processes and some advisors are worth being there to help control these.

Chilton advises getting an advisor who uses ETFs. If they charge 50BP which some advisors do under this model this means they are charging $10,000 which at $250 an hour means they are poring over your account for 40 hours a year which they should not be doing if its a couch potato portfolio.

@Andrew: This older widow, given that she is amenable, like me, to a passive investment strategy, er… is she available? Like for a “reverse Berlusconi Gambit” (showing off my newly acquired knowledge from this blogsite!). Just kidding.

Your second and final paragraphs make dismal statements for which the only rational reply would seem to be “never pay anything for service and financial advice that purports to predict the future, which is a futile promise”, which is really the mantra of Passive Investment devotees, a group to which I now resolutely belong.

But that doesn’t mean I don’t need or would not profit from strategic advice that does not depend on market timing, but rather is tailored around my particular situation, investment horizon, investment fund size and Registered to Non-Resigistered amount ratio.

So, with your scenarios, are you trying to point out deficiencies in my allocation strategy, or merely pointing out that you need a cool head and a hardened heart to effectively carry out the passive investment strategy year after year in the face of fluctuating markets (i.e. not to abandon the plan to balance the allocation to the original proportions every year, or whatever the recurrent time period the plan calls for)?

In your first scenario, of what I understand to be the possibility of LOSS OF VALUE (during a time of generally higher interest rates) of bonds, purportedly your portfolio’s stabilizing component, does this point to a deficiency in the reasoning that for a more elderly portfolio holder, a higher percentage of Bond Index funds confers safety? In my situation, given that I don’t actually require this Non-Registered component to be used for income, would a lower percentage of Bond Index, say 50% , or even less, protect me from that scenario, and also be reasonable for other scenarios? Would it also help to select a Bond Index containing only Short Term Bonds (say 1 to 4 years)? I have no idea if this will help, but in my unsophistication, it seems this would establish the safety effect of the Bond component, and not confuse things by giving them a significant Value component.

In the next scenario, I don’t understand what buying “limit orders” means. I thought you decide on your optimal strategic percentage of each component, and make an initial buy to those percentages, and balance yearly, or whenever, with “whenever” being established early as part of your strategy. No watching nervously. Perhaps I’m missing something here.

In the next scenario, when the equity portion grows rapidly, I see no other alternative but to sell the amounts necessary to buy more bond index EFT, and to declare a capital gain and cough up the corresponding tax that year, according to the strategy. Merely holding on to the gain is contrary to the plan, and at or before my eventual death the fund is liquidated anyway and the capital gains has to be declared and taxed eventually. I’m not sure that the advantage of capital gains tax deferral by just holding the increased valued equity EFT’s here offsets the benefit of locking in the profit by rebalancing the portfolio. My first knee-jerk thought was the locking in the gain in value of those equities, but on recalling the advice buried in this blog somewhere, the real benefit actually is in having an appropriate Equities-Bonds balance in your portfolio, isn’t it?

Lastly, in your disaster scenario where values crash everywhere, what would I do? Just what the plan says I ought to do. Shit happens, and will happen. You just don’t know when. So sell your Bond component to restore the original percentages to balance out the portfolio, understanding that the loss would have been much worse without the constant 50% (or whatever) Bond component, and take comfort that the Equity portion you are now restoring is being purchased at a discount.

How am I doing so far?

The only concept that I am not clear about is the question of when to do the regular rebalancing. It would seem that any strategy that includes the idea of doing it whenever the ratios differ enough from the original to frighten you includes the element of trying somehow to time the market, which one should not try to do. So is it intrinsically safer to select an arbitrary time, say once a year? And would it be contrary to principle to include an algorithmic refinement such as invest more US Equity percentage in the 2 years prior to the US election and reduce to a lower percentage in the 2 years following? Or would that also be a violation of “don’t try to time the market”?

@Dale: Your point about being sober about how little you can expect to grow your nest egg in real terms (after accounting for inflation) is valid in that your future financial security depends so much on how early you start and whether you put away enough at this early age. Of course this principle trumps any investment strategy later on. You can’t invest anything if you haven’t got it.

But once you have your hard earned nest egg, given that you should never expect to grow it by much more than the rate of inflation, it behooves you to invest it as safely as you can with respect to your time horizon, and not squander any portion of it, seeing as what a narrow margin of expectation of profit you have. If you accept the idea that the passive management of acquired index funds safely matches the stock market over the long term, and that paying an active fund manager to juggle your portfolio loses to the average of the stock market return over the long term, then that is, in my book, squandering a precious resource.

So I don’t think this reality invalidates your original point. Yes, you must save enough and early enough to grow enough. But the fact that you shouldn’t automatically expect your portfolio to grow much more than the rate of inflation should not blind you to the fact that you can easily, with sloppy thinking (i.e. I’ll pay a manager who is more clairvoyant than me), effectively achieve net growth LESS than the rate of inflation. So you must still pay a lot of attention to the disposition of money that you have accumulated through the discipline of early saving, or else you’ll lose it.

@Dale: There’s no arguing that the last dozen years have been very poor for equities, but over the very long term I think it is reasonable to expect market returns to be 4% or 5% above inflation. But as you say, most investors do not earn that because of costs, taxes and bad behaviour. And I agree completely that your personal savings rate is more important than your investment strategy in most cases. All the more reason to focus on what you can control (costs, tax efficiency, discipline and savings) and less on the one variable that is out of your control (market returns).

@Oldie: First, welcome to the blog and thanks for sharing your experience. You’ve raised a lot of questions, but let me just focus on one main point. When I first learned about index investing, I too felt that indexing meant firing your adviser and handling your investments on your own. I soon learned that DIY investing is much more difficult that it seems at first blush. I think that someone with significant assets and no experience managing their own investments is much better off with an advisor.

I respectfully disagree with Andrew on this point. A lot of experienced DIY investors assume that everyone has their level of knowledge, interest and experience, but unfortunately that’s not true. It’s a bit like an electrician telling you that it’s easy to install your own pot lights. It is easy—after you’ve had many years of practice. Everyone else is at risk of doing some serious damage.

But this the most important point: it must be the right type of adviser. everything you have read should make it clear to you that it is almost never worth it to pay for active investment management: stock picking, fund picking, market timing, tactical shifts based on forecasts, etc. But there are advisors who do not include any of these things as part of their value proposition. (Admittedly they are perhaps 5% of the advisor population.) These advisors will create a long-term investment plan for you (including risk management and asset allocation), make sure your investments are tax-efficient, build the portfolio for you with low-cost passive funds or ETFs, rebalance when appropriate, manage your cash flow in retirement (this one if huge) and most importantly, save you from costly errors that all new DIY investors make. On large portfolios, they often charge 1% or less, which is deductible on non-registered assets, so it may end up costing only 0.6%. And the tax savings alone will often pay for that fee.

I’ve written at length about this idea:

https://canadiancouchpotato.com/2011/05/09/do-indexers-need-an-advisor/

https://canadiancouchpotato.com/2011/09/30/when-should-you-use-an-advisor/

http://www.moneyville.ca/article/977647–what-should-you-expect-from-your-advisor

I also host a directory of “index friendly” advisors across the country:

https://canadiancouchpotato.com/find-an-advisor/

@Philippe V: As you are obviously in the beginning end of the spectrum, let me share some of my experiences and thought processes at the time. When I was in your phase, there was no RESP when my two children were young. RESP’s came into being when they were about 16 and 17, I think. So I had only about a 7-8 year contributing and investment horizon to accumulate within the fund. I had no idea what to expect — I had never been through it before, remember? All I knew was that the RESP was a no-brainer — contribute the max (ok, you’ve paid your tax already on that) , and get the 20% government match as a TAX-FREE FREEBIE. Then invest the RESP aggressively for that horizon till they turn 23 (or when I expected them to graduate).

I figured that as long as I kept the maximum amount invested yearly, and kept in the RESP as long as possible, it could accumulate tax free to the greater financial advantage of the family unit. The original intent of the government’s plan, I think, was that it be used directly to fund the education. But to cannibalize it, as it were, to directly pay in real time for their education would interfere with the tax-free compounding profit idea. So I thought of the RESP as part of my own savings scheme. If, by paying into the RESP I was not able to pay down my home mortgage as fast, and wasn’t able to make as much savings contribution as I wanted, I was fully prepared to pay for the kid’s education directly out of my current income and extract the amount back from the kids later (after cashing out tax-free!) and use it as a deferred contribution for my own investment! (I’m ruthless).

As it turned out, with various happenstances several things transpired; 1) In Alberta, where I live, high school students qualify for a “scholarship” if they attend tertiary education, really a tax-free cheque from the government of $400 in Grade 10, $800 in Grade 11, and $1300 in Grade 12 for getting >80% average in their courses for those years. I had made it clear to the kids that although I’m not a stickler for high grades for their own merit, this was a financial matter, and if they failed to produce, I would somehow extract the difference sometime in their lifetime, to compensate me for the extra after-tax net amount I had to shell out for their tertiary education. They both produced the $2500 in sweat equity, although there was a lot of squealing and whining with one of them. 2) We kept costs down for one, who went to University in town here, lived at home, even got some more scholarship award, paid for her own in between 3rd and 4th year “internship” in Europe out of the internship salary paid, and, all in all was cheap; and for the other kid, we, regretfully had to spend a little more, but broke even. 3) We had already established modest spending habits for ourselves and kids, so they bought whatever frivolties they could afford out of their summer jobs. At the end of the story, we had somehow managed to pay for the education out of pocket, keeping the RESP investments intact until the years they were no longer in University, when the plans had to be deregistered. All this time, all the RESP rules required was that the child be registered in a qualifying tertiary institution each year the Plan was in place. It did not literally have to be taken out an accounted for and proved to be spent on education. As I had more or less managed to keep my own investment contributions going through all this, I didn’t have the heart (ruthlessness?) to extract the amounts back from the kids, so the Plans were deregistered and the proceeds turned into conventional investment accounts in their own names. The younger child, whose education cost more, and whose plan had received one more year’s infusion of cash from his parents and from the government was gracious enough to “gift” a suitable amount of his deregistered Plan’s proceeds to the sibling’s account to offset the acknowledged extra parental spending for the more expensive child’s education. The RESP investment all took place, by the way, a long time ago, under the management of a fund advisor who did OK, but extracted his annual percentage, so did less ok than I would have, had I read Andrew Hallam’s book 12 years ago instead of 3 weeks ago. But that’s the past.

Now, hopefully for each child you will have from year 0 to year 23 or so to invest annually and extract 20% from the government in essentially what is a tax free savings account, with tax free government augmentation. This is huge. Hope the kid goes to tertiary education, or else the government portion is repaid back. (I don’t know if you can keep the interest on that loan.) But, using the principle of start investing early, this is a goldmine, whether you think of it as yours or your kids’ investment. You can calculate an A or B scenario, investing in the RESP and collapsing it to pay for the education, freeing up your funds to invest for your retirement, or using your current funds to pay for the education and using the RESP to be a tax free investment vehicle that you can grab back when it has outlived its life. I think the latter wins, even if there is a forced savings element (you gotta come up with the tuition fees and daily room and board) to that approach.

Ideally, for maximum financial advantage, each child should take a trade, so that they can earn money as they apprentice, go to a trade school to qualify for continuing their RESP, and start earning money young so they can start their their saving habits young. Over a lifetime they will easily outperform most professionals financially. OK, so mine didn’t. But they didn’t cost me too much to educate and I was able to finesse the RESP to my advantage, even though I didn’t get nearly enough time horizon to do so compared to what you will get.

Okay, I see that most of my own strategy was achieved by saving costs rather than by using the RESP to pay for an expensive education. And I didn’t help you with “how much will the tertiary education cost?” But I don’t see why the ability to use the RESP to maximally invest in a long term tax free investment cycle, with tax free government contributions should preclude you from attempting to minimize the education costs. You can do both. It all boils down to the frugal spending principles of the wealthy people featured in “The Millionaire Next Door” by Stanley and Danko (a title that seems to come up repeatedly in most financial advice books and blogs that I have read in the past 3 weeks). The more money you have left over after consumption, the more you possess to invest adequately for your future. I am a strong believer in education, including tertiary education (admittedly, it is can be regarded as a currency of its own), but it doesn’t necessarily have to be expensive. And education is still consumption. I know everyone’s experience will be different, but you have nothing to lose by establishing thrifty habits early, and gradually transferring this sense of financial accountability to the kids, so the choice of tertiary institution will be jointly made by child and parent with the knowledge that every after-tax dollar that is spent on education has to be taken out of future invested value and financial security. Hopefully, that will tend to keep costs down, and put perceived value and respect into the education provided, and keep the kid motivated to capitalize on his or her educational opportunity.

Sorry to sound preachy — I read over the stuff and it sounds sort of sanctimonious, but I’m so glad now that we did what we did then (except for paying for an investment fund manager). We have money now, and the kids didn’t seem to do too badly under all those financial constraints that other parents didn’t seem to impose, and now they are adequately educated, and fiscally and personally responsible, and independent.

@CCP: Whaddya mean? I’ve installed my own pot lights and done all my own electrical work at home to save costs all my working life, and have come out quite far ahead, even taking into account all those years in I spent in hospital. Just kidding. Point well taken, (although, actually, seriously, I sort of did a lot of practical electrical apprenticing under the guidance of my best friend, a journeyman electrician, and also plumbing, under the guidance of another friend, a plumber, and I valued the educational experience and respect all the things that can go wrong in electricity, and water, and that understanding has really helped over the years in planning renovations and repairs etc.).

On the subject of financial advisers, my present “adviser” for my RRSP portfolio is my Professional Association’s financial arm’s representative, and his retirement planning and estate planning advice etc. is “free” except that the strings attached are that I use the fund managers (also chosen by my professional association), and overall, 1.2% per annum is extracted from me. My wife feels constrained to continue getting this advice.

A competitor (my long-standing bank’s Investment Broker affiliate) has offered to take over this portfolio for 0.85% per annum, or less, by which he undertakes to put together an actively managed portfolio that pays income and preserves value throughout my life, and, because I asked if the percentage would increase as the fund value was consumed over my lifetime, his reply was that rather it would tend to drop to 0.55% as the percentage of investments in Bonds grew towards 100% as my age progressed. He similarly provides “total” financial and estate advice “for free”, having at his beck and call, a wide array of financial, accounting, actuarial and legal experts.

My problem is, if I can persuade my wife that choice Number 2 provides the same degree of service that Number One does, then I have dropped my overhead from 1.2% to 0.85% or less. But I still have the problem of actively managed portfolio. If too actively managed, do I run the significant risk that the manager will in his eagerness do WORSE than the stock market, even before the 0.85% is extracted?

For a Financial Advisor who advocates Passive Index Fund management, (call him Advisor Number 3) what does he do for his 1%?. Would he give me all the advice, in yearly or 6 monthly meetings, then tell me what ETF’s to buy and sell on my discount brokerage account which he would help me to set up? And how to bargain for low rate US dollar conversion transactions, or show me what stocks to use for Norbert Gambits…Or is the whole point that I would be spared the nitty gritty of learning the details of this process, and completely insulated from the probability of connecting a black wire to a white wire. Ooops. ZZZZZT! Arrrrrrgh. So he would do all the trades himself?

I would calculate that if the going rate for a Passive Management advocating Financial Advisor who does all the legwork is 1.0% for an RRSP portfolio for which I have been quoted at 0.85% or less, then I might as well add my 2000k non-RRSP to the RRSP portfolio so far discussed, and take a further drop in the MER percentage (which he has assured us he would allow) and go with Advisor #2, effectively paying 0.7% or less for all his useful advice and for his meddling. But that would assume the investment risks of his meddling are inconsequential. And I would never get to learn firsthand, in the trenches, the reality of the power of Passive Index Fund Investing.

@Oldie: An adviser who set you up with ETFs or passively managed funds would manage the portfolio via their firm’s brokerage: you wouldn’t be making the trades yourself with a discount brokerage account. So you would not need to worry about Norbert’s gambit, when to rebalanced, how to place limit orders, etc. That’s part of the service.

@MD: Busted!!!! Hahaha.

OK, now we know who we are, this may be the best news I’ve got so far. (No offence, CCP!) You mean, I maybe can keep on subscribing to the same professional association management company, but, on their advisor’s advice on mix, buy ETFs that match that mix???

It seems too good to be true. At our last meeting 4 days ago, he revealed that the financial transactions help fund the other do-good aspects of the association management company. That’s a lot of overhead. No wonder they push the Association-recommended fund manager, who extracts a goodly fee, then kicks back a commission to the professional association, or essentially that same transaction.

I found it very difficult in that meeting to confront the advisor who was talking to us. To be fair, I’m not a confronter — I was all prepared to quietly take my money out and invest it myself if my wife had let me, but I couldn’t bring myself to burst the guy’s bubble — he didn’t get it, as he went on at great length describing all the positioning to avoid risk that the Fund manager and he had achieved in light of today’s economic climate of uncertainty. He was emotionally heavily invested in the certainty that all this tremendous intellectual analysis and legwork done by so many people in the Managed Fund had to have some tangible financial benefit in the long run; it would have been devastating for him to have to accept that a lifetime of belief was proven a sham.

So, if I can persuade him that he is not failing his professional responsibility to me (because HE KNOWS that the 1.2% the fund is charging is repaid in full and more by the resultant superior returns) by allowing me to invest his recommended mix in passively managed Index funds, how much would they charge for this portion?

Does your account get charged the $29.95 rate per transaction or can you get the discount brokerage rate? Does your total cost for the passive management part of your portfolio amount to the costs of the transaction plus the quoted MER of the ETFs? Or are there any other hidden costs that the professional association extracts from you to make up for the loss of management fees that those funds are now no longer generating for them on a percentage basis?

“I still leave some money in their funds to keep the peace…”

Haha — so, how much money is needed in there to “keep the peace”? Any rules of thumb?

And you’re right, the estate planning general financial and insurance advice were all very valuable in the past, and I appreciated that. But I have also paid very heavily for that advice in the past. I believe I need less advice now, going forward but of course there’s my wife to account for, and maybe there’s a sweet spot that might be acceptable to all parties — an RRSP component heavily weighted to bond fund committed to active management by the associations’s designated fund manager in an amount that, multiplied by a now higher percentage MER (smaller actively managed amount) comes to an annual dollar figure that I can stomach, and yet is high enough to “keep the peace” with the professional association’s advisor, and my wife LOL!!

There’s also the issue that I only just became aware of (see Andrew’s post regarding various upcoming hypothetical economic scenarios) that bonds and bond funds should not be regarded merely as “safe” components of investment portfolios, because their VALUE (as opposed to their INCOME) may diminish in times of higher interest than what they are promising to deliver. But that’s a mix-advice issue that the advisor can fine tune me on, even if he isn’t making as much money off me now, hahaha.

Thanks so much for your input and revelation!

@CCP: Sorry to be hogging the space but when this Passive Investment favouring advisor makes the trade on your behalf, doesn’t that generate another expense which is passed on to the client?

So the true total cost of the Passively Managed Index portfolio is:

Annual cost of Financial Advisor, say 1%

plus

Cost per trade (not really that much in the grand scheme of things, even if usual $29.95 per transaction, but much reduced because the transactions are few, perhaps annually)

plus

Annually: The weighted net of all the MERs of the individual ETF’s

plus

All Currency Exchange costs, taxes, fund fees, if applicable, and hopefully minimized by astute advice from the above manager.

Again, sorry for the badgering, but this is all new stuff for me, and I want to be sure I’m comparing Apples with Apples; even the much lower MER’s of ETF’s seem to amount to something significant when added to the Advisor’s annual fee

@MD: I just thought of another practical difficulty staying with my professional association financial management team, and using them as advisers on what a prudent passively managed mix would be.

Assuming they are truly dyed-in-the-wool believers in Active Management, (which is a reasonable likelihood, I think, as my Adviser there appears to be a decent individual who is an experienced practicing financial adviser who truly believes in the product he is promoting) even if I can get him to give his best theoretical advice on prudent asset mix for the fees he is getting, how do I stop him from giving knee-jerk active management advice at times of economic volatility, or to phrase it more exactly, how do I differentiate the knee-jerk, fear-driven emotional component of advice given at those times, which, I understand from my reading of this blog and elsewhere, even professional Financial Advisors are subject to, from fundamental, rational, asset mix allocation type advice, free from any market timing bias?

The more I think about it, it is a serious problem. As I understand the genesis of inadvertent fear and greed-driven bad decisions made even by experienced Active Management Advisers, I would trust the judgement of the bloggers here like CCP and Andrew, for example, even in the little recent exposure I have had to their opinions more than I would the judgement of my Financial Adviser at my professional association’s investment arm, merely because I am aware of his bias towards the merits of active management, no matter how much he may deny that this has anything to do with trying to time or predict the market.

@CCP and @Andrew; I guess my thoughts in formulating this latter paragraph have raised a very fundamental question in my mind regarding Passive Index Investing: is there ANY component of Active Management of Funds that can be successfully rationalized to NOT being equivalent of trying to time the market, which I understand to be a futile thing.

And, in the other camp, does shifting of percentage allocation of component types (as opposed to rebalancing to regain the original planned allocation percentages) in a Passively Managed Index Fund portfolio at different i.e. volatile times amount to a violation of the principle of NOT INTERFERING with your fund that has been preached here?

@Phiippe V: I just realized I projected a result that wasn’t correct. Or at least I said incorrectly that the government contributions were tax-free. The proceeds of an RESP are not exactly tax-free. All profits and government contributions accumulate tax-free while within the fund, and thus benefit from compounding. But on collapsing of the fund, the original parents’ contribution is the only non-taxable part of the money you get out (having had tax paid BEFORE contributing to the fund). All excess profits, whether interest derived or capital gains, plus the amount donated by the government plus the growth and interest from that portion, is fully taxable in the hands of the student. Now in our case, after only 7 years investment, the taxable portion was small enough that when added to their net declared income at that time (students), especially with their allowable education and other deductions attracted no tax.

However, in your case, with 23 years of passive compounding, the profits would be formidable. I believe that’s also a French word! In any event, the taxable amounts even in your children’s hands, will likely be high enough to require some planning to collapse the plan over several years, taking into account your children’s net income and deductibility of tuition for each year to minimize the total amount of tax paid at their marginal rates on the proceeds. I’m a bit fuzzy on the likely exact amounts involved, but the general principal of my remarks, I believe is correct. I’m sorry if my initial blurting out was inexact, but that’s what happens when a non-expert gets a mouthpiece!

Oops, that should be @Philippe V:

Hey Dan, actually those 4-5% returns above inflation for equities are not there (historically). OK, again they could be there if your time horizon goes back enough to grab some of the bull market in the 90’s, or 50’s. It’s feast or famine with equities. But of course you need them in the mix, and it’s evidence once again that you need to be exposed to all asset classes.

Here’s a great chart on that.

http://www.ritholtz.com/blog/wp-content/uploads/2009/06/6-19-09-secular-cycles-1.gif

I’ve written an article on this. I will link it here when I get it posted.

@Oldie:

More information about “MD management” in this thread:

http://www.financialwebring.org/forum/viewtopic.php?f=29&t=110398&p=379636#p379636

For what it’s worth, I have a friend who use their services but manage his investments by himself and doesn’t have any money in their funds. Even if their advisors don’t seem to agree with the passive investment philosophy, they can still give useful advice about risk management, financial planning, tax management, controlling bad behavior, etc.

If you use a fee based advisor charging 1% of assets, even if the advisor believes in passive investing, the total cost with ETF’s MER + 1% management fee who probably more expensive than the MER you are currently paying with your professional association…

@oldie, You can simply ask your adviser to set you up with a trading acct so you could view your holdings online. Then you can trade in it to your hearts content at $9.99 per trade. You can gradually (or quickly) simply replace your mutual funds with equivalent ETFs in the same asset classes assuming you have confidence in the asset mix your adviser has you in. This avoids having to get into a battle of wills with the adviser who will try to keep you in their mutual funds. The adviser does get notified each time you do a trade online and may call you to ensure you know what you’re doing. So few people actually do this that they don’t seem to mind too much. Over time, my adviser has become very supportive of my approach once sstisfied hersel that I knew what I was getting myself into.

@Dale: Certainly there are many periods where real returns on equities have been lower that 4% to 5%. But the chart you linked to is extremely misleading because the returns do not include reinvested dividends. This is a common tactic used to make equity returns look far worse than they are. Does this chart really suggest that equity investors saw a –65.44% real return from 2000 to 2009?

Readers might be interested in Vanguard’s recent paper demonstrating that a simple 50-50 portfolio delivered over 5% real returns through both expansions and recessions since 1926:

https://canadiancouchpotato.com/2012/06/07/why-plans-should-come-before-products/

If there is one thing all of these data show, it’s that investing must be a lifelong commitment—at least 30 years, anyway. If you expect every 10-year period to be in line with the historical averages, you are likely to be disappointed.

Thanks Dan. US investors likely saw a 45% or more negative real return for that period – based on broad market sp500. Inflation would have eclipsed the near 2% dividend stream. Index price is down nearly 40% or that period.

If dividend and reinvestment are not included in the ritholtz chart that would mean that for 20 and 30 year periods, the only gains above inflation over these periods are dividends and potential reinvestment (if in wealth accumulation phase). That could mean 2%-3% above inflation depending on one’s appetite for dividends.

Many equity investors see their entire wealth acculuation phase deliver very, very small returns. I would certainly agree with that 50-50 asset allocation. For me, I’m certainly even more weighed bonds to equties.

But the point seems clear. Very few of us get rich or retire due to our investment returns. Be happy to get 6-8%. A few points above inflation.

Market timing is the only way you’ll make real money.

@Dale: WHAAAAAAAT??? Hahaha, Great comment in this blogsite to trigger a lot of explosive comments! Seriously, @CCP: can this last paragraph statement of Dale’s be finessed in any way to make it somewhat true and safe at the same time? My present understanding of the Couch Potato Philosophy compels me to say no, but my eagerness to learn more is why I’m wathching this blog!!

@Oldie: You’ll have to ask Dale for the details on his market timing stratgey. :)

But I do agree completely with his statement that “Very few of us get rich or retire due to our investment returns.” Most people build wealth by earning and saving.

Ha. Oldie, not saying I will continue to market time in any way, but I’m open to it if we get a serious meltdown over the near year or so. My accounts are 60-80% shorter bonds, with a decent (separate) allotment in cash as well. I will put much of it to use (in higher income equities) if things get real ugly.

That said, practicing rebalancing within the modern portfolio theory essentially asks you to market time and sell what is working.

Oldie:

Thanks for taking time to give an extensive reply to my post. I only made the post because the lady I mentioned had substantial assets yet was upset at the relatively high fees and lacklustre performance of her portfolio over a decade. She opened a discount broker account and started putting money into in and promptly lost it – but fortunately it was a small amount, a sort of “testing the waters”. This persuade her to switch to another advisor for 1.5% with a 60/40 portfolio. This advisor is very nice and transparent in her dealings so she is happy and does not worry about her portfolio because she trusts her. The advisor is however a market timer in that she overweights and underweights sectors based on analyst recommendations but it is all tweaking at the margins and seems designed to demonstrate that something, anything, is being done to respond to economic and financial conditions. If you can get an advisor who charges 0.85% then this is a relative deal. Can you convince such an advisor to use passive strategies or is it a pooled situation?

My point about the scenarios is this – extremes can occur good and bad and they eventually will occur unless you have an investment period which is a lucky sweet spot.

What I was getting at is that once one’s portfolio is sufficiently large the dollar numbers of volatility are correspondingly large. I imagine most people dealing alone with the numbers in those scenarios would want to get some help, even cursory, because deciding to take a capital gain of $150K or crystallize a loss of 200K has consequences. Most of the time it would be fine but in the extremes emotions can be strong when so much is on the line.

My point about advisor fees is that I think the industry has gotten away with high fees for too long. Fees used to be even higher but 150 BP to manage a 1000K plus portfolio of 40% stocks is in my opinion still too much even with all the other services on offer (most of which you have to pay extra for anyway – like tax preparation).

A limit order is just a method of putting in an order in a brokerage that sets a limit on what you are willing to pay for the stock. Another type of order is a market order which is whatever the market is offering at the moment your order is executed. With a liquid high volume stock or ETF a market order could be okay but with a less liquid ETF or stock I would use a limit order to avoid paying more than I should.

One of the reasons bonds have worked so well in the past 30 years is because interest rates have been steadily declining – so you got capital gains on top of the yield. Rates are very low now – if there was a deflationary depression they could go lower or they could stay low for a very long time (look at Japan) in just slow conditions. Or if there was inflation starting, or questions about credit ratings of sovereigns, rates could start to rise generating capital losses that are a function of the duration of the bond or the bond ETF.

For the present conditions consider a simple ladders of GICs – yields are as high as corporates but the risk is essentially same as government bonds because of the insurance guarantee. Ladder captures rising yields. Now if there is some kind of crazy deep deflationary depression then maybe all bets are off. A simple very low cost portfolio is high interest savings accounts for cash, a ladder of CDIC GICs from credit unions and the like, a bond ETF for liquidity and rebalancing and equity correlated ETFs for the equity component (maybe managed by a hourly fee only advisor).

Wow! You guys are having a heck of a conversation.

Oldie, thanks for the kind words about my book.

Dan, based on the detailed responses you’re giving readers, and the great writing and editing you’re doing elsewhere, I finally understand why sleep is a four letter word for you.

Don’t work too hard–it’s an overrated virtue.

Cheers,

Andrew Hallam

@Andrew H: Thanks for dropping by. I hear from people every day who have read your book and want to learn more. Keep up the great stuff.

@MD: Hey, are you still there? Progress report — I have been steadily acquiring information experience and confidence, and have been depopulating the Prof Association Mutual Funds from the Prof Association Accounts and repopulating some new accounts with a balanced portfolio of plain vanilla ETF’s. In the process, one of the Prof Association advisors seemed mildly alarmed, then, at best neutral. Another one, in the department that manages the accounts that I am filling with Index ETF’s has shown support and in fact seems to be learning new things as I introduce him to my evolving plan. I really wonder if these advisors actually believe the mantra of the Active Management myth, or are they in a state of suspended disbelief, and only need a client who states his requirement for Passive Management support to slap themselves back into the rational world?

Question: I have acquired a large surplus of US Dollars, only some of which I will be needing to purchase my quota of USD ETF’s. The rest needs to be converted to CAD, and I have been trawling the CCP site and other sites for information on the mechanics of low-cost USD-CAD Norbert’s Gambit conversions. I have already established that conversion using DLR/DLR.U can be done in our professional association brokerage, buying and selling on the TSE. This would cost me 0.20% for the 2 transactions (based on the best bid-ask spreads). However I would like to lower the cost further using, say, TD purchased on the NYSE and sold immediately on the TSE. My advisor tells me that our association’s discount broker (who happens to be National Bank) will not allow newly purchased shares to be sold until settlement, i.e. 3 days later. If this is true, then I shouldn’t be doing it here for risk of incurring losses on the drift of share price in 3 days. But in the discussions on this site there have been multiple instances of couch potatoes being told by advisors at their brokerages that things can’t be done (such as selling shares at the other stock exchange immediately after purchase from the first stock exchange) only to transpire that this was not true. So, do you happen to know if Norbert’s Gambit can be done at our Professional Association’s Financial Arm, i.e. purchase TD on the NYSE and immediately journal the shares over to the Canadian Dollar account and sell them on the TSE for Canadian Dollars? Much appreciate your prior input, btw.

@Oldie

Haven’t tried Norbert’s gambit yet. The prof association’s brokerage charges”only” 0.5% above the bank rate to purchase USD. Basing this on purchasing 100K of vxus last week and calculating the cost of the USDs purchased. In light of this, I felt that it wasn’t worth it to me to execute Norbert’s gambit in order to reduce costs from $500 to $200 using DLR/DLR.U. Everybody’s gotta eat, and the extra $200 ove my planned holding period of 15 years is reasonable. If the USD/CDN conversion fees were as high as at other brokers, I would definitely try Norbert’s gambit. [May still do it once for the experience]. I have noticed however that trades do take at least 3 days to clear, so it sounds like you may be getting accurate info. Glad to hear that you transition to a couch potato strategy is going well.

@MD, @Oldie and @Jas,

Hopefully you are still there. I have been using MDM for a few years managing my own couch-potato ETF portfolio and my adviser has actually been quite supportive and admits his own portfolio is similar. I’ve recently become a little concerned about the ACB adjustments that CCP has been writing about – when I asked my adviser he said that the ACB should be the same as the book value reported by National Bank (back office for MDM), and my accountant has just been using the book value given by MDM. I get the sense from reading CCP that the book value and ACB are not always the same – do you have any experience with the true ACB vs book value as reported by MDM?

@ Sleepydoc, @ Oldie

Personally, I do not trust MD management for their calculation of the ACB. I’m pretty sure that they do no adjust their ACD for phantom distributions using the CDS innovation database as explained on these websites:

https://www.pwlcapital.com/pwl/media/pwl-media/PDF-files/White-Papers/PWL_Bender_As-Easy-as-ACB_2015-January.pdf?ext=.pdf

http://www.adjustedcostbase.ca/blog/tax-breakdown-service-for-etfs-and-trusts-from-cdsinnovations-ca/

http://howtoinvestonline.blogspot.ca/2014/04/light-at-end-of-acb-tracking-tunnel-for.html

Oldie said, in another discussion on this site, that he would check with his MD management adviser…I am curious to know the answer !

@Oldie, @MD, @Jas,

Did any of you end up trying the Norbert’s Gambit? The 3 day window also discouraged me, but I’d like to hear of any personal experience.

Thanks from Melissa

(in the same professional association. Recently sold ~all mutual funds to go to mostly passive investing)

@Melissa: regarding the Prof association — my loyalty to them for all the benefits they have offered over the decades of my investing ignorance is now partially offset by my annoyance at their inflexibility, especially in the context of my recent education in Couch Potato investing.’

I have done three major Norbert’s Gambits one in February 2013 while still a raw neophyte, scrambling to amass the necessary information and expertise to execute a safe and economical NG, documented in this post in the Canadian Capitalist blog and subsequent reader comments

http://www.canadiancapitalist.com/a-foolproof-method-to-convert-canadian-dollars-into-us-dollars/

another in March, 2014, and lastly, once in about November 2014. On the first 2, I used TD, a stock trading on both TSE and NYSE in high volumes, so the trading was accomplished very rapidly, within seconds, despite large blocks of shares being transacted, and because of the high price, a bid ask spread of 1-2 cents represented a very small percentage of the share price, making my cost extremely small. This required personalised attention from my prof association, which was offered as a special consideration, it was my understanding, once I had explained to them the mechanics of the transaction.

The first NG was done with me in the advisor’s office, and he was in constant direct phone contact with the trader in Toronto. This went without a hitch, and I was only charged the on-line fee rate, despite the phone contact.

On the second occasion a year later, by mutual consent, I did it from my own home, with me being in direct contact with the trader in Toronto, and again it went brilliantly. Again I used inter-listed TD stock as the vehicle.

On the third occasion, having used up all my favours at the professional association, I thought, I needed to convert a smaller amount of currency, so I thought I would use DLR/DLR.U so as not to require rapid journalling and rapid re-selling of your purchased shares, and thus did it on-line, although I think I needed to phone for advice regarding journalling for the shares to be sold in the other currency account. In my research for this there was some initial confusion at the brokerage regarding whether the trade needed to be settled before the proceeds could be used to purchase other stocks, so beware that this specific knowledge seems to be thinly spread around.

In the end, I did use the DLR/DLR.U method, and had to wait 3 days before I could used the proceeds. I found this rather unsatisfactory, having enjoyed the convenience of the TD gambit previously. Therefore, when an email survey arrived in my in-box regarding my satisfaction with the service given by the professional association, I indicated less than full satisfaction. I received a phone call from the supervisor, concerned about my less than full satisfaction. I explained my position, and obtained the understanding that they were reluctant to encourage this practice in large or escalating numbers. I offered my advice that if they were discouraging members from doing NG, all that knowledgable investors would do would be to migrate to RBC Direct Investing, for example, where no-hassle NG can be done on line. He had no direct answer to this, but he offered his personal support for me for Gambits in future that would involve large amounts, making the savings worthwhile.

So, it was a somewhat mixed message — I don’t know what to advise. You could ask your own adviser directly — that’s what he’s there for, but unfortunately you may have to explain to him explicitly that you want to purchase a quantity of TD shares, for example, on the TSE, then sell them immediately on the NYSE, and so you need to enlist the help of the trader in Toronto to journal the shares for you to the other currency account, so please what would he advise. At that stage he may ask for advice and get back to you. Or you could phone the trading desk in Toronto yourself to explain this directly to the trader, and ask if the telephone trade rate would apply or the on-line rate (a bargain in any case, really). Unfortunately, for a neophyte, this means doing the research and being crystal clear what you need to do, etc. In the the long run this may be an advantage to you.

Or, if this seems too much a hassle just to maintain loyalties, open an account at RBC DI and do it there.

I too am with MDM, and have had a very positive experience transitioning to passive ETF investing with them. Empowered with the knowledge imparted by this website, I walked into the office and told my advisor that he could either support the move or see the money move to another institution. He has been nothing but helpful, ensuring I always have the cheapest trading fee, annually reviewing the portfolio allocation and even helping me choose between different ETFs etc when requested (perhaps not as well as say Justin or Dan would, but you get what you pay for I assume)

In terms of NG, I did find it a little bit of a hassle, but I just made the trades myself online with the tradecenter on the phone line to ensure that everything went well. I’ve only use DLR/DLR.U for NG. On the last trade I also asked for the spot exchange rate at the time of each trade. I calculated the difference to be less than 0.5% saving using DLR. For the amount of money I exchange (and now that you can access most bread and butter funds on the TSX), this is not worth the brain damage doing NG, and for the last year or so I just use the institutional rate offered by MDM and get instant forex conversion. I have confirmed with other banks and ex-MDM advisors that the forex rate offered to clients is exceptional low.

The only doubt I have had about sticking with MDM is whether they calculate ACB correctly. I have checked with my accountant who only does MD professional accounts and he has assured me that between MDM and him the ACB is recorded correctly, but all the wealth of info provided by Dan and Justin makes me doubt that. I have resigned that my portfolio has a little leak in its efficiency in this area, but I still think that not paying a fee based advisor likely saves me money overall. Any thoughts from other MDM clients?

@sleepydoc: I’m glad you’ve had positive experiences too, as I have had myself. So my loyalty is appropriately based. However all the more irksome that my own association corporation can’t see the merit for or can’t get it together to organise the logistics to achieve Norbert’s Gambit on their online platform, something that the other commercial serious players have achieved years ago.

It’s not a huge deal-breaker for me any more, especially seeing as how I am not likely going to make large currency changing transactions ever again (and I accept the CCP advice that it is best to arrange your affairs so that you rarely need to make currency exchanges at all); but if they intend to cater to a large cohort of high net worth and possibly knowledgeable investors, they should read the writing on the wall.

To illustrate, doing a NG using DLR/DLR.U which the association platform accommodates, sort of (you have to make a phone call to journal the shares to the other currency account), costs you 0.20% which, granted, is better than the 0.5% that they would offer you if you asked. But I did it using TD which at the time was trading at about $82, with a bid-ask spread of 1-2 cents. So, assuming an average spread of 2 cents, my cost was 0.02 divided by 82 which is about 0.024% (plus of course the cost of the number of trades I made, which in my case was eight, because, for safety, I split the amount into 4 equal tranches to gambit separately). For a large amount of currency to convert, do the math at how much it would cost, and how much you could save! I saved a bundle!

Once you start along the line of seeing it’s not necessary to pay exorbitant fund management fees, (and calculating how much in dollars you could safely save), it’s just a natural progression to seeing what other unnecessary expenses you are paying that you could safely save!

@oldie – I think they have no intention of “catering to a large cohort of …. knowledgeable investors”. The vast majority of their profession have no idea about money other than how to make it (and for some, how to spend it!) – that is why MDM was created in the first place. Most of their clients are pleased to have reasonable advice at a reasonable price, with the knowledge that they will also provide the same for immediate family members. It is safe to say that no ponzi schemes, hedge funds or penny stocks are sold. It is why I still advise my aging parents and lower-income siblings to make use of their service – not everyone feels comfortable with the couch potato model. Of course those that have found their way to this website are biased – but it is sort of like walking into a fine dining restaurant at a members only golf club and asking for a bag of Doritos – they might go out of their way to find some for you, but the vast majority of their clientele are perfectly happy snacking on the caviar and they aren’t likely going to change the menu.