Over the last year the loonie has declined significantly relative to the US dollar: the currencies were at par early last February, but the Canadian dollar closed under $0.92 US on January 10. That has been a benefit for Canadians who hold US equities: not only did the stocks deliver huge returns in their local currency in 2013, but we got a further boost thanks to the appreciation of the US dollar.

Unfortunately, the drop in our dollar has encouraged some ETF investors to attempt to exploit a buying opportunity. Trying to make currency plays is foolish at the best of times, but it’s especially unwise if you don’t fully understand how currency exposure works.

Meet Gerry, who uses the Vanguard S&P 500 (VOO) to get exposure to US stocks. This ETF is listed on the New York Stock Exchange and trades in US dollars. With the greenback riding high, Gerry plans to sell VOO and use the proceeds to buy an equivalent fund listed on the TSX: the Vanguard S&P 500 (VFV). Gerry tells his friends he’s selling US dollars high and buying Canadian dollars low while keeping his equity exposure the same. If the Canadian dollar eventually gets back to par, he’s going to switch ETFs again and make another tidy profit. Clever, isn’t he?

Not at all. Gerry’s strategy will just incur trading commissions, bid-ask spreads and currency conversion costs—and maybe realize a big capital gain—all while gaining absolutely nothing.

Understanding currency exposure

The problem is Gerry doesn’t understand that these two funds have exactly the same currency exposure. When you invest in foreign equities, your exposure comes from the underlying currency of the holdings, not the trading currency of the ETF. So whether he holds VOO or VFV, Gerry benefits when the Canadian dollar falls, and he suffers when it appreciates.

This idea might be easier to understand if we instead consider a single cross-listed stock, such as Royal Bank of Canada. A Canadian buying Royal Bank on the New York Stock Exchange in USD would not have any exposure to the US dollar, because the holding itself is denominated in CAD:

- Imagine the CAD and USD are at par when Gerry buys 1,000 shares of Royal Bank on the TSX for $70 CAD per share. His holding is worth $70,000 CAD.

- At the same time, his wife Sharon buys 1,000 shares of Royal Bank on the NYSE, where it is trading at $70 US. Sharon’s holding is valued at $70,000 USD.

- Now let’s say the loonie declines to $0.90 USD, but Royal Bank’s stock price remains at $70 CAD. In New York, the stock would now be trading at $63 USD.

- If Sharon sold her shares now, she would net $63,000 USD, which is a 10% loss in USD terms. But although Sharon has fewer US dollars than when she bought the stock, each is worth more CAD. And as a Canadian, she likely measures her investment returns in Canadian dollars. In CAD terms, her investment return is zero—just as it is for Gerry.

US stocks mean USD exposure

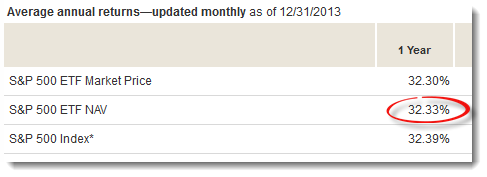

The same principle holds with VOO and VFV, which have identical underlying holdings denominated in USD. If Gerry owned VOO, he would have noticed it reported a 2013 return of 32.33% in US dollars:

But as a Canadian investor, Gerry would have benefited from the appreciation in the US dollar, which rose about 6.29% in 2013. When calculated in Canadian dollar terms, his holding in VOO was up 40.65%.

But as a Canadian investor, Gerry would have benefited from the appreciation in the US dollar, which rose about 6.29% in 2013. When calculated in Canadian dollar terms, his holding in VOO was up 40.65%.

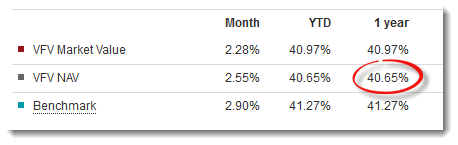

And if Sharon owned VFV, she would have visited Vanguard Canada’s website and found that her holding also returned 40.65% last year:

So if you measure your returns in Canadian dollars, it makes no difference whether you use VOO or VFV. Their holdings—and therefore their exposure to USD—are exactly the same, even though the ETFs trade in different currencies.

So if you measure your returns in Canadian dollars, it makes no difference whether you use VOO or VFV. Their holdings—and therefore their exposure to USD—are exactly the same, even though the ETFs trade in different currencies.

If Gerry wanted to protect himself from a rebound in the CDN dollar while staying invested in the S&P 500 could he not invest in the BMO ZUE ETF? It would replicate the performance of VOO without the currency risk; albeit at a slightly higher MER .

This post made my day (sort of). I responded to a previous post with the exact same question so I am the “Gerry” character. Thanks for the clarification. The solution is not to think of it as selling $US and buying $CAN, but that these are investments and part of an overall portfolio. Currency speculation might seem inciting, but it is gambling and not within the Couch Potato strategy.

@Frank: Yes, if you believe the Canadian dollar is likely to rise against the USD, then a currency hedged ETF would be the right choice (VSP and XSP are also examples). And you could switch back and forth according to where you think the dollar is headed, though that would be nothing more than speculation.

@meeko: I have received email from several “Gerrys,” so I wasn’t trying to single anyone out. :)

Out of curiosity, how does currency hedging work? (in an ETF that does it) Rather, if two ETFs track the same index, but one is hedged and the other is not, how do they differ?

I had an investment advisor once who led me to buy a significant amount of a S&P 500 ETF when the Canadian dollar was at $0.65US.

You can imagine how well that holding did as the dollar climbed back to par, even though the S&P500 was rising at the time.

Great post. Too few investors understand that they don’t own any dollars when they own stock ETFs. (OK, ETFs might have a few dollars, but what I wrote is mostly true.) They own businesses. We quote the ratio of the value of an ETF share to the value of a dollar, but that doesn’t mean that we own dollars.

I even take issue with “US stocks mean USD exposure,” at least partially. If a particular U.S. business derives its revenues outside the U.S. and owns assets primarily outside the U.S., then owning it offers almost no U.S. dollar exposure. The fact that its stock is quoted in U.S. dollars does not change things. The fact that we quote its yearly returns in terms of how (stock value)/(U.S. dollar value) changes still does not mean investors have exposure to U.S. dollars.

What are your thoughts on how currency fluctuations affect rebalancing? Do you rebalance based on every holding’s value in CAD or USD?

A question in the same category. I own international etfs in USD and in NYE (e.g. IDV) . with rising USD in 2014, I loose money. Is it a wise move to switch to currency hedge ETFs such as EBDF?

@Alex: Lots of info online about how hedging works. These posts may also help:

https://canadiancouchpotato.com/2010/10/29/to-hedge-or-not-to-hedge/

https://canadiancouchpotato.com/2010/08/11/will-the-real-sp-500-please-stand-up/

@Chris: When you rebalance, you should convert all foreign currency investments into Canadian dollars and use those values. If your target is equal amounts Canadian and US equities,for example, it doesn’t makes sense to hold $50K CAD in Canadian equities and $50K USD in US equities if the currencies are not at par.

@Behzad: IDV holds US stocks, so a rising US dollar would benefit for you (assuming you measure your returns in Canadian dollars). Not sure why you think you’re losing money.

Pursuing that rebalancing question.

Suppose (to simplify) that I have 50% bonds and 50% in equities.

And suppose also that I hold my equities in us-based ETFs.

Whenever I have to rebalance between bonds and equities, it means that I have to convert currency between CAD and US, in one direction or the other.

Do the implied currency conversion costs negate the advantage of having US equities (for their broader economic base ) ?

@CCP: IDV has exposure to Euro and Yen by owning European and Japanese stocks. Rising dollar against Euro and Yen in 2014 means losing money. Right?

I think switching to currency hedge ETFs such as EDBF is not a bad idea.

“Switching to currency hedge ETFs such as EDBF is not a bad idea.”

Until it is a bad idea …

“Until it is a bad idea …”

When all experts and strategists are screaming for strong US$ in 2014 is still a good idea. Remember! In the beginning of 2013 every experts were calling for a weak CAN$ against US$. There was people who he listened and had good ideas to be prepared for this predictable weak CAN$

@Jean B: Currency conversion costs can indeed negate the benefit of holding US equities if you are not careful. If you are not able to convert currency at a reasonable rate, you can always use a Canadian-listed ETF or index mutual fund that holds US equities but trades in Canadian dollars.

@Behzad: My apologies, I didn’t realize that IDV held international equities, not US stocks. My next post will deal with this question directly. As for expert forecasts on where currencies are headed, these are even less reliable than their forecasts on where equity markets are headed, and that’s saying something. Trying to play currencies is rank speculation.

@Dan

linking to https://canadiancouchpotato.com/2010/10/29/to-hedge-or-not-to-hedge/ you brought back a question I’ve always wondered about. In the comments section of that article the following conversation occurred:

—————————————-

Bill – … shouldn’t there be a long-term appreciation in developing countries’ currencies relative to developed?

Canadian Couch Potato – Interesting question. I don’t know the answer, but I will look into it and report back.

—————————————–

Were you able to find any info on this in the end?

For the people who try to rebalance their portfolios with both CAD and USD, I used CCP’s own rebalance spreadsheet and added a few extra columns. I’ll try to explain it here.

What I did was under “How much are you buying today” I added a cell called “Today’s USD=>CAD”, and that’s the exchange rate of the day. Any time you need to rebalance, just look up the rate on Bank of Canada, or XE.com

Under “Current Allocation” and “Amount to Buy/Sell”, I put in an extra column under each headings. One for CAD, another for USD. Any ETF’s with CAD traded on TSX is put under CAD column, and any with NYSE is under USD.

When there is a USD ETF, I put in the formula “=USD * exchange rate” (Today’s USD=>CAD) in the corresponding CAD cell. Thus I can quickly convert all my USD ETF’s into CAD on my spreadsheet, and see the “Current Allocation” of my portfolio in CAD.

Under “Amount to buy/sell”, the original equation:

ie. [=IF($D$90,($E$35+$D$9)*B15-E15,0)]

should be in the CAD column (you might have to adjust the cells location),

$D$9 should be the “How much money are you adding”

$E$35 should be the total of your “Current Allocation” in CAD

B15 is your “Target Allocation” in %

E15 is your “Current Allocation” in CAD

And in the corresponding USD column, I used the formula “=CAD/exchange rate”, to convert CAD into USD. I can quickly see how much USD I have to use to buy more of US ETF’s to keep everything in balance.

Not sure if everyone will get it, but it just takes some playing around with the spreadsheet to get it to work for you.

@CCP: I agree that speculating on currency fluctuations is pointless, but can you take advantage of it using volatility harvesting? For example, if split your US equity position equally between VFV and VSP, you could re-balance back to 50/50 when you perform your regularly scheduled re-balancing. This should capture a small premium from changes in the CAD/USD exchange rate as you are buying low the CAD or USD depending on which has weakened.

@Ian: It’s logical to assume that the currency of emerging countries will appreciate, but it’s certainly not something you can count on. In practical terms, it’s a moot point because no emerging markets funds use currency hedging, so there are no choices to make as an investor.

@Smithson: Hedging half the foreign currency exposure is actually pretty common in institutional portfolios, though mostly the idea is to lower volatility rather than boost returns. Your suggestion might work over the very long term, but I haven’t seen any research on it.

@CCP: I started hedging half my foreign currency exposure a couple of years ago. I’ll let you know how it works out in 20 years ;-)

Point & Figure Charts has the $CDW hitting $0.86 US.

@gil: What is the long-term track record of “Point & Figure Charts” when it comes to predicting currency movements? Is it any better than random chance?

Thanks again for this simple reminder. My portfolio was in its target range across the board this year. My main requirement was to sell US equity as it had done well for the year and the US dollar was strengthening. Now back to bed for 12 months.

@Betzad : If you are so sure that cad will go down , why do you want to hedge them against a raising loonie?

@Francis I am not talking about hedging my CAD$ equities. I own International equities in US$ (IDV). I am asking about hedging my USD ETFs when Euro and Yen are weakening against US$?

@CCP I have always heard that it is not easy to predict the market direction of in short term, since it is function unpredictable variables such as buyers’ emotion, fear and greed. But how about the direction of currency value? Is it more correlated with macro economic parameters, and therefore more predictable? (Just curious to know and I admit that my knowledge about economy is very limited)

@Behzad: I’m no economist, but in general currency values are largely driven by supply and demand, which is related to interest rates, inflation, political stability, etc. all of which which are impossible to forecast with any accuracy. It really is nothing more than speculation.

I currently hold significant amounts of VTI and VXUS in my U.S investment account, but I am not adding any fresh money to these holdings anymore, since I am now investing in the equivalent canadian etfs VUN, VDU and VEE in my Can$ investment account. However, my VTI and VXUS holdings throw off dividends that just sit in my U.S account until I accumulate enough to make it worthwhile to purchase more VTI/VXUS (no DRIPS allowed for VTI/VXUS). I was thinking that instead of this strategy, are there any U.S index mutual funds that I could put these dividends into that mimic VTI and VXUS, so that the dividends are being reinvested immediately?

Thanks,

Adam

@Adam: TD has a USD-denominated version of its US Index Fund that might be an option. I’m not aware of any international equity fund denominated in USD, but you don’t need one. Just invest the dividends from both VTI and VXUS in the US equity mutual fund and reduce the allocation to VDU/VEE accordingly.

@CCP, @Adam: I’m in exactly the same boat. I hadn’t thought of this idea – it seems like it may be a decent approach.

The other option I was considering was selling my US account holdings and moving it all to the CDN side, shutting my $50/year account. All of my holdings are in an RRSP, so I understand that it is beneficial from a tax perspective to keep it in the US account. Does this factor in to my personal income tax return, or is it transparent and just washes out in the price of the ETF? Any idea of what the annual $ value is of this tax benefit (per $10K invested, for example)? If it’s less than or similar to my $50/year account fee, I don’t think it’s worth the hassle keeping the US account open.

Dan, if some hypothetical Canadian were to have a substantial position in $US equities now, and if the Canadian dollar were to fall to say $0.75US or lower, would it make sense to sell those US securities in order to reap those currency rewards?

@KJF: Between the higher MERs and the additional withholding taxes, expect Canadian-listed foreign equity ETFs to cost an additional 0.5% or so in an RRSP, so about $50 on every $10,000 invested. Remember, however, that this ignores the savings you would get from avoiding US-listed ETFs and their associated currency conversion costs.

@Trevor C: What would you buy to replace those US equities?

@Trevor, I don’t see the benefits of selling your USD positions to take advantage of CAD dropping to $0.75. There are a few issues here:

1) You don’t know if CAD will fall further, and if it does, then it means you’ve sold early.

2) What would you do with excess cash after selling your USD positions? Will you convert that to CAD and put that into ETF’s denominated in CAD but invest in US equities (ie. VUN)? But then it’s a wash.

3) Hold onto your cash? It has the lowest return after bond, and if you put it into GIC, then your portfolio might be too conservative

4) Waiting for a market crash/correction? Then it’s market timing.

I’d suggest you continue with the couch potato method and follow your asset allocation.

Thanks @David, all good points.

@Dan, I imagined converting the USD into CAD and investing in Canadian-listed ETF’s of US equities. However as @David suggests this would be a wash, as any subsequent gain in the value of the CAD would erase whatever benefit I’d accrued. Perhaps reinvesting the money into Canadian equities would make more sense? Admittedly this reduces the diversification of the portfolio. A currency windfall seems like something that should be locked-in when the opportunity arrises, but maybe not. (Admittedly, I’m still stinging from the currency loss that was locked in several years ago.)

@Dan: The comment about the savings you would get from avoiding US-listed ETFs and their associated currency conversion costs by buying the Canadian-listed ETF instead keeps being mentioned and I began to question how exactly is that possible. For example, you use CAN$ to purchase VUN.TO, then Vanguard who manages VUN somehow buys USD$ positions. How does Vanguard convert your CAN$ into USD$ without incurring a cost that would obviously be paid by you the investor? Is this cost part of the MER, if so, how would that make sense, since the cost would be directly correlated the volume of trading and would therefore constantly be different every year? Thanks, Que

@Que: Institutions with tens of millions of dollars can convert currency at negligible cost. Retail investors, on the other hand, are charged exorbitant spreads to do so.

Any thoughts on the new RBC etfs?

Hi Dan,

I read all the comments but couldn’t interpret the meaning I was looking for. I hold VTI and VEA and I have to buy more in a month or so with CAD $5000 each. Should I still buy these two but it will be less units as I will get less USDs or should I buy Canadian equivalents of these two? May be it is the same thing but I am not really sure. Part of me thinks it wouldn’t matter as the underlying equities are still the same in USD so either way I will be buying same portion but may be I am missing something. Am I in a same situation as Garry? But I am not planning to sell like him just buy more.

Thanks

@JS: The unit price of the ETF is irrelevant: as you say, the holdings are identical. Think of it as a choice between buying a 10-pound bag of potatoes for $10 or a 2-pound bag for $2. In both cases you’re paying the same amount for the underlying assets.

@Adam,@KJF: I have both VTI and VXUS holdings with iTrade with a DRIP set up with both accounts.

Should I change my VTI to VUN (and VXUS to XEF/XEC)? So sell all and then buy the Can versions?

Re your response to KFC, what if I need emerging market exposure in my RSP and I have $50k to spend? I know you’ve said I can get the same holdings in a Cdn ETF as an American. So is there any point where it makes sense to buy VWO and VTI because of the tax implications and lower MERs? Or given the currency exchange, is it better to suck up those additional 0.5 percent costs and stay with TSX offerings?

Thanks for simplifying for me.

@Rob: You’ve correctly identified the tradeoff: the US ETFs have lower management fees and are more tax-efficient in an RRSP, but it can be expensive to transact in USD. If you can keep the transaction costs low (with Norbert’s gambit, for example) it’s often worth using the US-listed ETFs.

So if I’m holding an S&P ETF hedged in CAD, am bulling on the S&P, but believe that the Loonie is gong down, I should switch to the non-hedged version of this fund, non?

@JWS: Yes, if you believe the loonie will go down, you would want to be in non-hedged funds.

“Trying to make currency plays is foolish at the best of times …”

Really? Seems a bit of a gross generalization.

We own iShares S&P US Div Growers Idx (CAD-Hdg) (CUD.TO). I do not believe iShares offers a non-hedged version of this fund (?), but what other US index dividend funds are available to Canadian investors, with a comparable ETF-range MER? Thanks!

@JWS: Vanguard’s US dividend ETF is available in both hedged and unhedged versions (VGH and VGG).

So what if I am buying a fund that is using the same underlying currency?? I am basing my entire portfolio in USD.

Let’s say I want equal holdings in the US stock index and CDN index. If I hold 25,000 CDN in VCE and 25,000 in VTI based in USD. When I bought both, the USD and CDN were on par. Now, the CDN has depreciated in value (relative to the USD) and consequently the value of VCE has dropped in value to around 21,000.

If I sold all my VCE stocks, wouldn’t I have lost 4,000 USD? When it is time to rebalance, what should I do??

@Mark: The short answer is, yes, if you are measuring your portfolio returns in USD your VCE holding has declined in value because of the decline in the Canadian dollar. Your situation would be similar to that of Canadian who owned US stocks during a period when the US dollar declined. That is the nature of currency risk, and it must be expected if you’re a long-term investor.