[Spoiler: This was an April Fool’s joke!]

Simple is beautiful, but in investing it ultimately loses its appeal.

Since the beginning of 2018, all three of Canada’s top ETF providers have launched families of asset allocation ETFs, which are “one-ticket solutions” that allow investors to build a globally diversified portfolio with a single trade. But while these products can be useful for novice investors, they just aren’t well suited for those looking for the benefits that come from greater complexity.

Many readers have asked whether I plan on ditching my current model ETF portfolio (which includes three funds) in favour of one of these asset allocation ETFs. The answer is no— at least not anytime soon. However, I would like to encourage readers to explore a different option, which I call the 3BAL Portfolio.

The 3BAL Portfolio is built using three asset allocation ETFs—one each from Vanguard, iShares and BMO. It retains some of the benefits of a one-fund solution without sacrificing the benefits of juggling three moving parts.

It works like this: say you want a traditional balanced portfolio of 60% stocks and 40% bonds. Using the 3BAL formula, you would purchase equal amounts of the following three ETFs:

| ETF Name | Ticker | Equities | Bonds |

|---|---|---|---|

| Vanguard Balanced ETF Portfolio | VBAL | 60% | 40% |

| iShares Core Balanced ETF Portfolio | XBAL | 60% | 40% |

| BMO Balanced ETF | ZBAL | 60% | 40% |

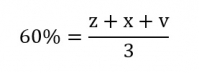

Notice that each of these three ETFs has a 60% allocation to stocks. Therefore, combining equal amounts of all three will achieve your target allocation of precisely 60% equities. I don’t normally like to use complicated math, but I think this idea is worth explaining with an equation:

* where z equals the equity allocation of ZBAL; x equals the equity allocation of XBAL; and v equals the equity allocation of VBAL

* where z equals the equity allocation of ZBAL; x equals the equity allocation of XBAL; and v equals the equity allocation of VBAL

Triple your pleasure

Not only does the 3BAL strategy allow you to build portfolios with precise asset allocations, it also offers the following benefits compared with simply using a one-fund solution:

Three times the diversification. Hey, no question, all of the asset allocation ETFs are very well diversified on their own. For example, VBAL holds close to 27,000 individual stocks and bonds, while XBAL holds over 15,000, and ZBAL adds another 4,000 or so. By holding all three ETFs, however, you’ll own more than 46,000 individual securities. And because each of the funds holds stocks from about 40 countries, the 3BAL Portfolio allows you to invest in 120 different nations.

Higher returns from rebalancing. One of the key benefits of investing in ETFs is the premium that comes from rebalancing: you can boost your returns by selling whichever asset class has recently gone up (selling high) and using the proceeds to prop up whatever has lagged (buying low). Except one-fund solutions don’t allow you to take advantage of this opportunity. The 3BAL Portfolio offers more flexibility: in any given year, one of these ETFs might deliver double-digit returns, while another could suffer a significant loss. By selling the winner and buying the loser, you can look forward to enhanced returns without any additional risk.

Tax-loss selling opportunities. One-ETF solutions rob you of another benefit of more complex portfolios. Specifically, they offer fewer opportunities for tax loss harvesting, which can allow you to defer capital gains taxes. However, the 3BAL Portfolio puts another arrow in your quiver. During a period when ZBAL falls by 10%, for example, you could sell your holding to book the loss, and then use the proceeds to purchase more XBAL, or VBAL, or both, or vice-versa. If all three happen to fall at the same time (highly unlikely, but possible), you could even liquidate your whole portfolio and then buy it back. But to avoid the superficial loss rule, be careful to buy them back in the opposite order that you sold them.

The 3BAL Portfolio isn’t a magic formula, but it’s about as close as you can get. The only disadvantage is the additional cost: the management fees for VBAL, XBAL and ZBAL are 0.22%, 0.18% and 0.20, respectively. Holding equal amounts of all three means incurring an annual management fee of 0.60%. (Again, apologies for the math, but this is calculated as follows: 0.22% + 0.18% + 0.20% = 0.60%.) But even at triple the cost, that’s a small price to pay for a perfect portfolio.

Brilliant post as usual for this time of year.

Your math is way off when you say the downside is incurring an annual management fee of 0.60%. It is not triple the cost to hold all three portfolios but an average of the three MERs (0.20%) if they are equally weighted or the weighted average if they are not.

ahhhh is this April fools? I thought the additional diversification piece was off about holding the combined amount of different companies/stock when holding all three ETFs sounded fishy….

As my teenagers would say, “Wait. Wuh? Huh?”. This has to be an April Fool’s joke because of all the bad math.

1. Diversification: These funds track similar indexes, and hence stocks and countries.

2. Higher Returns: See above. Each fund is already rebalancing and since they have very similar holdings the returns will very similar.

3. Tax-Loss Selling Opportunities: That’s an interesting take and seems quite plausible, but I’m neither a tax accountant nor a tax lawyer. Would this pass CRA rules?

4. Management Fee Math is Wrong: Average the three and you get 0.20.

So from my perspective, I believe only 1 out of the 4 points. Am I still a fool if only 1/4 tricked?

I’m using the 3BAL portfolio approach over two accounts, so I’m actually invested in 240 countries.

Ha! I love that in the time it took me to type up my post, two others jumped in ahead of me. :-)

“to avoid the superficial loss rule, be careful to buy them back in the opposite order that you sold them.” This part was inspired. Great post.

My mutual fund advisor says you need a minimum of FOUR funds to achieve the level of perfection you describe – what say you?

Dan you got the MER wrong. It is actually 0.22 x 0.18 x 0.20 = 0.0079%. That is the true power of 3Bal!

A couple of months ago you did a post on asset allocation ETFs and I asked if we have reached “Peak Potato”. This time you have truly exceeded Peak Potato. Congratulations Dan!

This should be April’s full. MER is calculated wrongly. Also the stocks covered by the 3 funds should not be so different, so saying three of them cover 46000 companies is not correct….

Always fun to read your April fools posts.

Peter Forint: concerning your point #3, I think that with 3 awfully similar ETFs, there would be few circumstances where only one or two would post losses.

You got me! For a few seconds, I really thought you turned insane! I realized the joke the moment I read about the 46,000 individual securities held in the combined portfolio. Well, I’m glad you still like boring investment strategies!

It how you are able to invest your money in 3 mexican countries ?

This is pure gold! Once I figured out it was an April Fools joke I laughed my head off.

Given what we know of how people tend to read on the internet, it’s increasingly clear that April Fool’s Jokes — especially on a reference site like this — is a BAD idea.

Too few people will notice the tiny little tag at the top and may inadvertently take away part of this “joke” thinking it is good advice. Sure an average person might recognize that the average is wrong, but will a newbie or passer-by using this site to learn more about Index investing reliably notice that the claims about diversification aren’t possible.

There is enough misinformation and misleading claims on the internet as it is. We don’t need reputable sites to intentionally make more :)

I got reading this saying “What?!!”

Then I looked at the date.

You are great Dan–and a very funny guy.

Long time reader and fan.

JQ

0.22% + 0.18% + 0.20% = 0.60%

This was what the person at TD actually told me to try to show that the e-series were just as expensive as their managed funds. I had to explain to them how math works. I don’t think they were being intentionally deceptive.

I love it, Dan! I was looking forward to this year’s April 1 post for the past few weeks.

Thanks again for all your helpful advice.

@Pat: Wow, that is an embarrassing error for a financial advisor to make. I wonder if they also told you that if you owned three funds, and they each went up 5%, that works out to a 15% return. :)

April fool’s joke aside, here the math as I see several math-confused in the thread…. but the point is that the % mentioned are management fees, not the MER. MERs are higher for all. BMO estimates it’ll be around 0.20%. For VBAL is .25 and XBAL .75. I pasted the source.

3 BAL MER = (v MER + x MER + z MER) / 3

3 BAL MER = ( 0.25 + 0.75 + z MER)/ 3

x MER: http://quote.morningstar.ca/Quicktakes/etf/etf_ca.aspx?t=XBAL

v MER: http://quote.morningstar.ca/Quicktakes/etf/etf_ca.aspx?t=VBAL

z MER: https://www.bmo.com/gam/ca/advisor/products/etfs?fundUrl=/fundProfile/ZBAL#fundUrl=%2FfundProfile%2FZBAL

@Rod: This has been a common misunderstanding since the launch of XBAL/XGRO. Their MERs will not be anywhere close to 0.75%.

These two funds (unlike their counterparts from Vanguard and BMOs) were not brand new: they evolved from two older ETFs (tickers CBD and CBN) that had much higher fees. Published MERs are backward-looking: they tell you the expenses of the fund over the previous 12 months. So investors holding CBD or CBN did pay an MER of 0.75% last year. But when iShares changed the mandate of these ETFs they lowered the management fee to 0.18%. I would estimate another 0.02% for taxes, so the MER will be right around 0.20%. Only after these funds have been live for a full year will the published MER reflect that current investors are paying this much lower cost.

As usual I really loved your annual.April Fool’s joke; and they always have been real thigh slappers for me. The delicious irony that comes with finally learning a Couch Potato concept after only partially understanding it for years contributes to the twisted humour that gives the joke its kick.

But that is the case for all on-the-edge humour — because it skims on the edge of anxiety and stress (which of course adds to the release of the punch line). But for much the same reason, jokes like that will always have their detractors who are on the anxiety and stress side of that cusp and are outraged because they only see the stress side of the ridiculous presentation (in this case because they haven’t yet acquired the comfort that comes with the full understanding of various aspects of Couch Potato-ism, which in retrospect is really quite a sophisticated concept. Your joke is so plausibly written (almost like some seriously intended pieces in the newspaper business section) that it wouldn’t be funny if we didn’t know it was you writing it. Likewise it wouldn’t be funny if we didn’t understand it was all parodic BS. So, much as it pains me to suggest something that waters down an outrageous joke, I seriously think you should display your “[Spoiler: This was an April Fool’s joke!]” warning more prominently in large bold capitals, so that there can be no misunderstanding, or else risk inadvertently misleading some first-time readers, thus detracting from the shine of this really excellent blog site.

>And because each of the funds holds stocks from about 40 countries, the 3BAL Portfolio allows you to invest in 120 different nations.

Absolute genius, wow.

@Pat, can you explain further what you mean by

“0.22% + 0.18% + 0.20% = 0.60%

This was what the person at TD actually told me to try to show that the e-series were just as expensive as their managed funds. I had to explain to them how math works. I don’t think they were being intentionally deceptive.”

@Ron: I hope it was clear that the above post was a joke. :)

When you have multiple funds in a portfolio, the overall MER is a weighted average: you don’t just add the fees of the individual funds. To use the simplest of examples, if you have three funds in a portfolio and each one charges 1%, the overall cost of the portfolio is 1%, not 3%.

Pat’s TD rep was trying to argue that the e-Series index funds are expensive, because each one charges about 0.30% to 0.50% and there are four of them in the portfolio, so that adds up to about 1.5%. Of course, this is nonsense: the weighted average fee is about 0.45% or so. This was probably an honest mistake on the part of the rep, but it’s a pretty bad error for anyone in the industry to make.

Hi,

You wrote: “VBAL holds close to 27,000 individual stocks and bonds, while XBAL holds over 15,000, and ZBAL adds another 4,000 or so. By holding all three ETFs, however, you’ll own more than 46,000 individual securities.” Had it ever occur to you that these equities are mostly overlapping? I read a lot of Coach Potato article and found them very useful, but there are too many issues with applying math in this one.

@Ian: Please read the large red “spoiler” at the top of this post. :)

:) You got a lot of people here to believe you were serious :)

Truly love your witty side, Dan! This is extremely funny April’s Fool’s blog. Thank you for coming up with the name 3BAL.