Last October, Justin Bender wrote a blog post explaining why GICs are more tax-efficient than bonds. The blog caught the attention of John Heinzl of The Globe and Mail, who wrote his own article on the topic a month later. Many investors are still surprised and confused by this idea, however, so I thought it was time to take another look.

It’s true that bonds and GICs are taxed in the same way. If you buy a newly issued bond with a face value of $1,000 and a coupon of 4%, you’ll receive $40 in interest each year, and this amount is fully taxable at your marginal rate. If you buy a $1,000 GIC yielding 4%, the situation would be identical. Nothing complicated so far.

However, in practice, things aren’t that simple. Interest rates have been trending down for years, and bonds issued when rates were higher now trade at a premium. Let’s use an example to explain this concept. Twelve months ago you bought a five-year bond with a face value of $1,000 and a coupon of 4%. Since then interest rates have fallen one percentage point. That means your bond now has four years left to maturity and is still paying $40 in interest, while new four-year bonds are paying just 3%, or $30. If another investor was in the market for a four-year bond today, which one would he want?

The answer is obvious: he’d want the bond paying more interest. But we know there’s no free lunch. The bond with the 4% coupon will now sell for a premium: it would be valued at approximately $1,036. (I’m simplifying the math here, because the concept is what’s important.)

Now there’s a trade-off: the buyer of your old bond will receive more interest, but at maturity he’ll collect only the face value of $1,000 and suffer a capital loss of almost $36. If both bonds are held for the full four years, their total return will be the same: in other words, both now have a yield to maturity of 3%:

| Premium bond | Bond at par | |

|---|---|---|

| Term to maturity | 4 years | 4 years |

| Face value | $1,000 | $1,035.71 |

| Price (initial investment) | $1,035.71 | $1,035.71 |

| Coupon | 4% | 3% |

| Yield to maturity | 3% | 3% |

| Interest paid over four years | $160.00 | $124.29 |

| Capital loss at maturity | -$35.71 | $0.00 |

| Total return (interest – capital loss) | $124.29 | $124.29 |

The upshot is if you’re investing in your RRSP or TFSA, it doesn’t matter whether you buy bonds at a premium, at par, or at a discount. With no taxes to pay, it all comes out in the wash.

Taxes change everything

If you’re holding fixed income in a non-registered account, however, the situation is quite different. The reason is that interest and capital gains/losses receive different tax treatment. And when you buy a premium bond, a greater share of your total return comes from fully taxable interest. Here’s an example using the same two bonds as above, and assuming the investor’s marginal tax rate is 40%:

| Premium bond | Bond at par | |

|---|---|---|

| Term to maturity | 4 years | 4 years |

| Face value | $1,000 | $1,035.71 |

| Price (initial investment) | $1,035.71 | $1,035.71 |

| Coupon | 4% | 3% |

| Yield to maturity | 3% | 3% |

| Interest paid over four years | $160.00 | $124.29 |

| Net interest after tax (40%) | $96.00 | $74.57 |

| Capital loss at maturity | -$35.71 | $0.00 |

| Total return (interest – capital loss) | $60.29 | $74.57 |

If you could subtract the $35.71 loss from the premium bond’s $160 in interest payments, then both bonds would deliver the same after-tax return. But you can’t do that: a capital loss can only be used to offset a capital gain, not to reduce interest income. Capital gains are taxed at only half your marginal rate, so in the above example, the investor who used the loss to offset a gain would save only $7.14 in taxes ($35.71 x 20%). That would bring his total after-tax return to $67.43—still a lot less than the bond purchased at par.

Remember, too, that tax on the interest is payable every year, while the capital loss can only be claimed after it is realized when the bond matures four years down the road.

Par for the course

So what does all this have to do with GICs and bond ETFs? The key point is that GICs never trade at a premium or discount to their face value. Unlike bonds, GICs don’t trade on the secondary market—you can’t buy a five-year GIC today and sell it to someone else at a premium next year if interest rates fall. As with a bond purchased at par and held to maturity, a GIC’s total return is made up entirely of interest, with no capital gains or losses. Its coupon and its yield to maturity are always the same.

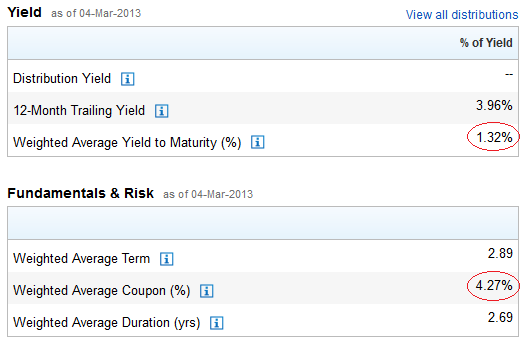

Compare that with bond ETFs today: virtually every one is filled with premium bonds. You can see this by visiting the fund’s web page, where you will notice that its coupon is higher than its yield to maturity. In some cases, the difference is dramatic, as with the iShares 1-5 Year Laddered Government Bond (CLF):

This ETF would be much less tax-efficient than a five-year GIC ladder, because that entire 4.27% coupon (minus fees) is fully taxable, even though the yield to maturity is just 1.32%. What’s more, GICs pay higher yields than government bonds: today you can build a five-year ladder with an average yield over 2%, with no credit risk and no chance of a capital loss.

ETFs do offer more liquidity than GICs, and there’s an opportunity for capital gains if rates fall and you sell the fund after its price has gone up. But if you’re a long-term investor who needs to hold fixed income in a taxable account, GICs are likely to be a better choice.

Hi CCP, I enjoy reading your articles. Recently, I can across this article and I am not sure I totally agree or understand this article. And I afraid it can be misleading for some investors to completely move to a GIC ladder to replace Bonds. Maybe the numbers worked in 2013 but I dont think your high level advice is correct. I do not think investing in GIC in taxable accounts are better than bonds – at least in terms 3 year or longer. The GIC rates are just not “high” enough. ( I do agree with you for a 1 year term and probably 2 year term. )

I quickly did the math comparing $5K in a 4 year BBB corporate bond to a compound 4 year GIC. Bond came out ahead – even without using the capital loss credit. In fact, I would suggest that you can invest the additional income you receive from the bond each year so you can potentially achieve more growth over the 4 years or just spend the extra income.

@Brian: There may be specific instances where a given bond comes out ahead, but it doesn’t change the fact that GICs are more tax efficient than premium bonds with equivalent yields. In your comparison, the risk level is different. A GIC is a guaranteed investment with no credit risk: a corporate bond is not. So if the corporate bond delivers a higher return it is because it pays a higher yield due to additional risk.

@CCP:

Is it possible most advisers don’t seems to be aware of the tax inefficiency of regular bonds ETF/mutual fonds? I’ve seen many friends/colleagues with portfolio managed by financial advisors from different horizon (major canadian banks, MD management, private advisors ,etc.) that include a big portion of their fixed income investments within taxable accounts using mutual funds and/or bonds ETFs

Beside the few “tax friendly” special bond ETFs that you have written about on this blog (BXF,ZDB, HBB), are you aware of any other bond mutual funds (active or passive management) that try to solve the problem of the tax inefficiency due to premium bonds?

@Jas: I don’t think there is any question that many advisers are unaware of the tax inefficiency of funds that hold premium bonds. We see these tax-inefficient funds held in non-registered accounts all the time. I have also noticed many advisers don’t like GICs: I think they consider them too stodgy.

In addition to the specialty ETFs you mention, DFA funds are also quite tax-efficient because they hold primarily low-coupon bonds.

@CCP:

Should we expect so-called “Tax effective funds”, such as Mawer Tax Effective Balanced fund, to hold low-coupon bonds instead of premium bonds? Or maybe this a unique feature of DFA’s fixed income funds?

You explain how one can assess an ETF’s information page to screen for the presence of premium bonds with the difference between “Coupon” and “Yield to maturity”. Is this information also available for mutual funds?

http://www.mawer.com/mutual-funds/fund-profiles/mawer-tax-effective-balanced-fund/

@Jas: DFA is not unique in its efforts to tax-manage their funds. From the description on the PDF (“the manager minimizes taxes through the application of a tax overlay strategy, with the objective to minimize taxable distributions”) it sounds like Mawer is doing something similar. Unfortunately mutual funds aren’t very forthcoming with the specifics. We only learned about the tax advantage of the DFA fixed income fund when Justin complied all the distribution information manually and crunched the numbers.

Here is what I found inside Mawer’s tax effective balanced fund annual management report

(from sedar.com database):

“Bonds are used primarily to control risk. Bonds are chosen with a view to the appropriate term, credit quality, and issuer depending upon the expected direction of interest rates, the interest rate spreads between different sectors of bonds, and the expected state of financial conditions for the issuer. Bonds trading near par or at a discount are preferred, all else being equal, given their better tax efficiency versus premium bonds.”

So this confirm they prefer low-coupon bonds to premium bonds for their “tax efficient” fund.

Does the recent arrival of Horizons Canadian Select Universe bond ETF (HBB) dramatically change this discussion? (I am trying to figure out whether to use GICs or HBB in a taxable account.)

@Susan: HBB is certainly more tax-efficient than traditional bond ETFs. You just need to be comfortable with the counterparty risk inherent in any swap-based ETF, and the possibility that in the future the government may decide to put an end to this structure. Note that BMO’s new Discount Bond ETF is also an alternative to GICs in taxable accounts.

https://canadiancouchpotato.com/2011/06/08/swap-based-etfs-what-are-the-risks/

https://canadiancouchpotato.com/2014/05/08/a-tax-friendly-bond-etf-on-the-horizon/

https://canadiancouchpotato.com/2014/02/13/new-tax-efficient-etfs-from-bmo/

@CCP:

Do you think that the same advice should apply to balanced index funds like Tangerine balanced fund? The bond portion of the fund is probably not very tax effective for the reasons you mention… but at the same time the MER is tax deductible from

the balanced fund return and should be subtracted from the bond return (as explained by the steadyhand article)

http://www.steadyhand.com/industry/2010/07/08/management_fee_deductibility_clearing_the_air/

“The deduction is first applied against the interest income, as this is the least tax favourable form of income. “

@Jas: The fact that funds deduct their fees from the least tax-efficient income doesn’t change the fact that premium bonds are tax-inefficient. As much as I like balanced funds, they really aren’t a great choice in taxable accounts. I would also think there are few investors who would be in a situation where they would need to hold a balanced fund in a taxable account. If you’re investing in a non-registered account it’s usually because your RRSP and TFSA are maxed out, in which case you probably have a fairly large portfolio and should therefore be looking at better options.

Hello Dan,

Please forgive me in advance. While I accept the concept that Bonds and Bond ETF’s should be held in registered accounts, I’m having trouble getting a grip on just where the bad tax news comes home to roost.

If I compare a 100K GIC at 2.0 % vs BMO’s ZAG ETF, I come up with the following.

The GIC would pay 2000 interest per year, or 166.66 per month.

ZAG is currently priced at $15.84 which would give me 6313 units for the same 100K. Let’s use 6312 to cover the sales commission. ZAG has paid 0.042 or 4.2 cents per unit for 2014, and, although extrapolation is for geniuses, I guess we have to make some assumptions, so let’s say they continue to pay the same for 2 years. My calculator tells me that comes to 265.10 per month payout for the ETF.

On the surface, it looks like almost $100 more per month for the ETF, so my question is – where do the tax consequences show up?

Thank you very much in advance, best regards,

Tony

@Tony: The example in the post uses an individual premium bond and a GIC, since neither is affected by changes to interest rates if they are held to maturity. That’s the best apples-to-apples comparison. If you compare a bond ETF and a GIC it’s more complicated, because a bond fund never matures, so its return cannot be known in advance.

But the principle still holds. If rates do not change, ZAG would pay more interest than a GIC with the same yield to maturity, but it would decline in price by approximately the same amount. In a registered account, this would be a wash. But in a non-registered account, the interest is fully taxable and the capital loss cannot offset all of that additional tax. It would be different if you could deduct a capital loss from your income, but you cannot.

@CCP:

Another advantage of GICs, versus bonds ETF, is that they are exempt from HST, is that correct?

@Jas: That’s correct: no fee, no GST/HST.

Thanks for the great article. The example given is in an environment with declining interest rates. What about in an environment where interest rates are generally rising? Are ETFs then the same or better than GICs?

Also, what about the MER? You don’t need to pay a MER to buy GICs.

@Larry: Thanks for the comment. The situation in the example implies interest rates have fallen in the past, which has been the case. If interest rates rise for a sustained period, we would eventually find ourselves in a situation where most bonds trade at discount. If that happens, then bond ETFs would be more tax-efficient than GICs.

The lack of MER on GICs makes them even more attractive relative to bond ETFs. Though you should be aware that GIC issuers pay a (hidden) commission of 0.25% annually to the dealer who sells them. So nothing is free.

Just like Tony, I’ve compared historical results to test the statements in this article.

Using the TD eFunds Canadian Bond Index Fund, it’s assumed that I purchase 100k worth of units on the first trading day of the year and and then sold them off the following year. This would result in a taxable event since since this is being held in a taxable account and all dividends are assumed to be interest income. All dividends are reinvested to purchase more units.

2009: +$4,313 in dividends (interest income), +$1,136 in capital gains

2010: +$3,920, +$2,140 in capital gains

2011: +$3,625, +$5,391 in capital gains

2012: +$3,156, -$182 in capital loss

2013: +$3,045, -$4,114 in capital loss

2014: +$3,083, +$5,281 in capital gains

2015: +$2,913, +$55 in capital gains

So for if we look at the returns over various periods:

1 year: +$2,913 interest, +$55 capital gains

2 years: +$5,996 interest, +$5,336 capital gains

3 years: +$9,041 interest, +$1,222 capital gains

4 years: +$12,197 interest, +$1,040 capital gains

5 years: +$15,822 interest, +$6,431 capital gains

6 years: +$19,742 interest, +$8,571 capital gains

7 years: +$24,055 interest, +$9,707 capital gains

The return from interest is generally decreasing since 2009, but even factoring in value of the units it seems favourable to invest in the bond fund since the net capital gain is significantly positive. I would have expected a significant capital loss.

I believe at the end of the day if the net capital gain/loss is close to zero, it ends up being a wash.

If there’s any error in my calculations let me know as I’m debating moving my bond units into GICs, but my calculations seem to indicate that sticking with bonds even in a taxable account still makes sense for now.

@William W: The problem here is that the results you present could not have been known in advance. The period in question saw a significant decline in interest rates, which created large capital gains for broad-market bond funds. That resulted in significantly higher returns (even after taxes) compared with GICs. If a fund holds primarily premium bonds it cannot be expected to have a net capital gain unless interest rates decline. If that happens, then sure, a bond fund would outperform. But this is no different from saying that you should have held international equities in a non-registered account over the last five years because they outperformed Canadian equities even after taxes. If you have a time machine, all investment decisions are easy.

Remember, too, that GICs and bonds do not have the same risks. GICs have terms of one to five years, while the bonds in TDB909 have an average term closer to 10 years. This means that they are more sensitive to changes in interest rates. If rates rise, the GICs will see no capital losses, whereas a broad-based bond fund will fall in value significantly. If you want bond-like risk exposure, then a tax-efficient bond ETF may be a better choice than GICs:

https://canadiancouchpotato.com/2014/11/19/ask-the-spud-bond-etfs-in-taxable-accounts/

Hello! Thanks again for all your articles that I frequently revisit. I’m a young incorporated physician and you helped me get started investing back in February. Currently I hold a portfolio of 35% XIC, 35% XAW and 20% ZDB. I’m interested in diversifying my fixed income to include some GICS. Am I right to understand that this would diversify and be more tax efficient? What proportion of my fixed income would you recommend splitting (i.e. 50% ZDB and 50% 5 year GICS)? I would like to keep some

Liquidity to rebalanace my etf portfolio twice a year but also don’t need these funds for the foreseeable future. Thanks for your help!!

Since you don’t recommend bonds in a Non-Registered Account, what distribution would you recommend for Non-Reg? I currently have 55% Canadian Bonds and then 45% in Equities in my Non-Reg. Are you saying that a better option would be to remove the 55% and hold them in GICs and then merely leave the 45% Equities in the Non-Reg? Re-distributing the entire holdings to the remaining equity funds only ( 33%, 33% and 34%), would seem a little aggressive. And yes, I have maxed out my RRSP and TFSA. They are both 55% Bonds and 45% Equities, as well. I am just entering retirement, so want to take a little more cautious approach.

@Brenda: It’s fine to hold fixed income in a non-registered account: the problem is specifically with traditional bond funds, which are currently filled with tax-inefficient premium bonds. There are more tax-efficient alternatives, such as ZDB and BXF:

https://canadiancouchpotato.com/2014/02/13/new-tax-efficient-etfs-from-bmo/

https://canadiancouchpotato.com/2013/06/07/why-use-a-strip-bond-etf/

Hi Dan,

What do you think about holding a US index bond fund such as BND in a taxable account? It currently has a return of ~ 4% since inception. I am a dual citizen thus holding canadian funds such as ZDB etc incur high accounting fee as it will be considered a PFIC. Given my circumstances, which one would you recommend in taxable account: US ETF BND or canadian GIC? Thanks.

@Jazzy: Buying a US bond ETF exposes you to currency risk. If the goal of bonds in a portfolio is to reduce overall volatility, then adding currency risk in fixed income negates that benefit. It is likely better to hold GICs and cash for fixed income in a taxable account if you do not want to use Canadian-listed ETFs.