Preferred shares are often considered a hybrid security, since they share characteristics of both common stocks and corporate bonds. Like bonds, preferreds typically have a predictable income stream. But unlike bonds, most preferreds do not have a maturity date. And most important, the income from preferred shares is considered dividends rather than interest.

I’ve received many questions about preferred shares over the years: this asset is class is clearly popular with Canadian investors. But the honest truth is that I didn’t have much insight to share: I don’t include preferreds in my model portfolios for DIY investors, and our Toronto team at PWL Capital does not include them in client accounts. But other PWL advisors use them regularly, so I teamed up with my colleague Raymond Kerzérho, director of research at PWL Capital, to write a new white paper on the subject. In The Role of Preferred Shares in Your Portfolio, we describe the different types of preferreds in the Canadian marketplace, consider their risks and potential rewards, and help investors decide whether it’s worth adding them to a diversified portfolio.

In the first of a series of blog posts on this subject, let’s start by considering the reasons investors are attracted to preferred shares.

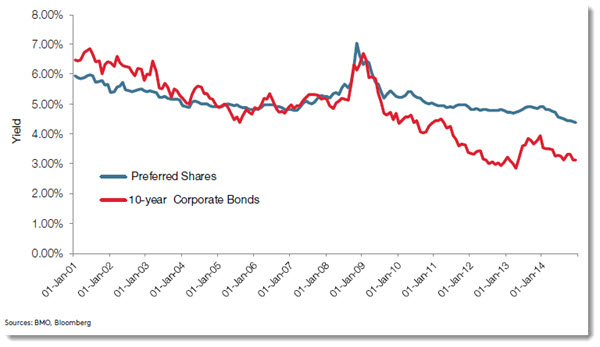

High yields. The yields on preferred shares often exceed those of bonds—even bonds issued by the same corporation. This isn’t the case during all periods, but in our current low interest rate environment those 4% or 5% dividends look more tempting than ever. The chart below compares the yields of preferred shares and A-rated 10-year corporate bonds for the period 2001 through 2014:

Preferential tax treatment. Bond interest is taxed at an investor’s full marginal rate, but income from Canadian preferred shares is taxed far more favourably, thanks to the dividend tax credit. This makes them a tax-efficient alternative to corporate bonds in non-registered accounts.

Preferential tax treatment. Bond interest is taxed at an investor’s full marginal rate, but income from Canadian preferred shares is taxed far more favourably, thanks to the dividend tax credit. This makes them a tax-efficient alternative to corporate bonds in non-registered accounts.

The table below outlines these estimated tax savings by comparing the tax liability of $1,000 in interest with the same amount in eligible Canadian dividends. As you’ll see, the benefit is significant for both moderate and high-income earners.

| Taxable income | Ontario | Quebec | BC | Alberta |

| $50,000 | $227 | $192 | $232 | $224 |

| $100,000 | $180 | $157 | $191 | $209 |

| $150,000 | $157 | $148 | $171 | $197 |

Estimated from 2014 tax rates. Source: KPMG

Low correlation. Investors achieve the greatest diversification benefit when the asset classes in their portfolios move independently of one another. The correlation coefficients in the table below describe the degree to which preferred shares moved in lockstep with other asset classes during the decade from 2005 through 2014. (The lower the figure, the lower the correlation and the greater the diversification benefit.) Preferred shares displayed low to moderate correlation with most asset classes, with most coefficients below 0.50. But I was most surprised to see that they were least correlated with bonds:

| Asset class | Index | Correlation |

| Canadian bonds | FTSE TMX Canada Universe Bond | 0.16 |

| Real estate | S&P/TSX Capped REITs | 0.62 |

| Canadian equities | S&P/TSX Composite | 0.44 |

| US equities | S&P 500 in CAD | 0.29 |

| International equities | MSCI EAFE in CAD | 0.38 |

| Emerging market equities | MSCI Emerging Markets in CAD | 0.43 |

Source: Morningstar Direct

Next week we’ll take a look at whether these characteristics offer enough potential reward to justify including preferred shares in a diversified portfolio.

I’ve always found that preferred shares are great in theory, but when you look at the options it’s basically all the major banks and insurers. Since the TSX and corporate bond indices are already very heavy on financials, I just don’t see how it makes sense to add preferred shares.

Here’s the ishares preferred shares etf, CPD: http://portfolios.morningstar.com/fund/holdings?t=CPD®ion=can&culture=en-US

The main holdings are BMO, RBC, TD, Sun Life, CIBC, Scotiabank, Manulife with a few utility shares mixed in (Fortis, Enbridge and Transcanada).

It looks like the BMO ETF is a little better in that it also contains real estate and telecom.

Looking forward to the follow-up, because I’d like to be wrong. More diversification sounds good to me.

Thank you for this post!

I’ve always had confused mixed about preferred shares. Many times the price is more or less the same many years after, so there is not much growth, only yield. It seems great for long term investments but not so much for short term.

It is suggested that we hold preferred shares outside a TFSA mostly because they are tax efficient, but that brings one question to my mind:

Let’s say I put a lot of money into preferred shares (and other income stocks / etfs and bonds) and I receive $2000 a year in cash returns into my TFSA. I still have my yearly room of 5500 to invest in that same TFSA. In theory, if I count the dividends, I would have $7,500 cash money to invest per year in the TFSA without breaking the contribution rule. Wouldn’t this trick be a good one?

What’s your thoughts on this?

Jon, if you pull out the 2,000$ of the TFSA, you sure get 7,500$ room, there is non trick doing this. The sum is the same as leaving the cash into theTFSA and re-invest + 5,500$ :/

@Le Barbu

Ouais c’est un peu ce que je dis.

I’m just going against the main school of thoughts that preferred shares should not be in registered accounts due to dividend tax credit we can receive in normal accounts (if they are canadian products). I think they can bring the advantage of a higher contribution room in TFSA.

I could be wrong. I’m just starting with investing.

While you don’t presently include preferred shares in your model portfolios you did in the past when CPD was part of your yield portfolio. Your thinking has changed favouring a total return model for both accumulation/deaccumlation phases instead of an income model for retirement. Still there are those in retirement who prefer an income oriented portfolio particularly those who are volatility and risk averse and require a lower annual rate of return. Indeed, something like CPD satisfies that group with lower volatility and risk as well as having a stable monthly income compared to traditional broad market equity assets.

Informative post. Any insight as to why the correlation between preferred shares and Bonds is so low? Could it be related to duration?

@Tennis Lover: Good question. My thought going in was that the correlation would be fairly high, since both preferred shares and bonds are sensitive to interest rate changes: both should rise in value when rates fall, and vice versa. But that wasn’t borne out by the data, at least not over the 10 years we looked at. The biggest factor is that prefs are more vulnerable to price declines during times of turmoil in the stock market (they are stocks, after all), whereas bonds are still where people go when the flee to safety.

Interesting white paper Dan. Especially how both 10 years returns dropped (bad) and 10 year volatility went up (bad) when preferred shares were added. I can see the return dropping due to the dismal 10 year return of preferred shares, but it’s interesting to see the rise in volatility with correlations that low.

Garth at greaterfool.ca is always beating the preferred drum and I have been wondering if it made sense in the CCP portfolio. However, these results don’t have me convinced prefs should be a core holding. Definitely interested to see the next post on this.

This is an interesting post about preferreds and glad you are giving us some valuable information. If one is to invest into an ETF preferred, what would you suggest. Dan. I am currently in ZPR, BMO’s ETF that doesn’t have perpetuals

@Jon: there’s no fundamental difference between capital gains (from price increases) and dividends, in terms of adding to the room in your TFSA. Since preferred share pricing takes into account the tax benefits, using them in a tax-sheltered account likely means you’re over-paying with respect to the risk and return they offer. You would most likely be better off with a standard mix of equities and bonds.

This is going to be a highly biased response but I would like to get my two cents in.

The key to successful portfolios is true diversification. I don’t mean just buying various types of stocks divided by say geography or sector that have low correlations in normal markets, because these stocks tend to become highly correlated in down markets. The main benefit I see of adding in an asset class like Preferred Shares is the low correlation to the rest of the portfolio. The key over time is having various income/return generating assets that won’t rip your soul out of your chest in a down market.

And now to the biased part, my clients invest in Syndicated Mortgages which allows investors to access real estate development. Like preferred shares, most clients do not have exposure to real estate in their portfolios. Some may think real estate is over valued or in a bubble. You might find it useful to have a look at a 50 page analysis of the current state of affairs in Canadian Residential Real Estate. You can download it from here: http://www.thesyndicatedmortgage.com/manuscript. The key point is that, like preferred shares, real estate is an asset class with a low correlation to most other asset classes, which helps you whether the storms better than a standard portfolio.

But neither is a panacea, and no investment is, these all have to fit into the overall structure of the portfolio in manner that makes sense for the individual and their risk profile.

If you are going to build a proper portfolio, you need to be chasing non-correlated assets like preferred shares and real estate to reduce volatility over time, this is what pension funds do.

What about corporate class etf’s for non registered accounts. I am not sure they have been discussed on this sight but would be interested in getting some feedback on these. Heard they where a good way to defer taxes?

Thanks

Thanks for the earlier reply on correlations. Thinking further about this, do you have any insight on the stability of correlations. Do they change from year-to-year? Are long-term correlations stable? What if a shorter or longer time frame was used to calculate correlation?

@cmj: The white paper addresses that question at the end. ZPR does seem to be the best option for those who want to include preferreds.

@Tennis Lover: Correlations do indeed change over time, and in unpredictable ways. There’s not a lot of great long-term data on preferred shares.

If I compare the total return of CPD and XSB over the last 5 years, they both have approximately the same very modest return and yet CPD is much more volatile. The CPD lifetime history (when you include 2008) is even worse. I don’t get why anyone would hold preferred shares. They add no value.

For comparison, if you want Canadian dividends, why not just combine XSB (or a GIC ladder if in a taxable account) and XMV (or CDZ+XRE) to your portfolio? 80%/20% will most likely outperform CPD alone and still have lower volatility.

Most new preferred are also extremely investor unfriendly with their rate resets. Basically, unlike bonds when rates go down the rate resets will take away all advantage to holding them at the worst possible time. When rates go up, there are no resets. This is likely why they have a low correlation to bonds and it’s not a good thing from an investor perspective. No all are like this, but a lot are now.

Avoid.

Really silly question here; When a preferred states a yield % (e.g. ~4% for bce), is this on the initial face value of the preferred share (e.g. $25) … Let me ask this in another way; Assuming the company never changes this, are you always going to get 4% of what you invest regardless of the market price of the preferred share ?

This is similar (in theory to dividends) companies pay a fixed dividend regardless of the share price, but of course they can increase or decrease this.

So say you hold on to preferred ETF ZPR which has a dividend yield of ~ 4.5%, does this mean ignoring capital appreciation or depreciation you are always going to net ~ 4.5% a year ?

Does this yeild change much, I imagine it can when the ETF needs to get new preferred or when the interest rate changes.

Given all of that, if I understand it correctly, I wonder in what scenarios is this preferable to a GIC for example, lets say the best GIC you can get is X % but the preferred is always 1.5 * x % (i.e. 50% better rate, maybe that’s too high). But lets also assume the preferred ETF will lose ALL value i.e. not just capital apprieciation but loss … but as long as you hold it you get 1.5 X %.

Could this be better for someone in retirement over the long run ?

Sorry one other point, if my comment above was accurate, it seems similar to an annuity, where in many cases you lose all the capital as well, but with better tax treatment I imagine and some upside potential ?

I am glad to see this post on preferred shares I think they should be in all portfolios, and am on the same page as Neil Murphy wave length. I think fixed income should be divided 50/50 with preferred shares etf’s and GIC/Bonds, although I think bonds will take a beating in the future. The Canadian preferred market is small XPF north American etf would be a better choice for this asset class IMHO.

Interesting stuff, thanks for the great info.

Its all about owning a balanced basket of stuff for the longer term and preferred share etf’s are no different.

Insightful article on the role that Preferred Shares have in investments!

A good starting place for considering preferred shares is to look at the term or maturity provided for in their structure. Usually the name of a preferred share gives away its term nature.

We also have similar articles defining Preferred Shares: http://www.finpipe.com/preferred-shares/

And the different types of them: http://www.finpipe.com/types-of-preferred-shares/

Looking for a way to get some fixed-income stability in my taxable account, I bought some CPD last fall. My timing turned out to be terrible because since then it’s done nothing but fall off a cliff. Do you have any sense of why that is happening? And is there any point in hanging around? I’d happily hold on if there was a chance of a rebound even five years in the future, but the trajectory of this security seems inexorably downward.

@Trevor: This article may help:

https://www.pwlcapital.com/en/The-Firm/Research-span-Department-span-/Blog/Research-Blog/April-2015/The-Volatility-of-Fixed-Reset-Preferred-Shares

I think the problem is in assuming that preferred shares provide “fixed-income stability.” They can actually be quite volatile. Fixed-income stability comes from short-term, high-quality bonds and GICs.

Are Preferred Shares a good idea for an RRSP account?

I have been interested in preferreds for a while and my interest was stirred with the recent jump in preferred ETF unit prices due the US interest rate rise (Dec. 2016).

I just did a comparison between three asset classes for the years 2006-2015 (10 years), so one year forward of the analysis above in Dan’s post.

Canadian Preferred Shares: I used the S&P Preferred Share Index to represent this class

Canadian Equities: I used the S&P TSX Composite Index to represent this class

Canadian Bonds: I used the FTSE TMX Canada Universe Bond Index to represent this class

I also added a composite 50% Equity/50% Bond Total Return fund based on the TSX and FTSE indexes above.

The full data doesn’t paste well into here, but here is the summary data.

—

10 year total return summary

Preferred total return 1.64%

Equities total return 6.05%

Bonds total return 5.08%

50/50 fund total return 5.56%

50/50 fund total return absolute terms advantage over preferreds 3.93%

So, a 50/50 equity/bond fund has had substantially higher total returns over the past 10 years than preferreds.

—

10 year volatility (in yearly total return) summary

Preferred volatility 12.04%

Equities volatility 17.70%

Bonds volatility 3.09%

50/50 fund volatility 8.67%

50/50 fund volatility absolute terms advantage over preferreds 3.37%

So, a 50/50 equity/bond fund is less volatile in year-over-year total return than preferreds.

—

I also looked at the specific returns of iShares CPD, XIC, and XBB for the three asset classes, looking at tracking error vs. their indices above.

10 year tracking error summary

Preferred tracking error (CPD) -0.57%

Equities tracking error (XIC) -0.25%

Bonds tracking error (XBB) -0.35%

50/50 fund tracking error (XIC+XBB) -0.30%

50/50 fund tracking error absolute terms advantage over preferreds 0.27%

As expected, all funds underperform their respective index. The difference is mostly due to the MER of CPD being substantially higher than either XIC or XBB, which shows up in its greater tracking error for CPD.

—

Finally, I looked only at the income return of preferreds vs. bonds, ignoring total return completely. It is only in this metric that preferreds have the advantage.

10 year income return summary

Preferred income return 5.16%

Bond income return 4.16%

Preferred absolute terms advantage over bonds 1.00%

—

And here are correlation metrics.

Correlation between preferred and equities price return = 0.80 = strongly correlated

Correlation between preferred and equities total return = 0.80 = also strongly correlated

Correlation between preferred and bonds total return = 0.25 = weakly correlated

Correlation between equity and bonds total return = -0.21 = weakly non-correlated

Correlation between preferred and 50/50 composite fund total return = 0.98 = strongly correlated

So, the 50/50 fund was extremely well correlated with preferreds in terms of ups and down but the 50/50 fund delivered higher absolute returns with lower volatility during the same period.

—

I also looked at 2016 year-to-date data through Dec. 15, 2016 using data from CPD, XIC and XBB. The pattern for 2006-2015 above is the same in 2016 to date despite the recent fall in bond funds and rise in preferred funds.

==

In conclusion after looking at this data, it makes more sense to me now to take the money one would have put into preferreds and allocate this to 50% equities and 50% bonds for a better performing overall return with less risk and less of an expense radio (MER) as well.

The one case where there is a more compelling case for preferreds is if one has a large enough portfolio that the income-only stream will sustain you indefinitely and you have no concern for the market value of the principal. Then, the higher income stream for preferreds over bonds come into greater play.

Also, one can say that the past ten years were in a falling interest rate environment and the next ten years will be a rising interest rate environment, so a greater advantage will accrue to preferreds over bonds. But equities may perform better as well if inflation rises alongside. Or interest rates could just stay low or rise very slowly. Who knows?

Preferreds also have caveats like if interest rates rise over time, the preferred issuer can call in the preferreds and re-issue them with a lower premium over the Bank of Canada 5 year bond rate, or holders of existing preferreds could see the capital value of their current holdings drop as new preferreds with more attractive yields are issued in the future, reducing the value of a hypothetical future interest rate rise to their preferred portfolio. (I’m thinking more of rate reset preferreds here than other types of preferreds.) There isn’t a straightforward relationship with interest rates even just with rate reset preferreds.

-Tim

It would be interesting to get an update on your thoughts on preferred shares. During the last quarter of 2018, preferreds dropped along with equities, presumably because of a fear of lower rate resets. Since then, they have not recovered with equities. This is not the correlation you want from the fixed income portion of your portfolio. Anybody buying in 2015 would not have gotten a decent total return since then.