If you’ve read our ironically titled white paper, As Easy as ACB, you understand how complex it can be to track the adjusted cost base of ETFs. You need to account for all purchases and sales of shares during your holding period and then adjust for any reinvested distributions, return of capital and share splits along the way. Since that paper came out, several readers have emailed to ask whether it’s really necessary to do all that work.

That’s up to each investor to determine, but I wouldn’t want the Canadian Revenue Agency to discover you were paying a lot less tax than you owed. And as we discovered recently with a client of our DIY Investor Service, taking the time to accurately calculate your adjusted cost base can also save you from paying unnecessary taxes.

Our client purchased 300 shares of the iShares S&P/TSX Composite Index ETF (XIC) in September 2005 and added another 200 shares the following year. She eventually sold the entire holding (which by then had more than doubled in value) in April of this year. On the surface that seems like a straightforward set of transactions, but along the way the following events took place:

- XIC had a 4:1 stock split in 2008, which turned the client’s 500 shares into 2,000

- five reinvested capital gains distributions (including three large ones in 2005, 2006 and 2007)

- 33 return of capital distributions

Remember that dividends paid in cash do not affect the adjusted cost base of an ETF. However, had the client elected to use a dividend reinvestment plan (DRIP) we would have had to account for a few dozen additional transactions. Fortunately she did not.

Nervous breakdown

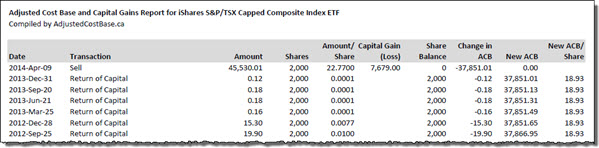

We started by collecting the tax breakdown information from the CDS Innovations website: we needed to retrieve the spreadsheets for XIC from 2005 through 2013. Then we entered all of this information into AdjustedCostBase.ca using the techniques described in our white paper. After accounting for all 42 items, the site allowed us to save a summary in Excel (I’ve added some formatting and deleted unnecessary columns to make it easier to read).

What was the result of this exercise? Each of the reinvested capital gains distributions allowed our client to increase her adjusted cost base, and over the years that added more than $2,900 to the final book value. The return of capital distributions, meanwhile, lowered her ACB by about $538. So the net result was the ACB on the holding was almost $2,400 more than it would have been if she had simply calculated it using the purchase and sale prices. Based on her marginal tax rate of 21.7% on capital gains, this should result in a tax savings of more than $500.

Bottom line, calculating your adjust cost base is not necessarily easy, but taking the time to do it properly could save you a significant amount of money when you ultimately sell your shares.

On the surface it would seem that it would be fairly easy for brokerage accounts to track the ACB of each holding and update it with each new purchase, sale, or distribution. Even when equities are transferred between accounts, the ACB of each could be passed along as well. It takes work and money to implement new systems like the one I describe, but it seems to me that once implemented, the cost of tracking such information for clients would be very small.

I get a statement from RBC Direct each year at tax time, showing all of my trades for the year.

It then gives a summary of total amount used to buy stocks and the total amount that came from sales and shows the difference which (I thought) was the capital gain/loss for the year.

Are you saying that the info we get from our brokerages does not accurately reflect the book value of the assets we trade with them? i.e the book value I see on my account screen is NOT correct? And the trading summary they send each year is also not correct?

If I buy some shares this year and then buy some shares next year, the book value stated in my account is wrong?

How can this be? Why do they even state a book value if it is not accurate? Why do they send a trading summary showing the loss/gain for the year if it is not correct?

Earlier this year I spot checked a couple of ETF ACBs in my TD Waterhouse account and it appears to me that they are tracking the ACB correctly. They update these for distributions around the end of March or early April after the T3s are issued. So, in Jan/Feb they may be incorrect but if you wait until after T3 time they looked OK in the cases that I checked.

I use the Horizon ETFs (HXT and HXS) in my non registered account so that I don’t have to do ACB other than when buying or selling. Am I right or naive?

Thanks for this nice example!

Curiously, tracking the ACB of index ETFs seems much easier in USA than in Canada. In US-listed ETFs , ROC distributions are much more rare than with Canadian ETFs and “phantom” re-invested capital gain distribution seem non existent.

This is the main reason why I don’t mind paying a higher MER with TD eseries funds and I’m very hesitant to switch to an ETF portfolio for my non-registered accounts… Tracking ACB is much easier with mutual funds (ie. no hidden re-invested distributions or ROC distributions, etc.). This fact isn’t mentioned very often, I find, when one reads investment books or journal articles about using ETFs for passive index investing in Canada…

Dan – I searched high and low for information on calculating the Adjusted Cost Base. There is suprisingly little information available. Your white paper is by far the best resource available. Thanks for all your efforts to keep us DIY investors informed. We would be lost without you!

Question: do we also need to do this for mutual funds, or only for ETFs?

Do you need to calculate ACB for any stock, mutual fund or ETF if they are held in a registered account?

Every March-April TD Bank sends me information about previous year ETFs distributions. There they specify what amount was reinvested and what amount was return of Capital. I track that in Excel spreadsheet (Portfolio Slicer) that tracks exact adjusted cost base. Any time I look at reports, I can see what is my actual capital gain for each position. There is a bit of work every year, but when I will sell my positions many years from now or if something happens to me – it is going to be very easy to prepare taxes. On top of that all investment related statements from bank are stored as PDFs in encrypted format on my computer and in the cloud.

I have a question about the ACB. I know stock split is a little different, but I hold HXS in my taxable account and in 2013 they combined units 2:1. I ended up with roughly half and some cash returned to me. There’s a lot of information to find on splits, but not when they combine. Any ideas?

As a corollary, if you’re investing in a taxable account, do yourself a favour and don’t automatically reinvest distributions. Just take them in cash and invest them along with your regular monthly/bi-monthly/whatever contribution. The time saved in accounting should more than make up for the small amount of market exposure lost.

@Jim: The book values given by brokerages may indeed be correct, and in most cases they probably are. But ETFs can be a little more complicated than individual stocks and mutual funds because of the nature and variety of distributions (reinvested capital gains, return of capital, etc.). We have certainly seen examples of inaccurate reporting. In this case study the book value reported by TD was not accurate.

Remember that your brokerage is not ultimately responsible for reporting capital gains and losses: you are. Sometimes investors will have duplicate holdings at two different brokerages, for example, and both would need to be considered when calculating ACBs. When a holding gets transferred from one brokerage to another the book value is often lost.

@Pat: I don’t think you’re naive: Because these ETFs have no distributions you should not have to do any adjustments to their cost base.

@Dennis E: Thanks for the kind words, and glad you found this helpful!

@Sebastien: Yes, all investments in non-registered accounts have a cost base that needs to be known when reporting capital gains or losses. However, mutual funds tend to be easier in this respect, as the book values are adjusted at the fund level rather than by the brokerage.

@ljh: No, this is not necessary in registered accounts, since there are no capital gains to report.

@Chris: A unit consolidation is treated the same ways as a stock split: With AdjustedCostBase.ca you enter it as a split and enter the ratio “1 for 2.” As for the residual cash, if it does not appear on a T-slip (and HXT did not issue a T-slip in 2013) then you can ignore it for ACB purposes.

That’s one of the reasons I decided to switch to mutual funds this year.

I almost had a nervous breakdown when calculating my ACB after selling a complicated ETF portfolio I had held for many years.

I figured the cost advantage of ETF vs low-cost mutual fund was not worth it for me, considering the costly errors that are easy to make while reporting investment income and the headache at tax time.

Thanks for the timely article, Dan.

I happen to have purchased four ETFs in my non-registered account a little more than a year ago, and back then I thought DRIPs were a wonderful idea until I recently read your articles explaining that DRIPs in non-registered accounts complicate matters a fair bit. That non-registered account also contains a TSX-listed stock that went through a 3:1 stock split (which also has DRIP).

I don’t plan on touching any of the five assets in this account (except for rebalancing) for at least 5-10 years, so I don’t foresee having to calculate ACB in the short term.

That being said, do I understand that I should drop the DRIP option ASAP for each of the five holdings in order to simplify the ACB process down the road?

Thanks.

Dan,

How to calculate ACB of 100 RBC shares bought in 1979 and held through 3 – 2:1 stock splits to the present?

Is it a good idea to sell and rebuy the shares to readjust ACB? ( Capital gain will be used to offset a capital loss)

Thanks

@Pamela: As long as you have all your records (including the dates of all sales and purchases as well as the dates for the splits) then AdjustedCostBase.ca should be able to help you with the calculation. But it might be pretty painstaking.

I can’t advise you whether it’s a good idea to sell the stock. But, yes, selling it and rebuying it would allow you to use a carried-forward capital loss, and it would reset the ACB. You would not have to wait 30 days to rebuy it, since there is no “superficial gain” rule. :)

As an accountant that’s worked on countless personal tax returns I’ve seen the work that goes into tracking ACB for the calculation of capital gains.

Most brokers do a poor job of tracking ACB and leave the onus on their clients when it comes to income tax reporting. Often DIY tax returns are incorrectly reported opening the door to potential penalties and fines by the taxman.

Good post on a topic that I’ve rarely seen discussed.

I’m not sure how to handle mutual funds where the 10% free amount in a DSC fund was moved each year to the FEL version of the same fund in order to preserve the free units. A 1:1 split maybe? Any ideas?

@Jean: A switch to a different fund class should not affect the ACB. In any event, mutual funds are generally good about tracking ACB at the fund level so you should probably not need to worry about this.

So, when I start the ACB for the FEL fund it should be the ACB/share of the DSC fund at the time of the switch times the number of shares switched in? Not the $value of the shares switched in, which is higher?

@Jean: I can’t be specific without knowing the details, but I’m still unclear why you need to do this manually. The fund company should be able to provide you with the information you need. Mutual funds are different from ETFs in this respect: with ETFs, the ACB can only be calculated at the brokerage level or the level of the individual investor.

Using the services of a Robo-advisor might alleviate this problem of tracking ACBs. Am I correct in assuming that?

This is the first time I have used your guide “Easy as ACB”. Thank you for the very clear instructions. You do an amazing job of helping new investors. However, I have come upon a situation that does not seem to be addressed in your paper.

The 2014 CDS “Statement of Trust Income Allocations and Designations” for ZCN splits the non-cash distribution between Capital Gain and Return of Capital. How would these be entered in ACB?

Thanks again for making so much excellent information available.

@Chris: Thnaks for the comment, and glad you’re finding our work helpful. This blog post explains the BMO situation and how to handle it:

https://canadiancouchpotato.com/2014/04/07/tax-tips-for-bmo-etf-investors/

Awesome! Thanks so much.

A potentially silly question here; Say you didn’t bother with any of this, less the obvious e.g. ETF x pays a dividend (assume no DRIP), and eventually I use this to purchase more shares, so will adjust the ACB accordingly. And of course I’ll pay the tax slips received any year on returned capital.

But that’s it, I won’t bother going to ishares website to find out for cases when they never returned the capital to the investor. In all scenarios, will my ACB be lower than it should ? Implying I’ll pay more tax, but there’s no chance of me having NOT paid enough tax ? And maybe I’m okay taking the hit (but again, as long as its a hit).

Another question, can this apply to stocks / mutual funds, or do they 1) never have “hidden” returns, or 2) adjust the base cost ?

Thanks!

@Taal: It’s not a silly question at all, but I think you have misunderstood some important points. You mention “I’ll pay the tax slips received any year on returned capital.” Return of capital does not need to be reported because it’s not taxable. And when you ask whether your ACB will be “lower than it should” if you never adjust for ROC, the opposite would be true. Your ACB will be higher than it should and you would pay too little tax. If you ever get reviewed by CRA that’s going to be a problem.

On the other side of the coin, if you never adjust for reinvested capital gains you’ll end up paying more tax than you need to (which is what would have happened in the case described in the blog). CRA is quite happy to allow you to do that.

Mutual funds may also need to be adjusted for reinvested capital gains and return of capital, but in most cases the mutual fund companies do a good job of recordkeeping. This tends to be a bigger issue with ETFs.

@Taal:

Many mutual funds do not have ROC distributions (TD e serie, Mawer for example), but if a mutual fund do have ROC distributions, the ACB must be adjusted. I think most discount brokers would automatically adjust your ACB if your mutual funds have ROC but that I am not sure.

Mutual Obligations: Tax Tips for Mutual Fund Investors

http://www.jamiegolombek.com/media/weekly-tax-tips-briefings-apr-29-en.pdf

As for re-invested capital gain distributions, it is my understanding that mutual funds do not have “hidden” re-invested distributions like mutual funds:

“In the mutual fund world the term makes more sense because you have the option of receiving a capital gains distribution as cash or of reinvesting the distribution by purchasing more units at the current net asset value. Selecting to reinvest the distribution in a mutual fund simply results in a greater number of units held at an automatically lower adjusted cost base (ACB); the total dollar value of the investment doesn’t change.”

The ABCs of ACB

http://cawidgets.morningstar.ca/ArticleTemplate/ArticleGL.aspx?id=579455

I mean to say mutual funds do not have “hidden” re-invested distributions like ETFs

Canadian Couch Potato / Jas – thanks a lot for the replies ! I did indeed have it backwards : ) What I meant is I’d pay yearly taxes on the dividends (which is clear through the tax slips), but the ROC would have the opposite effect I cited and the ACB would be higher than it should, which implies less tax.

While I wouldn’t rely on it, I’d hope most brokerages would reflect the ‘obvious’ ROC … so maybe my original statement still holds some merit assuming they do indeed correctly adjust down the ROC, I’m sure they don’t factor the reinvested ROC so you would lose out on this.

Thanks !

Sorry one last final point for others, there is a website that does this for you, but you have to pay:

https://www.acbtracking.ca/

I’ve watched the demo, I believe they simply catalog all such changes (including reinvested ROC) … you do need to enter your buy and sells though.

I’m thinking a google spread sheet and some work every year should be more than sufficient though but hey maybe some folks will find it interesting.

@Taal:

If you accept to pay a little more capital gain taxes then necessary (by not adjusting your acb for hidden re-invested distributions), but you do adjust your ACB for ROC distributions, as reported on your tax slip evey year, the CRA should be happy…

Will holding index funds inside a non-reg account without the option of using DRIP be hard come tax time when I sell my funds? Or is this only applied to ETF’s? Can I just use the statements from my bank to calculate this for index funds?

@Stark: In general, mutual fund companies do a much better job of tracking ACB, so this is usually only an issue with ETFs.

@Stark:

The ACB reported by your discount broker should be reliable for mutual funds.

I still prefer to keep track of my ACB for my TD e series mutual funds using the website recommended by CCP: adjustedcostbase.ca

I then compare my results with the ACB reported by TDWaterhouse. The report generated by the website saves some time to my accountant to calculate the capital gain/loss every year.

Hi Dan,

Would I follow the steps laid out in the ‘Easy as ACB’ white paper for a mutual fund? For example, I bought 1689 shares of BNS397 in 2013, automatically reinvested the dividend at the end of 2013 which netted me 435.312 additional shares then I sold all of them in 2014. My iTrade account did not increase my ACB to account for the reinvested dividend in 2013. I’m assuming I should be increasing my ACB using adjustedcostbase.ca to account for the additional shares purchased at the end of 2013?

This article and the white paper have been extremely helpful for calculating my ACBs and preparing my tax filing. Thank you!

@Landon: In general, mutual funds do a good job keeping track of reinvested distributions etc. and these are reflected in the book values on your statements. So I would start by contacting the fund company and asking them to check the calculation. The problems we discuss in the white paper are usually only an issue with ETFs.

This document from RBC is very helpful for mutual funds:

https://www.phn.com/portals/0/pdfs/FormsandDocuments/030-2013-rbc-1834-S-tax-invet-mutal-fund-final.pdf

I had a quick question about this confusing topic. I just noticed back in April or so that RBC direct investing did a return of capital to my account. Now I am not sure if that changes my average cost base in there records or if I need to continue to calculate them independently as I have been doing. Or even if they can be deemed entirely accurate. I had my system in place as described here but now I am not sure if this supersedes my efforts or disrupts them at all…….can you give some guidance?

Thanks as usual….

@Bruce: It’s impossible to say much without knowing the details. I would suggest calling RBC Direct and asking them if the book values they report for ETFs are adjusted for return of capital. If they are, and if you are following the method we’ve outlined, then your results should match RBC’s. If they don’t match, the challenge will be to figure out who made the error. :)

It turns out that none of the Excel spreadsheets on CDS Innovations work with Excel in Office 2016 for Mac due to macros specific to the Windows version. OpenOffice didn’t work either. I had no choice but to get a Office365 trial version in order to see those files.

I am sorry to state this but it is 2016 and why is anyone using excel anyway. Why can’t they provide the information in XML so that we can automate the entire process? Who has the time to enter every distribution for every asset held at every brokerage? Even for single brokerage, their auto-generated T3’s are completely incorrect.

@Karim/Karan I feel your pain and frustrations.

@Karim/Karan/Sean

I share the same frustrations, especially with CDS innovations not working with exel for Mac, even with the latest Office 2016… I just discovered a new service on adjustedcostbase.ca .

For 39$/year, they import the important tax information such as phantom distributions and ROC.

All you have to do is to enter the buy/sell transactions and they do the rest.

It really makes tracking ACB much easier for DIY investors with assets inside taxable accounts!

You can find more information on this service here:

http://www.adjustedcostbase.ca/blog/streamlined-import-of-return-of-capital-and-phantom-distributions-and-for-exchange-traded-funds-etfs-publicly-traded-mutual-funds-and-trusts/

http://www.adjustedcostbase.ca/blog/annual-capital-gains-pdf-reports/

Hi Dan

Thanks for all the great information on calculating ACB information. I have read through it, and I plan to use the paid website to do the calcs for me. I guess what I am not clear on is:

Do you need to do this annually if you are not selling any of the ETFs? I assume it is only necessary when selling?

then once you calculate the ACB, what exactly do you do with this number? When is the best time of year to calculate this number?

Do you enter it into your brokerage account, so they can report accurately on their T3 (or whatever form it is)? or how exactly do you use it?

Thank you

@Lauren: You really only need to know the ACB of the holding when you sell it, but if you are planning to hold it for a long time, it’s probably a good idea to update it one a year, around March when the information about the previous year’s return of capital and/or capital gains distributions are announced. That way you won’t need to do a ton of bookkeeping when you finally do sell the holding.

If the ACB you calcuate does not mach the one your brokerage has (this is usually balled “book value” on your statements), then you can contact the brokerage and ask them to change it. But you don’t really need to do that, as it has no effect on T3 slips. When you sell a holding, the brokerage issues a T5008 that reports the sale and the proceeds, but not the book value. Using your ACB, you calcuate the capital gain or loss and report it to CRA on Schedule 7 of your tax return.

Hi Dan,

After many years of following your blog and saving diligently, I am now at a crossroads: it is time to start investing in a taxable account. To keep things simple, I will limit myself to one product and will not sell any units until 10+ years. I love ETFs and this is all I own in my RRSP and TFSA, but for my taxable account I am not sure if I should go with an ETF or with a tax efficient mutual fund. I think I am in a similar situation as fellow blog reader Lauren above and I found your answer to her to be reassuring when you say “You really only need to know the ACB of the holding when you sell it”. However, I have one additional concern: I don’t think I will ever be able to calculate my ACB myself, even using the paid version of adjustedcostbase.ca. That will prevent me from implementing the second part of your advice to Lauren, when you say “it’s probably a good idea to update it once a year”.

With that in mind, here are a few questions:

1) If I decide to use an ETF and keep good records of all my buying transactions, then in 10+ years when I decide to start selling units I will pay a professional to calculate the ACB for me, does that sound like a good strategy to you or a recipe for disaster?

2) Would you please walk me through the experience that is waiting for me during tax season for a year during which all I will do buying ETF units? It seems to me that it’s just a matter of cutting and pasting numbers from brokerage slips into my tax report, but I have no idea of how straightforward that would actually be.

3) Same question as above but with a mutual fund instead of an ETF?

Thank you so much and keep up the great work.

@Gui: As long as you keep careful records, it should be easy enough to have an accountant calculate your ACB when you eventually sell your ETFs. Your brokerage will send you a statement of the capital gain or loss, and that can being your starting point. A professional can then double-check this number to make sure it is accurate.

For both ETFs and mutual funds, you will receive a T3 slip at tax time, and the slip will itemize the amount of interest, dividends and capital gains distributed during the year. If you do your own taxes, your software will guide you through entering this information. It’s not difficult.