Last October, Justin Bender wrote a blog post explaining why GICs are more tax-efficient than bonds. The blog caught the attention of John Heinzl of The Globe and Mail, who wrote his own article on the topic a month later. Many investors are still surprised and confused by this idea, however, so I thought it was time to take another look.

It’s true that bonds and GICs are taxed in the same way. If you buy a newly issued bond with a face value of $1,000 and a coupon of 4%, you’ll receive $40 in interest each year, and this amount is fully taxable at your marginal rate. If you buy a $1,000 GIC yielding 4%, the situation would be identical. Nothing complicated so far.

However, in practice, things aren’t that simple. Interest rates have been trending down for years, and bonds issued when rates were higher now trade at a premium. Let’s use an example to explain this concept. Twelve months ago you bought a five-year bond with a face value of $1,000 and a coupon of 4%. Since then interest rates have fallen one percentage point. That means your bond now has four years left to maturity and is still paying $40 in interest, while new four-year bonds are paying just 3%, or $30. If another investor was in the market for a four-year bond today, which one would he want?

The answer is obvious: he’d want the bond paying more interest. But we know there’s no free lunch. The bond with the 4% coupon will now sell for a premium: it would be valued at approximately $1,036. (I’m simplifying the math here, because the concept is what’s important.)

Now there’s a trade-off: the buyer of your old bond will receive more interest, but at maturity he’ll collect only the face value of $1,000 and suffer a capital loss of almost $36. If both bonds are held for the full four years, their total return will be the same: in other words, both now have a yield to maturity of 3%:

| Premium bond | Bond at par | |

|---|---|---|

| Term to maturity | 4 years | 4 years |

| Face value | $1,000 | $1,035.71 |

| Price (initial investment) | $1,035.71 | $1,035.71 |

| Coupon | 4% | 3% |

| Yield to maturity | 3% | 3% |

| Interest paid over four years | $160.00 | $124.29 |

| Capital loss at maturity | -$35.71 | $0.00 |

| Total return (interest – capital loss) | $124.29 | $124.29 |

The upshot is if you’re investing in your RRSP or TFSA, it doesn’t matter whether you buy bonds at a premium, at par, or at a discount. With no taxes to pay, it all comes out in the wash.

Taxes change everything

If you’re holding fixed income in a non-registered account, however, the situation is quite different. The reason is that interest and capital gains/losses receive different tax treatment. And when you buy a premium bond, a greater share of your total return comes from fully taxable interest. Here’s an example using the same two bonds as above, and assuming the investor’s marginal tax rate is 40%:

| Premium bond | Bond at par | |

|---|---|---|

| Term to maturity | 4 years | 4 years |

| Face value | $1,000 | $1,035.71 |

| Price (initial investment) | $1,035.71 | $1,035.71 |

| Coupon | 4% | 3% |

| Yield to maturity | 3% | 3% |

| Interest paid over four years | $160.00 | $124.29 |

| Net interest after tax (40%) | $96.00 | $74.57 |

| Capital loss at maturity | -$35.71 | $0.00 |

| Total return (interest – capital loss) | $60.29 | $74.57 |

If you could subtract the $35.71 loss from the premium bond’s $160 in interest payments, then both bonds would deliver the same after-tax return. But you can’t do that: a capital loss can only be used to offset a capital gain, not to reduce interest income. Capital gains are taxed at only half your marginal rate, so in the above example, the investor who used the loss to offset a gain would save only $7.14 in taxes ($35.71 x 20%). That would bring his total after-tax return to $67.43—still a lot less than the bond purchased at par.

Remember, too, that tax on the interest is payable every year, while the capital loss can only be claimed after it is realized when the bond matures four years down the road.

Par for the course

So what does all this have to do with GICs and bond ETFs? The key point is that GICs never trade at a premium or discount to their face value. Unlike bonds, GICs don’t trade on the secondary market—you can’t buy a five-year GIC today and sell it to someone else at a premium next year if interest rates fall. As with a bond purchased at par and held to maturity, a GIC’s total return is made up entirely of interest, with no capital gains or losses. Its coupon and its yield to maturity are always the same.

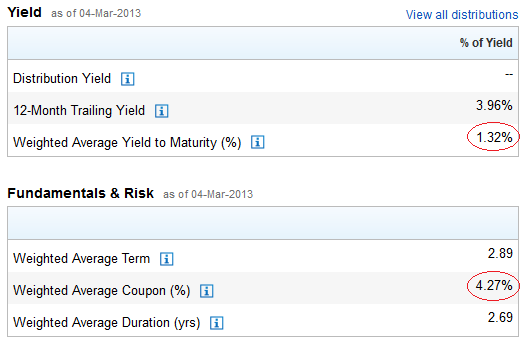

Compare that with bond ETFs today: virtually every one is filled with premium bonds. You can see this by visiting the fund’s web page, where you will notice that its coupon is higher than its yield to maturity. In some cases, the difference is dramatic, as with the iShares 1-5 Year Laddered Government Bond (CLF):

This ETF would be much less tax-efficient than a five-year GIC ladder, because that entire 4.27% coupon (minus fees) is fully taxable, even though the yield to maturity is just 1.32%. What’s more, GICs pay higher yields than government bonds: today you can build a five-year ladder with an average yield over 2%, with no credit risk and no chance of a capital loss.

ETFs do offer more liquidity than GICs, and there’s an opportunity for capital gains if rates fall and you sell the fund after its price has gone up. But if you’re a long-term investor who needs to hold fixed income in a taxable account, GICs are likely to be a better choice.

“Doesn’t the efficient market hypothesis hold for bonds?”

For the most part, it does. There are exceptions though. In this case, the main thing is, GICs aren’t bonds. They aren’t bought and sold on an open market, so there’s no guarantee that they will be priced ‘fairly’. Banks may choose to offer a higher rate on their GICs for all kinds of reasons, such as drawing in new business. Also, GICs are not (generally) liquid*, so it does make sense that they pay a small premium for that. With interest rates being so low, that small premium along with small differences in banks’ profit margins can make a large relative difference.

*If liquidity is an issue, even with a HISA you can get 1.9%, which is less than 0.1% less than XBB after fees and has all the advantages of the GIC ladder, but more so.

If you’re interested, there are other documented “inefficiencies” in the bond market too. For example, intermediate-term bonds have historically outperformed long-term bonds on a risk-adjusted basis. The theory is that this is because long-term bonds are more useful for hedging against long-term expenses, so are used by things like pension funds (and even individuals) as a sort of long-term portfolio insurance. This utility is worth paying a premium for. So if one is interested in long-term capital appreciation, in many circumstances an intermediate-term bond portfolio may be preferable to a broader one. Also, corporate bonds have not historically compensated well for their increased risk, as described here: http://www.cbsnews.com/8301-505123_162-37842555/3-reasons-to-avoid-corporate-bonds/. So if GICs and HISAs weren’t an option for fixed income, my choice would be something like CLG (10 year government bond ladder), rather than XBB.

@Nathan: Given your preamble, what bond term do you consider “intermediate” in the context of being preferable to “broader” (did this mean “longer”?). Is CLG in your opinion preferable to XBB because its average term is 5 years vs 9+ years, or because it only contains government bonds, or for both those reasons?

@Oldie: For both of those reasons. By intermediate vs. “broader”, I meant if you took two bond portfolios with the same weighted average duration, but one was concentrated in intermediate term bonds, while the other was a broader mix of short, intermediate, and long term bonds, I would expect the former to potentially outperform, all else being equal. I’m no expert though; I just read a lot written by those who are. Something like this would probably answer any question you could hope to have (although this one’s written for a US audience): http://www.amazon.ca/Only-Guide-Winning-Strategy-Youll/dp/0312353634

I’ve been looking at the types of GICs and am not sure how the returns compare between a (2 year) 1.64% monthly, 1.9% annual, and a 1.9% compound annual. Any help would be appreciated. Thanks.

@All: Many thanks for making very clear that CLF/CBO are not a good way to reduce the risk of losing part of your principal.

@Phil:

1.64% monthly: I think this means that you compound 1/12 of your annual interest every month. For $100k this would yield $3,332 for 24 months, but it really depends on when the interest is actually credited.

1.9% compounded annually: This would yield $3,836 for 2 years ($1,900+$1,936).

1.9% annually (w/o compounding) would yield $3,800.

@Aethelstane. Thanks seems the compound annual is the way to go:)

@Nathan: Thanks for your detailed answer. Lots to ponder. My problem is that I am far from being an expert on bonds so its difficult for me to assess when the risk premium for holding XBB over a GIC ladder is reasonable. Funny you should mention CLG – although I’m not considering going to a shorter duration, I have been considering moving to a laddered bond ETF such as CLG. It’s a bit easier for me to understand and it has a significantly lower MER than XBB.

@Nathan: Likewise, thanks for the clarification.

@Smithson, ya, I hear you there. But at the very least, XBB (or CLG) should pay *some* amount more than a 5 year GIC ladder. As long as it’s actually paying the same or less, you could stick with GICs. As soon as the bond ETF starts paying more than the 5 year GIC you’re looking at adding to your ladder on a given year, you could start switching back to the ETF. It might not be absolutely optimal, but (like you say) for us non-experts, good enough is… good enough!

We haven’t mentioned one aspect of ETFs vs. GICs in taxable accounts, and that’s the role of tax advantaged ETFs like CAB, which classify their distributions as Return of Capital instead of fully taxable cash payouts.

On first sight it seems that the problem is quite similar as for CLF. CAB has a Weighted Average YTM of 2.13% and a Weighted Average Coupon of 3.68%. So there will be some capital depreciation over time.

I have not done any detailed math, but on first sight it is doubtful that the better tax treatment offsets the interest rate risk (average duration is 5.97 years), compared with a GIC ladder.

Meanwhile back at the 2.5% inflation ranch that $1000 has $975 purchasing power after year 1, $950 after year 2, $927 after year 3, $904 after year 4 and $881 after year 5. At least you can sleep at night.

Maybe I’m missing something here but this discussion seems mostly focused on income and I agree with everything here based on that perspective. My view though on bonds in a portfolio is that they are there primarily to provide diversification from equities with an asset class that has a low correlation to equities. Even though we are in a low interest rate environment and yields are already very low, if there is a large drop in equities and a rotation into bonds, if you were only in GICs you would miss out on any capital gains on the bonds to offset any drop in your equity component. To me, the income component is only one aspect of the overall decision.

@Darin: That’s a fair point, and it’s an important reason why bonds still have an important place in registered accounts, even if current yields are not much higher than GICs. You cannot rebalance with GICs because you can’t usually sell them before maturity.

However, in a non-registered account you could argue that the tax disadvantage outweighs that advantage. As always, one needs to consider the big picture: this discussion ignores what the investor might hold in other accounts.

@Darin: Also keep in mind that when there is a rotation into bonds, your GICs will gain value just like bonds. The only problem is, as Dan mentions, you won’t be able to sell them to rebalance. However, for many people in the accumulation phase, that isn’t really an issue. 1/5 of your 5 year GIC ladder matures every year, so that portion could be used for rebalancing, as could any new contributions for the year. In many cases that would be enough to cover all but the most extreme swings. And of course, there’s nothing saying you can’t have a portion of your fixed income portfolio in a bond fund (hopefully in a registered account), or even an HISA, for accumulation throughout the year and for rebalancing, while keeping the rest in GICs.

@Nathan: ” …your GICs will gain value just like bonds.”

If GICs are not liquid, and you can’t sell them, how do calculate this increase in value? More to the point of countering Darin’s objection, how do you capitalize on this increase in value when equities decline? Even when your 1/5 portion of GIC ladder matures, how does the cash realized at maturity increase in value higher than the interest rate guaranteed at time of initial purchase? (Or did I misunderstand your point?)

@Oldie:

To calculate the value of your GICs, you can use any bond value calculator. Here’s one for example: http://www.ultimatecalculators.com/bond_present_value_calculator.html

Let’s say you have $100k in equities and $100k in a 5 year GIC ladder. When it comes time to rebalance, the value of your entire GIC ladder is up by 20% and the value of your equities is down by 20%. To compensate, you take the $20k you get from the maturing GIC and put it into stocks, instead of a new GIC ladder rung. You now have a four year GIC ladder worth $100k and equities worth $100k.

The principal you receive at maturity for each GIC is still the face value, but because interest rates have gone down, you essentially now have premium GICs, and you require less of them to meet your fixed income asset allocation. (You don’t ‘see’ this increase in value at maturity, but rather in the increased interest you will collect until maturity compared to an equivalent GIC bought after the change in value.)

Of course in practice the numbers don’t work out this perfectly. The size of each GIC rung won’t be exactly the same, prices won’t conveniently change by exactly 20%, etc., but it shows how the rebalancing can be done in principle. You can then use new contributions, a bond fund, or an HISA to make up any difference if equities drop by more than 20%. (And of course it’s not the end of the world if allocations temporarily get off by a few percent either.)

@Nathan: I found this very challenging to grasp — I had to read it several times. Your paragraph 3 sounds like smoke and mirrors at first, but understanding came in stages. Firstly, as I understand it, the GIC structure in this scenario protects you from the realization of the increased value of your remaining GIC’s (yes, I understand now why they are worth more than before!), and therefore protects you from tax on capital gains which would have been due on such realization — as would be have been due if bonds, or remaining shares of bond ETFs had been used in the Fixed Income allocation instead of GICs.

The only remaining issue I had was that the Fixed Income allocation was to protect the worth of the whole portfolio from dropping during a recession as far as it would than if it was 100% Equities. Having Fixed Income as bonds is easy to see as a benefit because the bond value rises and the bonds can be sold for this higher price, so this protects the portfolio’s value. Not being able to sell your (theoretically, newly enhanced) GICs seemed to me, initially, to totally defeat your protection. But on thinking it through, I now see that although your remaining GICs have unchanged nominal principal value, they are paying higher interest than any new GICs you could buy at that time, in other words, punching above their weight class, or doing the same work (interest) as new GICs with a higher nominal value, and therefore ARE ACTUALLY PERFORMING APPROPRIATELY ACCORDING TO THEIR INCREASED VALUE, which is really all that you care about, even if you can’t sell them. Thank you for clarifying this very subtle point!

After moving some bonds into GICs in my non-registered account I began wondering if it might be worth moving some portion of my bond allocation to GICs in my TFSA as well. How much does the capital loss affect the total return in a tax sheltered account? Is it the difference between the current coupon and YTM? How would a 2% GIC compare to XBB or XSB? I do realized the interest rate risk is minimized with the GIC. If the total returns are similar I would prefer less risk. So much to ponder from this post:) The comments posted have been a great help.

“…although your remaining GICs have unchanged nominal principal value, they are paying higher interest than any new GICs you could buy at that time, in other words, punching above their weight class, or doing the same work (interest) as new GICs with a higher nominal value, and therefore ARE ACTUALLY PERFORMING APPROPRIATELY ACCORDING TO THEIR INCREASED VALUE, which is really all that you care about, even if you can’t sell them. ”

YES! Exactly, you’ve got it. :)

As for the first paragraph, I wouldn’t say GICs protect you from capital gains, per se. I mean, if you were to buy a government bond at issue and hold it to maturity, it would be exactly the same as a GIC – guaranteed to return the same principle you paid for it. It’s just that it’s a lot tougher to buy bonds at issue, and at least right now they tend to offer lower rates. And it’s impossible if you want to use a fund, because then you’re buying whatever bonds the fund already holds. Right now most of the bonds held by funds are premium bonds. As CCP describes, buying premium bonds is bad because you’re paying an inflated price in exchange for higher interest. When the bonds mature, you receive the face value, which is a capital loss for you since you bought at a premium. That’s not a good trade in a capital account because interest is taxed at a higher rate than capital gains (which you offset with the capital loss). So the issue isn’t so much that capital gains are bad and GICs protect you from them. It’s that 1) trading capital losses for higher income isn’t good in a taxable account, and that’s what you do by buying bonds at a premium, and 2) at the moment, GICs are paying higher rates than bonds even aside from tax consequences. GICs help with #1 because you buy them at issue, rather than at a premium; not because of anything particularly special about GICs.

Hope that helps! Isn’t finance fascinating? :D

@Phil: “How much does the capital loss affect the total return in a tax sheltered account? Is it the difference between the current coupon and YTM?”

Yes, that’s exactly right.

As far as how a 2% GIC would compare to XBB or XSB, well, XBB has a weighted average YTM (ie: the YTM of its contents) of 2.3%, and fees of 0.33%, so after fees the YTM is 1.98%. About the same as your GIC. For XSB it’s 1.48%-.28% = 1.2%.

The weighted average duration of XBB is 6.80 years, and XSB is 2.72 years. I won’t get into exactly how duration is calculated, but it’s going to be slightly less than the term of a GIC. So for example, a 3 years GIC at 2% has a duration of 2.88.

SO, a 3 year GIC at that rate has about the same interest rate risk as XSB (less than half that of XBB), and the same payout as XBB. Also keep in mind that unless you’re talking about government bonds only, bonds carry not only interest rate risk but also credit risk. The credit risk of XBB and XSB is relatively low, but not zero.

So short answer, your GIC option will definitely be lower risk than either option (especially XBB), and will pay more than either one too (especially XSB).

Even better if you want high (relatively speaking) return and low risk in a TFSA is a HISA though. At People’s trust you can get a 3% TFSA with zero risk. At Canadian Direct Financial I believe it’s 2.9%. There are plenty more options. Completely liquid, no interest rate risk, and 1% higher return. Worst case, they drop the rate at some point in the future, and with a few mouse clicks you can pull the money out and put in GICs (or a HISA somewhere else), with nothing lost. They’ve been pretty consistent for the past few years though.

@Nathan. Excellent explanation thanks! Do you purchase bonds directly?, and if so is there any reading that you would recommend?

For others that may have been newbies to fixed income understanding I just found a web page that provided basic explanations for GIC/bond laddering and interest rate risk. http://www.boomerandecho.com/how-to-create-a-bond-or-gic-ladder/

I haven’t, no, although I’ve looked into it. I don’t have an specific resources for Canadian bonds, but here are a few things to keep in mind:

1) Unless you are buying federal government bonds, it is important to diversify. The riskier the bonds, the more important, but even with provincial bonds, I would want several provinces. (Personally I’m not really interested in corporate bonds since it appears that one is generally better off taking those risks on the equities side, but if I were, I wouldn’t consider buying them individually unless I had a multimillion dollar bond portfolio.) Bond funds obviously make this easy.

2) Bonds get cheaper when bought in larger quantities. If you’re a TD Waterhouse client (some other brokerages too, but not all), you can actually go into their Fixed Income order screen and have it give you quotes for a given bond if you’re going to buy $1000, $10,000, $100k, $1M, etc. You’ll see the price keeps going down. The rule of thumb iirc is that you need to buy at least $10k of each bond for it to be worthwhile.

3) Put 1 and 2 together and unless you’re buying only federal government bonds, you need a portfolio in the hundreds of thousands at _least_ for individual bonds to make sense.

Personally I looked at what was available in the amounts I wanted to buy and saw that I could get better rates much more simply with GICs.

@Nathan: “…and saw that I could get better rates much more simply with GICs.”

Do you mean not necessarily a better quoted net yield to maturity rate GICs vs bonds, but rather a higher “actual” net yield, taking into account the bundled (and hidden) commission on buying bonds?

@Oldie:

Not sure what you mean by the hidden commission. When you buy bonds you see the ask price and the coupon, so there’s nothing hidden. TD Waterhouse actually calculates the YTM for you, which can be compared directly to the YTM of a bond fund or the coupon of a GIC. (GICs are only bought at issue, so the YTM of a GIC when you buy is equal to the coupon.)

Taking a quick look at TD’s Government of Canada bond listings, the best offered YTM is 1.2%, with maturity date in 4.5 years. Even if I increase my buy amount to $1 million, the YTM only increases to 1.3%. Perhaps by speaking to someone at the fixed income desk or using a full service broker I could do slightly better. Meanwhile though, also at TD Waterhouse, I can get a 4 year GIC at 2.2%, with a minimum purchase of just $1000.

@Nathan: I’m sorry, you’re right, the mark-up here doesn’t prevent a direct comparison with a competitive product. But whether you call it a “mark-up” rather than a “commission”, it is still a method that the brokerage uses to finesse a profit while making the sale. It isn’t hidden in the sense that, as you say, you see the ask price and the coupon, and you are given the yield, and there is no further surprise fee. But the sale is characterized as “commission-free”, while “mark-up” typically isn’t mentioned. The fact that you acknowledge that you expect the YTM to increase as you increase the buy amount suggests that you accept that some sort of “overhead” (call it what you will) is being applied that is relatively diluted out in bulk buying.

“Currently, buying provincial bonds to capitalize on the wide yield spread is challenging for retail investors The market is opaque, with brokers typically charging sizable mark-ups hidden in the quoted prices at which they’re willing to buy and sell the securities. This cuts into returns…” (Quote from globeadvisor.com Jan 22, 2013)

This quote was in relation to provincial bonds, but I believe it applies generally to all bonds, and it is difficult for the investor to discern exactly what the amount of mark-up is, so all he can do is shop around and compare prices, including the prices and returns on other types of fixed income (paying attention, of course, to the issues that were explained so thoroughly in this post).

Ahhh, gotcha. Yes, agreed 100%. (And agreed that it’s frustrating. It would be nice if you could easily pull up a table of the ask prices and resulting yields for various purchase amounts. But I guess I’m just happy the data is available at all without having to resort to picking up a phone. :) )

I disagree with this article. You can use capital loss to reduce your taxable income. So if you made a capital loss of 35.71 and interest of 160, you’re taxable income is 124.29, which is the same as the bond at par. So you make exactly the same amount of money.

@Frank: No, you cannot use capital losses to reduce your taxable income: you can only use them to reduce capital gains (assuming you have any). That is the whole point of the article.

Wow, wish I knew this before I invested in iShares XBB and XRB in my non-registered accounts. I followed the Canadian Couch Potato “Complete” model portfolio to the letter at the beginning of 2013 and my XBB is down 5% and XRB is down 14%. I sure wish that the GIC vs. Bond ETF tax concept had been noted somewhere in the portfolios. I even read the “Guide To The Perfect Portfolio” cover to cover – no mention of the problem of owning bonds in a non-registered account. In any event, should I sell them now at a loss and go with GIC’s?

@Rick: I didn’t get into asset location in the book: it’s a rather complicated topic and I wanted to keep the book simple. If you do decide you want to move to GICs, selling the bond ETFs would allow you to crystallize a capital loss that you could use to offset capital gains you incurred elsewhere this year, or in the previous three years, or you could carry the loss forward to offset future gains. So there’s a silver lining.

Investors love to “wait to get back to even,” but it’s important to understand that with bonds this might take many years, unless interest rates fall substantially. So I would encourage you not to fall into that trap.

Do you have a spreadsheet calculator that is able to run an after tax comparison on a GIC vs a bond priced at a premium?

@Ken: You’re welcome to adapt the one I use when writing this post:

https://canadiancouchpotato.com/wp-content/uploads/2014/01/Premium-bonds.xlsx

A five year GIC from a small institution yields over 3%, but only 1.5% from TD according to ratesupermarket.ca. The TD Waterhouse website offers 2.2% from TD, and nothing over 2.6% from alternative institutions. Can do i buy the higher rate GIC (say, from Implicity) from my discount brokerage account?

@RobD

No, you open an account with the institution offering the GIC and transfer your money there during opening the GIC. This will be completely separate from your broker. Usually, you send them a cheque with the deposit amount as part of your account application and they cash it during the opening process.

Several Manitoban credit unions offer very good GIC rates, but keep in mind that these are not FDIC insured, but rather through the Deposit Guarantee Corporation of Manitoba. The loss risk is small, IMO, but still higher than with federal insurance.

I hold most of my taxable fixed income assets in GICs with different MB credit unions and move funds over to bond funds in registered accounts when additional contribution room becomes available.

@Holger, @RobD:

The Manitoba government actually assisted in the creation of the DGCofM and appoints some directors to its board. Furthermore, it is widely assumed (but not guaranteed of course), that the Manitoba government would step in if there was difficulty in guaranteeing these deposits in the event of a default given it assisted in the creation of it and continues to assist in its governance. Also, the DGCofM apparently carries a much higher % of insurable deposits as assets on its balance sheet than other similar institutions in Canada. Currently it stands at well over $200M.

Theoretically the guarantee is not as strong as the CDIC (not FDIC as you quoted as that’s a US institution) but in practice I don’t think it is any different. However, if you have any concerns, then you should not deposit any money with a Manitoba credit union. But, it is one way to have your deposit insured above $100,000 as that is the maximum CDIC insurance available per account if you deposit elsewhere in Canada (with maybe one exception) whereas the Manitoba guarantee is unlimited.

Hi, I’ve read this article a few times over the past months and there’s something that’s been troubling me a bit. I’m hopeful someone can enlighten me.

With a premium bond, I understand that I will realize a capital loss on maturity (or when I sell). And so for a bond ETF, this translates into a price (or NAV) decrease, if I understand correctly. But the difference between a bond and a bond ETF, is that if I hold the ETF… I never have to actually realize that loss, right? So even in a taxable account, if I never sold any of my shares of the ETF, would I ever actually feel this “capital loss on maturity” effect that would normally be a drag on returns?

Thanks!

@Tyler: Even if you don’t sell shares of the ETF, the losses will still be realized inside the fund and reflected in a price decline. And a decline in the value of your holdings will clearly be a drag on your total return.

But everyone experiences that price decline, right? RRSP or taxable, the price goes down. The disadvantage of taxable premium bonds comes in on the capital loss only counting for half, doesn’t it? If I’m holding the ETF long-term, I might never sell and see that capital loss?

Thanks for your speedy reply, by the way!

@Tyler: If you paid $10,000 for shares in a bond fund and they’re now worth $8,000, it’s a loss whether or not you sell the fund. Yes, the price goes down regardless of the account type. But in an RRSP or TFSA the loss is fully offset by the interest payments. In a non-registered account, the interest is taxed and it therefore the loss is not fully offset. Even if you can claim the capital loss, you can only recoup half of it.

The one point to always keep in mind is that a fund is never going to be fundamentally differently from its underlying holdings. This sounds obvious, but it trips people up all the time. If premium bonds are tax-inefficient on their own, they must also be tax-inefficient if you hold them inside a mutual fund or ETF. This is why it’s odd to hear people say that individual bonds are less prone to interest rate risk than bond funds. It’s the same bonds, so the risk is the same. There’s just a little more predictability with individual bonds.

That makes sense. Out of curiosity, can the reverse situation happen, where YTM ends up higher than the coupon? And then would everything work the other way around, i.e. would such a bond/bond fund be a better deal than a GIC for taxable accounts?

@Tyler: I’m curious about your second question too. In theory, the answer is yes, but in practice I suspect it’s a bit different. Certainly bonds can sell at a discount, and a bond fund holding discount bonds would indeed have a YTM higher than its average coupon. The part I wonder about is whether it would end up being a better deal in taxable accounts than a ladder. Instead, I suspect the market would price in that tax advantage, much as it (normally) does with preferred shares. So the NAV would increase over time, but not enough to fully offset the reduced interest rate – only enough to offset it after taxes.

If I’m right, the bond fund would end up being roughly equal to a bond ladder in a taxable account (assuming you’re in the highest marginal tax bracket, which is what the market tends to price to), but in an RRSP or TFSA it would be worse, since you’re not getting the tax advantage. CCP (or anyone else), can you confirm this? We haven’t seen a significant period of increasing rates for a long time, so I’ve certainly never seen a discount bond fund in the real world!

@Tyler and Nathan: Yes, discount bonds could indeed be more tax-efficient in a non-regathered account, because part of the return would come in the form of capital gains, which are taxed more favorably than interest. Remember, however, that all of this comes with the usual qualification of “all else being equal.” GICs pay a considerably higher yield than government bonds with similar credit risk, so you may still be better off with the GICs on an after-tax basis.

It’s true that discount bonds are hard to find these days, they are still out there. As for a fund that holds only discount bonds, stay tuned! ;)

If I correctly recall from a previous article, Holding Your Bond Fund for the Duration, it was stated that no capital loss would be incurred so long as the bond fund was held for a period equal to its duration. This was, I believe, in the context of rising interest rates. Does this have any bearing on the capital losses associated with the maturing of premium bonds in the fund?

Furthermore, how does one calculate the future capital loss for a bond ETF, rather than individual bonds? Some of the necessary information (I.e. face value & price paid for the constituent bonds) does not seem available..

Thanks and keep up the great work!

@Bryan: “It was stated that no capital loss would be incurred so long as the bond fund was held for a period equal to its duration.” Not quite right. It’s more accurate to say that you will not experience a negative total return if you hold the bond fund a period at least as long as its duration. There may well be a capital loss (i.e. a price decline in the fund), but it would be offset by the interest payments from the bonds.

You can estimate the capital loss on a bond fund by looking at the difference between its average coupon and its yield to maturity. For example, if a fund has a coupon of 5% and a yield to maturity of 3%, it would be expected to suffer a capital loss of 2%. But this would only be true if interest rates stayed exactly the same, which is highly unlikely. This is why the return on a bond fund will always be less predictable than the the return on an individual bond.

I have a question in mind. I currently have about a large amount of US-dollars invested in Vanguard Total Bond ETF (BND) for my non-registered account. At TD, a 5 year US-dollar GIC is at 1.00%. Is the GIC a better investment here?

No. BND has premium bonds, but TD’s USD GIC rate is much too low for the GIC to be better. BND has a YTM of 2.4% and coupon of 3.5%. If you could find a USD GIC yielding somewhere over 2%, then you could run the numbers and compare, but for 1%, the GIC will not be better.

@Tyler

Thank you. You have cleared it all up for me!

Why not just buy new issue bonds? Problem solved.

Excellent article but what about ZDB/BXF vs a plain old GIC ladder ? Do the apparition of new ‘tax efficient’ ETF change the equation of GIC vs bonds ?

@LawrenceW: The tax-efficient bond ETFs are definitely an option to consider, especially if an investor needs liquidity and/or wants some flexibility for rebalancing. It’s just hard to draw any conclusions without any significant track record.

https://canadiancouchpotato.com/2014/02/13/new-tax-efficient-etfs-from-bmo/

https://canadiancouchpotato.com/2013/06/07/why-use-a-strip-bond-etf/