Experienced investors know the theory: ETFs are supposed to trade very close to their net asset value (NAV). And most of the time they do. But this week my PWL Capital colleague Justin Bender and I encountered a glaring exception that could have had expensive consequences.

On Monday, Justin and I wanted to sell the iShares US Dividend Growers Index ETF (CUD) in a client’s account. It was a large trade: more than 5,000 shares, which worked out to over $160,000. As we always do before making such a trade, we got a Level 2 quote, which reveals the entire order book. In other words, it tells you how many shares are being offered on the exchange for purchase or sale at various prices. By contrast, a Level 1 quote—the type normally available through discount brokerages—only tells you how many shares are available at the best bid and ask prices.

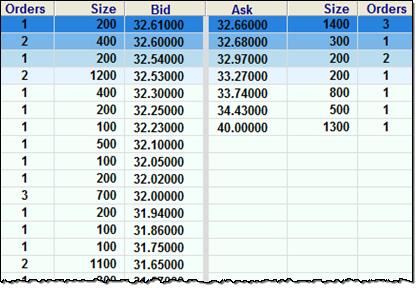

If an ETF’s market maker is doing its job, there should be thousands of shares available at the best price. But we were surprised to find the Level 2 quote looked like this:

Source: Thomson ONE

Let’s unpack this. As sellers, we looked at the “Bid” column, and the best price (at the top of the column) was $32.61. But we’d be able to sell a mere 200 shares at that price, as revealed in the “Size” column to the left. We could unload another 400 for just a penny less, but after that the prices plummeted. Had we placed a limit order to sell 5,000 shares for $32.60 (one cent below the best bid price), we likely would have seen only 600 shares get sold.

But that would have been a minor inconvenience compared to what might have happened if we’d placed a market order. Remember, a market order does not specify a minimum price you’ll accept when selling: it simply tells the exchange you will take whatever is being offered. Assuming a market order for 5,000 shares would have been filled according to the prices above, we would have received as little as $31.65 on the last few hundred shares—almost a full dollar lower than the best bid price. The average price for that market order would have been just $32.23, netting us proceeds of $161,150. Had we been able to sell all 5,000 shares at the best bid price—which is what we’d normally expect—we would have received almost $2,000 more.

As you can imagine, we did not place this trade for our client.

When market makers take a holiday

This lack of depth in an ETF’s order book is very unusual. Even if an ETF is not frequently traded, market makers ensure that thousands of shares are available for purchase or sale at a price very close to NAV. So what was the reason for this anomaly?

We can’t be sure, but Justin suspected it was because US markets were closed on Monday (it was Martin Luther King, Jr. Day) while the TSX remained open. CUD is a Canadian-listed ETF, but its underlying holdings are US stocks that were not trading that day: this would have made it more difficult for the market makers to determine the NAV of the fund. Indeed, the lot sizes were so small it’s unlikely they were posted by market makers at all: they may simply have been from individual investors.

To test that idea, we got a Level 2 quote for another Canadian ETF that holds US stocks: the Vanguard U.S. Total Market (VUN). Sure enough, this one showed little market depth as well. Had you tried to sell more than 400 shares (or buy more than about 1,300) you may have seen your order filled at a surprising price.

I checked the Level 2 orders for both ETFs again on Tuesday and the situation was completely different. Both funds had 20,000 to 30,000 shares available within a penny of the best bid and ask prices.

Lessons learned

This was a big trade that most retail investors would never make. But there are important lessons from our little adventure that apply to anyone who uses ETFs. First, it’s the most dramatic example I’ve seen for why you should never use market orders. In this situation, a market order would have got you into trouble had you tried to trade as little as $20,000. On a very large trade like ours, it might have been a disaster.

Second, avoid trading foreign equity ETFs when the underlying markets are closed. There are several American holidays when the Canadian market remains open, and these are not the days to be making large trades in ETFs that hold US stocks. If you’re making a significant trade in an international equity ETF, it’s also a good idea to pay attention to time zone differences.

Finally, if you have a large portfolio, consider subscribing to a service that provides Level 2 quotes. Check with your brokerage to see what is available, because practices vary a lot. Scotia iTRADE provides these free upon request, for example, while RBC Direct Investing and TD Direct Investing offer them as part of their Active Trader programs, and others such as Questrade charge a fee.

I wonder if anyone tries to manipulate the market on days like this. Say, sell enough shares of one of these ETFs to cause a noticeable plunge in price, hopefully causing a snowball effect of panicked selling (or more likely, stop orders being triggered), then buy once the price drops sufficiently further (or at least the ask side of the book fills up a bit). I wouldn’t want to try it, but I’m sure someone has.

I came across the same problem on Monday when I placed some trades to rebalance my portfolio. The spread was unusually large and I couldn’t understand why. I use BMO investorsline and they offer level 2 quotes to accounts of 250k and more and I’m not quite there yet unfortunately (140K).

I still went through with it because it wasn’t large enough to worry about it.

Good to know thought ;)

Thanks Dan for the info and keep up the good work!

Great post! If I’m trying to buy/sell a broad market international ETF like VXUS, which time zone should I aim to trade at?

@Jon: The Asian markets are never open when the North American exchanges are open, so nothing to be done there. Mid-morning Eastern time is usually the safest. Remember, though, that this isn’t likely to be an important issue unless it’s a very big trade. You can buy a couple of hundred shares whenever you want to.

https://www.pwlcapital.com/en/Advisor/Toronto/Toronto-Team/Blog/Justin-Bender/May-2012/What-time-of-day-should-you-trade-International-ET

Wow, this actually affected a friend of mine yesterday and we weren’t sure what was going on. So this is very timely.

@HD: Was this problem you encountered also involving stock(s) Canadian dollar listed stocks whose underlying holdings were US based, seeing as how it occurred on a US holiday when the Canadian stock market remained open?

@Canadian Couch Potato: Under the above circumstances, e.g. yesterday, is there any other category of stocks that could be similarly affected?

Interesting, I wonder if days like this provide opportunities for buyers AND sellers to catch some unsuspecting market orders. While this site has trained me to avoid looking for “timing” opportunities in general, I appreciate the heads up and will continue to double check the bid-ask spreads as usual. Thanks Canadian Couch Potato!

@oldie

I didn’t trade individual stocks that day if this is what you mean so I don’t know if they were affected at all. My transactions on that day only invloved canadian listed ETF (XWD and ZSP) with underliying American assets.

Best,

This is a very timely post for me. I’m at the point where I really should move to an ETF portfolio from an e-Series portfolio. So while I don’t have a big account, making the switch is going to be the biggest set of trades I will likely ever make and I’m really worried about making a mess of things. I should have done this a while back, but have been putting it off because of my apprehension.

Any suggestions on how to currency hedge our portfolio?

With BofC cutting rates by 25 basis points today, things don’t look good for the Loonie in the coming years.

@Nervous: If you have no experience trading ETFs, I would not be in a big hurry to bail on the e-Series funds. These are excellent products for anyone, and you should feel the need to “upgrade” if it doesn’t feel right. If you do decide to try ETFs, I would suggest starting small. Perhaps sell a few thousand dollars of your bond fund (bonds are less volatile and therefore a bit easier to trade) and start by placing one trade for a bond ETF. Wait for the trade to settle and then buy a little more. Sure, you’ll spend some extra money on commissions, but consider it tuition.

@Edwin: Let’s put aside the fact that trying to predict the movements of a currency in the coming years is futile. Even if you do think the loonie will fall in value, you wouldn’t want to use currency hedging in your US or international equity holdings: just the opposite. You would want more exposure to foreign currency.

@Nervous: To second what CCP says, if you feel the need to dip your toes in the ETF waters your bond fund is likely the best choice to start with. In addition to the generally low volatility (other than today!), in a balanced portfolio it is likely your largest individual holding (perhaps ~40%?) and has one of the largest MER gaps between eSeries and ETF (0.50% -> 0.13%).

To put some real numbers to this: assuming your bond component is around $40,000, this change represents ~$148/year savings.

I rebalanced my portfolio on Monday… oops! I had some very large transactions, I wonder if it affected the purchase at all…

I DID use a limit order, so nothing seemed too out of whack but I didn’t even think about looking up the Level 2 quotes, as I didn’t even really know what they were until after reading this article.

This re-balancing would have been the first time I had access to Level 2 quotes since I just crossed the threshold for 250k assets. I guess good to know for next time! For now what’s done is done.

ETF true liquidity is usually much better than anything you can discern from Level 2 quotes. That said, all ETFs whose underlying assets are not trading will be quoted wide. This is well-documented, see https://www.vanguardcanada.ca/documents/etf-trading-best-practices.pdf for an accessible explanation. Or http://www.etfs.bmo.com/ETFConsumer/controller/image?image=Trading_and_True_Liquidity . There is a lot of copy on this issue.

@CCP I am curious what would have happens had you put a limit order at 32.59, typical 2 cents margin. .. wouldn’t you expect the market makers to then see this massive 4400 sell order below NAV and step in?

@Francois: That is certainly possible, and that’s why limit orders are essential. The worst thing that could have happened in that case was that our order would have been only partially filled.

Thanks very much Dan and B, I really do appreciate the advice! I won’t be abandoning the e-Series, Dan. I plan to maintain my regular monthly contribution to the e-Series funds and just re-balance once or twice per year, as needed into ETF’s.That will keep trading fees down. At the same time, moving the bulk of my portfolio to the ETF’s will save about $950-$1,000 per year in MER costs for now, and more as time goes on. But I’ll definitely start with the bonds.Great idea! And you’ve convinced me on the limit order.

Thanks again!

Hi Dan & All,

This is all new to me, so thank you for the post!!!

Dan, you advised Nervous in the readers’ comments section above to perhaps sell “a few thousand dollars of your bond fund (bonds are less volatile and therefore a bit easier to trade) and start by placing one trade for a bond ETF”. I believe your suggestion was posted before Wednesday’s BOC interest rate cut. Does the reduction change any of your advice?

What do you mean by waiting for the “trade to settle”?

By the way, would Nervous be better off replacing his/her e-series bond fund with GICs?

@Atticus: Thanks for the comment. A long-term investor should not change his strategy or asset allocation based on an event like a change in short-term interest rates. As for bonds v. GICs, both can be a good choice in different circumstances: it depends on the individual.

All mutual fund, stock and ETF trades have a three-business-day settlement period. Practices vary among brokerages, but sometimes when you sell a mutual fund the cash will not be available in your account until the trade settles:

http://www.investopedia.com/ask/answers/03/061303.asp

Thank you so much for this informative post. I’m learning so much by reading your site!

I was wondering what is your opinion about the NOBL ETF (ProShares S&P 500 Dividend Aristocrats ETF), as part of the US stock component of a diversified portfolio, with the added benefit of some dividend income?

Thank you in advance.

@Newby: Glad you’re enjoying the site. I tend to prefer broad-market ETFs rather than those that select a small number of stocks based on their dividend payouts. NOBL, for example, holds just 53 companies, compared with well over 3,000 in a total-market US equity ETF.

Anybody want to bet Dan’s working on a post on interest rate fluctuations right now? ;)

Thanks for the tips especially for the second one. I was thinking of adding some international exposure by using Vanguard ETFs and I never knew time difference would play a huge role.

Thanks Canadian Couch Potato!

@CCP: After having read your previous posts on limit vs market orders I always use limit orders, but I am a little unsure about something. You mentioned that if you placed a limit order for say 5000 shares at $32.61 you would be able to sell 200 shares at that price. Is it always the case that when I place a limit order it will try to match the trade with as many shares as it can and the remainder will remain in a “pending” state? Or is it an all-or-nothing type of thing where if waits to make sure the entire trade can be satisfied before executing the trade? How does it work?

@Cam: On the TSX you cannot specify an “all or none” order. So in this example if you placed a limit order to sell at $32,61, you likely would have sold only 200 shares and the rest of the order would have sat unfilled. You can specify when you want the limit order to expire: if the price happens to rise, additional shares may get sold later in the day (or even on future days).

On the US exchanges you can specify “all or none” when you place an order, and if the order cannot be filled completely it will not get filled at all.

http://www.investopedia.com/terms/a/aon.asp

Really great post! Level 2 quotes are really off the radar for most retail investors, but raising that here was great and explained well.

Limit orders are very important, but I see varying opinions on the use of “GTC – Good til Closed” orders. Something I use, but would be interested in the thoughts of others here.

So, just a side question here. Other than the best practice of not trading (if possible) when the underlying market is close, what ultimately drove the decision to wait till the next day?

Let’s say the underlying market was open, but the market depth just happened to be thin. Couldn’t waiting be viewed as a sort of (very short) “market timing”? What’s to say that CUD wouldn’t dip the next morning (insert whatever reason here) when the markets opened, and you end up losing even more than the potential $2000?

e.g. what makes “wait a day to sell” any different than any other “wait for” that you generally counsel against?

Just curious.

@nbhms: The order depth is almost never going to be that thin when the market is open, but if it were, we would have put off the order for another day. If you follow a disciplined process it makes sense to wait for a day when you can be sure your order will be executed at a price close to NAV. As it happens, the US markets did open lower the next day. But you can’t judge the decision by the outcome: you judge the decision by the probability of its expected outcome. As any poker player will tell you, sometimes you make the right play and still lose the hand. This is not the same as market timing, where you have no reason to believe that picking an entry point offers any advantage at all.

@CPP or anyone else that may know:

Are there ary brokers that provide free level 2 data?

Has the list grown from:

“Scotia iTRADE provides these free upon request, for example, while RBC Direct Investing and TD Direct Investing offer them as part of their Active Trader programs, and others such as Questrade charge a fee.”

How does it work at Scotia iTrade?

Thanks, Que

@Que: At Scotia iTRADE you simply have to ask them to grant Level II access and it’s free for Canadian stocks/ETFs. However, there might be a minimum account size to qualify. At BMO InvestorLine you get them free if you have $250K+.

@Dan: How about some where online? I’ve seen websites advertising level 2 quotes.

I am wondering how somebody could get an idea of the depth of the market, with out having access to Level 2 quotes at their broker.

This has been the biggest deterent for me with regards to purchasing ETFs. I would like to move my fixed income within my registered accounts into VAB and VSB. My concern is this would be a large trade of $350,000 and I could run afoul of the issue you mention in this article. Since these are bond etfs should I be concerned with making such a large trade?

Would you recommend getting a level 2 quote?

@Cameron: If your brokerage does not provide Level 2 quotes, you should still be fine. But absolutely make sure you use limit orders. If you are selling, try placing the limit order one cent below the bid price, and when you buy place the order one cent above the ask price.

Bond ETF prices don’t tend to move very much, and VAB and VSB both have fairly large trading volume, so you it’s unlikely you will have any difficulty.