Investors love to rip into the financial media, and with good reason. So much of what passes for “investor education” is little more than worthless forecasts and attempts to explain random noise (“Canadian markets down on disappointing Portuguese GDP report”). More insidious are the pundits who do little more than talk their own book.

Investors love to rip into the financial media, and with good reason. So much of what passes for “investor education” is little more than worthless forecasts and attempts to explain random noise (“Canadian markets down on disappointing Portuguese GDP report”). More insidious are the pundits who do little more than talk their own book.

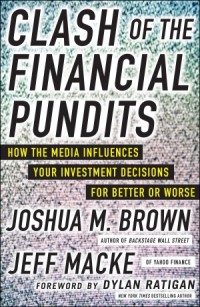

There’s a lot of this familiar criticism in Clash of the Financial Pundits, but what makes this new book so compelling is that the harshest words come from media commentators themselves. Authors Jeff Macke (formerly of CNBC’s Fast Money) and Joshua Brown (a CNBC contributor who blogs at The Reformed Broker) have set out to help readers and viewers be smart consumers of financial media. What should you heed and what should you ignore? The highlights are the detailed interviews with TV pundits, serious journalists, celebrity money managers and the inimitable Jim Cramer.

One of the recurring themes in the book is the relentless pressure on the financial media to produce entertainment, even if it means giving investors terrible advice. The easiest way to ensure you’ll never be invited back on CNBC is to admit you don’t know where the market is headed, say you share the consensus view, or recommend something prudent like a diversified index fund portfolio. The producers urge guests to make bold and outrageous calls, because that’s what viewers want. “People have been shown to prefer commentators with unwavering confidence over those who are more reserved and have actually gotten things right,” the authors write. “The research shows that in the presence of someone speaking emphatically about events to come, people subconsciously shut off the part of their brain that reminds them this cannot actually be done.”

One of the most constructive ideas in the book comes from Barry Ritholtz, who shares his method for holding forecasters accountable: “When someone says something I think is either outrageous or foolish, I diary it.” He uses a service called followupthen.com, which will send you an email on the anniversary of the forecast (or any other date you choose) so you can see how well it held up. It’s a brilliant idea, because the usual pattern is for pundits to be hailed as geniuses when they make a good call and simply forgotten when they make a bad one.

Some of the comments in the interviews are a little rich. Jim Cramer, for example, is an extremely smart man, but it’s hard to take seriously his assertion that Mad Money “informs and it educates,” or that he does the show because of “the satisfaction of knowing that I can help people.” Especially because a few pages later he says, “I decided I’ve got to have a little more entertainment value because I don’t want to get cancelled. I’m a commercial endeavor. It’s like the professors who say, ‘Jim you should come out every day and night and just say buy index ETFs.’ Well, you know, that’s not a show and people obviously want a show.”

They do indeed. But the real insight happens when you realize that investing isn’t about making a show, and the smartest decisions you’ll ever make are likely to be boring. If you think managing your portfolio is entertaining, you’re probably doing something wrong.

Read this book with a pencil in hand so you can mark the many nuggets of wisdom that will make you view the financial media with a more skeptical eye.

I’m reading this now, though I haven’t got to the Cramer part yet. Interesting format – I find the interviews a bit long and Macke sort of takes over most of them with his own stories (which, if you Google him, are quite interesting).

It’s always good to read what smart, rich people have to say about money. But you’re right, tune out most of what passes for entertainment.

Thanks Dan. This looks like a good read. I think you need to ignore what they are recommending and focus more on WHY they are recommending it. It’s easy for Cramer to say buy this or buy that. He recommends everything! Then later, when it goes up he will say I told you so. If the stock tanks, he will just shake his head and act like this was coming for a while. But, if someone comes on and says buy Apple because it’s selling for 10 times earnings and it’s got a bag of cash, that’s a different story. This really does educate people because then they start thinking; hey, I’ve got to look at earnings and free cash and the company’s ability to pay a dividend. I agree with Robb. It makes a lot of sense to listen to all of these guys and then filter out the irrelevant parts.

My favourite quote about those who forecast, which I heard many years ago, is

‘Economists have forecasted 19 of the last 4 recessions’.

’nuff said.

I’m at the stage where I still scan the financial section of the Globe and Mail, and note to my self — that’s crap, that’s crap, that’s crap, oooh wait, that’s interesting and read it..sometimes still half believing it, or at least taking it seriously.

Would you guys all agree that the true mark of a dedicated CCP believer is for the true believer NEVER to touch the Financial Section? Except maybe folded over as a firm backing so you can do the crossword on your lap.

Whenever I read a forecast about the stock market, I think about this article:

http://www.businessinsider.com/dow-jones-idiot-maker-rally-2013-3?op=1

It’s a list of financial gurus’ comments about the recent bull market starting in 2009.

@Smithson: That is a brilliant article, and one of the few that actually holds the gurus accountable.

@ Smithson – Loved that article! I wonder if there is a similar article about financial gurus that got it right at that time. Likely not because they knew enough to just keep quiet about what might happen, especially this one:

http://abcnews.go.com/Business/Economy/story?id=7495356&page=1

who said in 2009 in answer this question, not necessarily about the S&P500 (which he never makes predictions on) but the economy in general:

Q: ‘The administration is cautiously optimistic that we will see the economic recovery by the end of the year. Where do you stand on that…’

A: Buffett: The answer is, I don’t know. I wish I did. Incidentally, nobody knows. We have gone through all recessions, [which are] are somewhat similar, but they have differences. This one was a real shake, really shook up the confidence of the American public. They changed their buying habits, their saving habits all kinds of things, and we don’t know when that will be over. We do know it will be over, but I can’t predict the timing.

A social psychologist, Albert Mehrabian, completed research on the critical aspects of communication. His findings (summarized at http://en.wikipedia.org/wiki/Albert_Mehrabian) were that 55% of communication is non-verbal (e.g. facial expression), 38% is tonality and only 7% is the actual words.

So if a presenter was facially expressive and a good communicator (i.e. >90% impact) then most people may respond positively to the content, perhaps even if the content is nonsense. Heck, observers may even find it entertaining …

To my knowledge then this broad concept drives some comedy. If a comedian says something significantly offensive, but with a huge grin and joking tone then people tend to laugh rather be offended by the content.

I wonder how much of the criticism of financial media blarney also applies, to some degree, to active fund managers? :)

“If you think managing your portfolio is entertaining, you’re probably doing something wrong.”

My portfolio is a boring vanilla collection of ETFs exactly as described by this website, yet I find it EXTREMELY entertaining to manage. Something’s wrong alright… I think I’m sick!

The book looks interesting. I will have to check it out.

@smithson – thanks for the link to the Business Insider article – amusing. The pros are excellent at calling market moves/downgrades/upgrades after they have already happened.

@Oldie: I still like flipping through (or more often now, scrolling through) the Financial Post, but mostly for the entertainment value and the business articles. I think it’s just the urge to actually *do* anything about the articles you read that falls away.

CBC recently had a DocZone episode titled The Trouble with Experts. It makes a similar point and points out it’s not just financial experts that get it wrong, most experts in most fields get it wrong which is sobering but not unexpected. Being right is often much harder than it seems at first. (It also confirms my dislike of all political systems that rely on a set of “experts” that think they can do better than a competitive “market” of free ideas… but I digress.)

Many years ago my university economics 101 professor told us if somebody tells you how to make abnormal returns, ask them why are they are not keeping that information to themselves and getting filthy rich because that’s what a rational person would do. I think of that advice every time I hear a pundit talking about financial markets. I just think, if you are so smart, why are you on TV/radio/print telling me this and not on the computer trading your idea? It never makes any sense other than they actually suck at their own game and they have determined that they can make more money off of being a media pundit where they don’t need to be right.

But most telling of all is the way the bulk of the retail financial industry makes money via various fees and spreads as opposed to making good investment decisions. They claim they are experts, but will not take any risk themselves and ask you to take all the risk and then they want 2% to 3% (or more) of everything you own, no matter what happens, every year. As my economics professor said, if they are so smart at making abnormal returns why aren’t they just investing themselves and getting rich? Why do they even need retail clients? The only answer is they aren’t that smart and have determined they cannot make abnormal returns and thus have gone after fees instead which is telling.

As always, follow the money to know what’s really going on.

This was a great book on the same topic “pound foolish” by Helaine Olen.

http://www.amazon.ca/Pound-Foolish-Exposing-Personal-Industry/dp/1591844894/ref=sr_1_1?ie=UTF8&qid=1406977148&sr=8-1&keywords=Pound+foolish

James, I skimmed through the first few chapters of Olen’s book once at the library, but I can’t agree that it’s good. She takes issue with the advice that public finance figures give, and she’s absolutely right about the examples she picks. She takes them to task for inflating numbers or outright lying. Good for her.

But she then throws up her hands at the futility of it all. Because portfolio returns aren’t 11% as one person claimed, then it’s “oh my, we’ll never get that kind of return over our lifetime so investing is useless”. Because someone inflated the amount that someone might pay for a day Starbucks latte and cookie to $2000 per year, while she calculates it as a few hundred dollars less, then “oh my, what I spend at Starbucks every day doesn’t affect anything at all, how can I possibly get ahead now”.

I was fed up with the blame game and defeatist attitude after the first few chapters and stopped reading, so I don’t know if she changes her tone, but there was a distinct attitude of hopelessness about people being able to manage their personal finances. Because some people in the media are liars and cheats, the common person has no hope whatsoever. In a couple of places she trots out the “there’s nothing you can do about your finances, it’s a societal problem and needs to be fixed at a higher level” thing. Yeah, ok, I like not having to be responsible for my choices, and we can lay some of the blame at the feet of bad advisors and people lying to you in the media, and there are definitely societal problems with poverty (which she is not talking about), but she wants to absolve the reader of all personal responsibility, and I’m not buying it.

@Tyler: Good for you, calling her out on that. There IS something that the little guy can do. Firstly taking personal responsibility for the choices you still have. Secondly calling the shots as you see them. If enough of us sensible people all do that in a public manner, then hard as it may seem to those feeling “hard done by”, then being responsible for your own fate may become popular again — after all, that’s how we became a great nation, before easy money and the idea that our government would help provide us the standard of life that we were accustomed to became popular.

Boy, I’m really starting to sound like my late Dad.

Perhaps not all financial media are so scarred. Some seem to focus on considered content, rather that the temporary entertainment.

On 1 August, the Financial Times published an article “The hare gets rich while you don’t. Back the passive tortoise” (the hare referring to fund managers) … http://ftalphaville.ft.com/2014/08/01/1914342/the-hare-gets-rich-while-you-dont-back-the-passive-tortoise/

And 2 February, the Economist published an article “Against the odds”. Article quoted research, including from legendary John Bogle (founder vanguard), and broke-out the incremental fees paid by investors to active fund management strategy (higher AER, high portfolio turnover/transaction costs and resulting tax, …). Brutal and highly informative for those questioning active-vs-passive

http://www.economist.com/news/finance-and-economics/21596965-costs-actively-managed-funds-are-higher-most-investors-realise-against

On 1 May, the Economist published an article “Will invest for food”. Premise being that the fund management industry is commoditizing.

… I sure hope Buffett’s prediction is right. Wonder whether he would venture the same prediction today about Argentina’s future.

Part of the problem surely has to be to know who is an expert and who is merely pretending in order to further commercial / entertainment aims. It also seems that in many cases failed predictions by real experts arise when they overstep their expertise e.g. Nouriel Roubini an economist making predictions about the stock market. I listen much more closely when Rob Arnott, Staunton/Dimson/Marsh, Ibbotson, Seigel talk about the future of markets. Of course, as real experts if you read them closely there are always caveats, ranges, contingencies because, especially with stock markets, there are real uncertainties.

btw, does the book discuss blogs? I have some found excellent ones that are worth reading (like this one) because they provide real insight and new information. Similarly, within mainstream media, there are individuals like Rob Carrick who consistently provide good, fair information despite the overall preponderance of fluff from his employer the Globe because they feel they have to fill up the space with constant new stuff. SeekingAlpha is much the same – loads of junk with an occasional nugget. Bloomberg TV is also pretty good for keeping up with big business and the main world economic news.

“Bloomberg TV is also pretty good for keeping up with big business and the main world economic news.”

Still, I would argue that the alleged objectivity of this source, or any other in the financial news, is still noise in that it is a distraction form our true purpose, and might cause us to predict how this new reality might affect the future value of our portfolio and, if so, maybe our asset balance should be tweaked like so…you get the picture.

The true believer CCP doesn’t believe or do anything (except initially to establish an asset allocation that is appropriate) until the asset balance changes. Then he rebalances. This latter feedback loop is accomplished without any extraneous external input.

@CanadianInvestor: I agree it’s always worth considering the credentials and the potential biases of anyone claiming to be an expert. But we still need to remember that even legitimate experts with no conflicts of interest still have no clue where markets are headed in the short to medium term. Buffett is the first to admit that and is careful never to make market calls publicly.

The book discusses some blogs, including those by Barry Ritholtz and Josh Brown. Bloggers are under less pressure than TV pundits, I think. I agree Seeking Alpha is very uneven, which isn’t really surprising considering the huge number of contributors.

@Oldie’s comments “The true believer CCP doesn’t believe or do anything (except initially to establish an asset allocation that is appropriate) until the asset balance changes. Then he rebalances.”

I can’t dispute this, not even for a heartbeat. Way to go @oldie! Do many investors really do this? Really?

But I wonder if there is some form of cycle of acceptance / behaviour of investors in regards a CCP-like approach? A bit like a product life cycle, only for investment behaviour. I suspect that, over time, CCP-advocates become less-and-less inclined to follow financial news and more-and-more disciplined in their investment strategy. But that it may take time. Sitting on hands (not trading) and ignoring ‘expert’ folks is unintuitive for some investors … at least for those that once thought that they could beat-the-market. Or perhaps that’s just me ;)

Do people follow a predictable pattern in the timeline of their change of investment strategy, behaviour / mindset and receptiveness to financial media entertainment? Is the seeming bubble – of active investing / stock picking – burst gradually or in a brutal realization?

Regardless, I’d be very interested to hear from any CCP-advocate financial advisors in regards the typical real transition of beat-the-market go-getter investors towards change towards the end-game of accept-the-market CCP’ers. My gut instinct tells me that emotional resistance must be pretty significant. Especially for investors that remember only the wins.

Put another way, does the importance of financial media decrease over time? … say to @oldie’s indifferent level?

@Oldie … how long have you been following a CCP-like investment strategy?

@Ross: I was your typical know nothing investor tossing in the wind for most of my life. I had my professional association financial advisor rescue me for the last 10 years or so of my working life, and take of=ver running my portfolio in a rational, and reasonably inexpensive manner, and that sort of saved my skin, but I still didn’t understand what was going on.

I retired in 2012 and 1 month before retirement I stumbled upon the Couch Potato idea and this site. I read every post back for 3 or 4 years and followed everything since, eagerly devouring the information and insight. I sat on my hands, studying the material, for 6 months then gradually got into it then made some large investments. However, I still didn’t get it completely right (incomplete understanding in the face of finessing some odd personal circumstances) and had to rejig my portfolio earlier this year. I would say with intense study I got the initial powerful insight and confidence within 2 weeks; but the flushing out of residual emotional thinking that would have derailed proper CP implementation took a few more months. But I am still encountering instances now where I realise I hadn’t fully “got” it in small points until now; fortunately these are relatively minor points.

And, I would say, I think I may talk a good talk, but I’m really still a Newbie, and I really have to talk to myself a lot to keep myself on the straight and narrow.

@Oldie – No, I would venture to say that the ‘true mark of a dedicated CCP believer’ is for them to never even read CCP again, let alone the financial media, because if you truly believe you do not need the reinforcement that this blog provides! You just do your regular investing, rebalancing and tax-loss selling at the end of the taxation year. (Ok, maybe you google CCP it at the end of the year to find suitable substitutes for your tax-loss selling).

Of course, I am being a bit facetious here but I think you get my point.

PS: The Norbert Gambit that I learned here, while not an exclusive offshoot of CCP philosophy, was an early example of how specific as well as general information is given in sufficient detail here to be really useful. I had never heard of it before, but with enough research I was able to rapidly and confidently get up to speed and execute it — it saved me thousands.

@Noel: I do get your theoretical point and it’s a good one! But a subtlety of CP understanding is to understand and accept that we are emotional beings, and that this emotionality is often at odds with our mathematical mind, powerful though the latter may be. Thus we come back to the source for emotional sustenance, not really expecting to learn anything dramatically new intellectually.

It’s a little like why the True Christian still reads the Bible. (I am not religious myself, and I mean no offence to those that are, but my point is that there are intellectual as well as emotional components to every belief system — and to live with your own belief system you have to accept these components and understand how to nourish them).

This is why I think it’s so difficult for the average investor to get it right. Unless they do some serious, tedious, volumous reading, there’s so much noise and too many paths to presented to them as the correct one. Many of us strolled down several of those paths before ending up here because we really didn’t know what in the Sam Hill we were doing.

Boggleheads/Couch Potatoes: “Simple math shows indexes cost less and tend to go up over the long-run.”

Everyone else: “I can predict the future.”

Unless you discover passive investing you might as well give your money to the fortune teller or invest in the snakeoil salesman.

I am glad CCP is not forbidding the viewing of BNN by all of us! He knows well that when viewership of BNN is high then BCE profits and so ZCN outperforms :).

But wisely, CCP does not include BNN in his ‘resources’ section because for us mature investors books are for knowledge while television is for fun and entertainment!

It would be nice to get CCP viewpoint on following article:

http://www.economist.com/news/finance-and-economics/21610297-regulators-worry-asset-management-industry-may-spawn-next-financial

@singh, thanks for the article link, I enjoyed reading it. My personal view is that these are the types of stories the financial media should be covering and debating rather than their current obsession of bringing on “experts” to explain or predict the market.

Regarding the subject matter; I can’t help but think that here we go again. The actions of regulators created the housing bubble (because of historic low interest rates), the subprime loan problem (because social housing goals created regulations that ultimately imposed a moral hazard on lenders), the Greece crisis (again a moral hazard created by the shared Euro vs. country by country floating currencies) and now a bond and stock bubble (because of bond market manipulation and extremely loose monetary policy).

If regulators are worried about something blowing up again, they should look in the mirror see what they’ve set up to blow up next because of their own policies.

This is a great reminder that shows like Mad Money are just that… A TV SHOW! It’s main purpose is to provide entertainment and keep it’s ratings up.

@Smithson – that’s a great article! I’m keeping that one on file for sure because it just proves that no one can predict the future. If that were possible, you would always see the same person winning the lotto everyday. LOL!

Dan… I’ve been half using the Coach Potato for over 3 years now, but more in depth in last 6 months. Can i just say how often this has gotten me to be mad every time i read something else, and every time all i want to do is write the authors to tell them how misleading their content is…. (i will leave names out).

again thanks for all the great content, and also the fact you let the reader clearly understand what the point is…

@françois: Thanks for the comment. Just going my best to help people tune out the noise and focus on what’s really important!

@francois: There is some merit in writing to inform some otherwise knowledgeable authority that an important piece of information that he is propagating to his readers is in fact wrong. This wrong information, once flagged, can be relatively easy to verify, and presumably, this authority will check your information, and issue a correction, to the benefit of all.

Most situations, however, fall into the category of wilful ignorance. Such people basically don’t wan’t to be corrected, and it is a waste of your time to try. After a while, you’ll stop getting mad, just shrug your shoulders. As Dan says, just tune out the noise and focus on what’s important.]!

But a more subtle category is the relatively well informed person who gets into a position from long experience in a particular situation that biases them irreversibly, it seems from other more rational viewpoints. A case in point is my running buddy, an international tax accountant for KPMG. She knows her accounting backwards, and researches her personal individual investments meticulously. This is a lot of work, and undoubtedly she does it well. She is so committed to the process that she rejects completely my description of the merits of passive index investing on the grounds that the index contains a lot of dogs that will do poorly, and which, if she took the time to research them (she thinks) would demonstrate what poor investments they are, not to mention the importance (she thinks) of market timing. She is resistant to the statistical experiential logic that demonstrates that, despite all her effort, there is no evidence that meticulous research translates into better investment outcome.

I have just stopped trying to convince her otherwise. But discussions like this with people with some expertise require me to review my facts, and ultimately this process strengthens my own internal resolve and belief in passive index investing.