Many readers have used our white paper, As Easy as ACB, to learn how to calculate the adjusted cost base of their Canadian ETF holdings. I’ve received several comments and questions from readers who wonder whether the process is the same for US-listed ETFs—and the answer is no.

You already know that dividends and interest from US securities are taxed at your full marginal rate. What you may not realize is that return of capital (ROC) and capital gains are also fully taxable. And although ROC and reinvested capital gains affect your ACB with Canadian securities, they are unlikely to be a factor with US-listed ETFs.

Schmidt happens

First some background: in a 2012 court case, a Calgary investor named Hellmut Schmidt argued that ROC and capital gains distributions from a US-listed security should get the same tax treatment as they do when they come from Canadian funds. He argued the ROC should not be taxable, and that he should be on the hook for only half the capital gain. But the judge disagreed and ruled that all the US fund’s distributions were fully taxable as foreign income.

Let’s consider the implications of that ruling. Recall that ROC from a Canadian fund is not taxable in the year it is received, but it lowers your adjusted cost base, thereby increasing the future capital gains tax liability. The Schmidt case made it clear that if you receive return of capital from a US-listed ETF, it is fully taxable as income, and it does not affect your ACB.

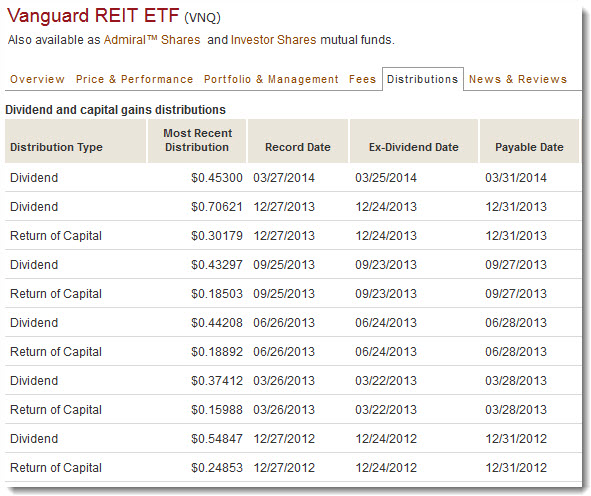

Fortunately, return of capital does not seem to be a common characteristic of US-listed ETFs. You should be able to tell if there were ROC distributions by visiting the ETF’s website. One example is the Vanguard REIT ETF (VNQ), which had four ROC distributions in 2013:

The lesson here is you should probably not hold this ETF in a non-registered account. Indeed, foreign REIT ETFs can be extremely tax-inefficient, because they throw off a lot of fully taxable income. If foreign REITs are part of your portfolio, consider holding them in an RRSP.

The lesson here is you should probably not hold this ETF in a non-registered account. Indeed, foreign REIT ETFs can be extremely tax-inefficient, because they throw off a lot of fully taxable income. If foreign REITs are part of your portfolio, consider holding them in an RRSP.

At a loss for gains

Capital gains reported by Canadian ETFs will appear on your T3 slip and are taxed at half your marginal rate. But as we’ve seen, any capital gains distributed by a US-listed ETF will be reported as foreign income on your T5 slip, and they are fully taxable.

More good news, however: capital gains distributions from US-listed ETFs are even rarer than ROC. According to a Morningstar article published at the end of last year, “at five large ETF providers—iShares, Vanguard, State Street, PowerShares, and Schwab—just 38 out of 670 funds are facing capital gains distributions of any kind.” Moreover, the Vanguard and iShares ETFs that did have capital gains in 2013 were mostly bond funds, and there can’t be many Canadians who hold US bonds in taxable accounts.

Even when a US-listed ETF does have a capital gains distribution, it is likely to be in cash, which means you don’t have to worry about adjusting your cost base. So this one is a moot point for Canadian ETF investors.

Making the exchange

All of which is to say that calculating your ACB with US-listed ETFs is largely about keeping track of purchases and sales. Lowering your ACB to account for return of capital is not permitted, and increasing it for reinvested distributions is almost never necessary.

Of course, that doesn’t mean it’s straightforward. ACB calculations for US securities need to be done in Canadian dollars, which means you will need to learn the USD-CAD exchange rate for the settlement date of each transaction. For a detailed explanation, see pages 13 and 14 of our white paper, As Easy as ACB.

Just so I’m clear on this: capital gains distributions from US-listed ETFs are taxed at 100% of your marginal tax rate, but capital gains from selling US-listed ETFs are taxed at 50% of your marginal tax rate?

Darren

@Darren: Correct. A capital gain distribution from a US-listed ETF is treated as foreign income. But selling shares of a US-listed ETF at a profit is just like any other kind of capital gain.

I realize you’re not a tax lawyer, but do you have any insight into the reasoning behind the tax court’s decision? I read through it and the judge was not convinced that the type of distributions that the fund says they made, actually flowed through to Mr. Schmidt. Why wouldn’t they?

what are the MER’s of the new BMO mutual fund etc series D funds?

@Tyler: Jamie Golombek has written about this, and he quotes the following from Canada Revenue Agency: “It is a question of corporate law, not U.S. tax law, that will determine the nature of the cash distribution for Canadian tax purposes. Under U.S. tax law, certain distributions may be treated as a return of capital when in fact they are a dividend under corporate law [and thus properly taxed as a foreign dividend].”

http://business.financialpost.com/2012/05/12/not-all-dividends-are-taxed-the-same/

I’m not going to pretend I understand exactly what that means, but it is reasonable to expect that the two countries are not bound by the other’s laws. My guess is that for US investors, capital gains and ROC from Canadian companies are also treated like foreign income and taxed accordingly.

@Jake: I’m getting some information on these and will report on them soon.

I don’t think you’re reading the Schmidt case right. The judge makes no conclusion of law in the decision. The only conclusion the judge reaches (paragraph 10) is that Schmidt failed to establish an evidentiary basis for concluding that DNP’s distributions flowed through to him. Unrepresented litigants like Schmidt often fail to establish an evidentiary basis for their arguments. This is absolutely not the same thing as the judge ruling that US return of capital or long-term capital gains are treated as income.

Perhaps a tax lawyer or accountant can chime in on whether there is a better decision on this issue.

@Chris: I am certainly no legal expert, but the discussions I have read reference the Schmidt case as a precedent and advise against trying to claim that ROC from US investment funds is not taxable, and against trying to claim that distributed capital gains should be taxed at half the rate of foreign income. Investors are welcome to do whatever they want on their own tax returns, but you’re playing with fire if your claim doesn’t match up with your T5s.

http://www.taxtips.ca/personaltax/investing/taxtreatment/etfs.htm

http://business.financialpost.com/2012/05/12/not-all-dividends-are-taxed-the-same/

Thank you very much for this info! You saved me a lot of money. I sold UBA last year that had decent amount of “Return of Capital” and I recalculated ACB based on that. Now I will ignore Return of Capital and save that money :)

@VM: I’m sure you know this, but just to clarify for others, it is indeed a benefit if you don’t have to lower your ACB to account for return of capital from a US security. But the flip side of that coin is that the ROC is fully taxable as foreign income (it would appear on your T5) which is not a benefit at all. So holding US securities that generate a lot of return of capital is probably not a great idea to begin with.

@CCP – You say that holding US ETFs that generate a lot of ROC is not a great idea – I assume that is the same for US ETFs that generate a lot of capital gain distribution. Any idea how to know in advance what ETFs are likely to do this? Any difference on taxable vs non-taxable accounts?

Dan, my accountant advised using average annual exchange rates in calculating the ACB. I find this simplifies the bookkeeping considerably, compared to looking up daily exchange rates for each transaction.

From http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/rprtng-ncm/lns101-170/127/clc-rprt/menu-eng.html: “Report your gains or losses in Canadian dollars. Use the exchange rate that was in effect on the day of the transaction or, if there were transactions at various times throughout the year, you can use the average annual exchange rate.”

@Zaphod: This is only an issue in taxable accounts. I would just suggest looking at whether an ETF had made return of capital or capital gains distribution in the past: if they have never none so (which is usually the case) there’s little reason to suspect they will suddenly start. I’d be most wary of REITs for return of capital.

@James: I never argue with accountants. :)

@James: My discount broker (BMO Investorline) included the following line on my annual investment summary:

THE US$ EXCHANGE RATE FOR 2013, ISSUED BY THE BANK OF CANADA IS: 1.0299

I was told to either use this or the noon rate on the transaction (settlement) date as long as I am consistent. I’m hoping this was the right advice.

@Robert: You’ll see that rate is the same as the Bank of Canada’s annual average rate. :)

http://www.bankofcanada.ca/stats/assets/pdf/nraa-2013.pdf

Excellent post.

What about reinvested dividends of US ETFs? Do we omit those as well from the calculation of the ACB?

@Cristian: Do you have an ETF with reinvested dividends? I’m not aware of any ETF that does this.

@CCP:

How about ROC for Canadian-listed ETFs which invest in US etfs (like Vanguard VUN) ?

Does it appear as foreign income or ROC on the T5 ?

@CCP:

And how about ROC for Canadian-listed ETFs investing directly in US equities (like BMO ZSP) ? Do you have the ACB for the ROC distributions?

@Jas: If the return of capital was generated by the Canadian-listed ETF itself (as opposed to the underlying US holdings) then it should show up as ROC on your T3 (not T5, because it’s a Canadian-listed ETF). If the underlying holdings generated the ROC directly, then it would lose its character and become foreign income. But this is really a moot point: VUN’s underlying holding is VTI, which has never distributed ROC. And the companies in ZSP are equally unlikely to distribute it.

@CCP:

So tracking re-invested ETF distributions and ROC if only a problem with Canadian equities ETF and not for international/US ETFs (US listed or Canadian listed)?

If thats the case, one could consider using TD e series for canadian equities and ETFs for US/International equities to simplify the tracking of the ACB?

@JAS

Like Jas, I too am very conscious about avoiding complex ACB calculations.

My current solution for my non-registered account is to use Horizon swap ETFs, HXT and HXS, which only require me to track purchase and sale to calculate ACB.

I also like GICs for the ease of calculating taxable income.

I’ve also considered buying Berkshire Hathaway stock as AFAIK it never has distributions.

So Jas, when holding TD e-funds, are there no “phantom distributions”, or ROC or dividends?

@IlyaK:

That’s right, with TD e-series funds there are no “phantom” re-invested distributions. I’ve never seen any ROC distribution either. Dividends are distributed once a year in december, unless you decide to have automatic re-investment of distributions, in which case the Adjusted Cost Base is automatically adjusted by TD waterhouse. In that case, you would see one transaction every year in december with the number of shares bought with the re-invested dividends. Also, every year you receive a T3 report from TD asset management inc. with the breakdown of the income you’ve received from your mutual funds (re-invested or not).

https://www.tdassetmanagement.com/Fund-Document/pdf/Distributions/TD-Mutual-Funds/2012_TDMF_TDCT_e_ENG.pdf

@CCP:

Ok, so ROC distributions isn’t a problem with US-listed ETF in your recommended model portfolios because they never distributed ROC in the past?

How about “phantom” re-invested distributions (dividend and/or capital gains)? Do we have to keep track of these? Is there a website similar to cdsinnovations.ca but for US-listed ETFs?

Thanks!

@CCP:

According to this article, “phantom” re-invested distributions is only a problem with Canadian ETFs (and Canadian listed ETFs investing in US-listed ETFs).

It appears that US-listed ETFs do no have re-invested distributions… It would be interesting to know if there a is reason for this difference ? It makes ACB tracking for Canadian ETFs much more complicated….

“While our neighbours stateside will typically receive actual cash distributions, which they are then liable to pay tax on, in Canada the process is handled a bit differently. Rather than making a payout, ETFs in Canada will usually automatically reinvest the “distributions.” Investors then can increase their adjusted cost base by the amount of that reinvested distribution”

http://cawidgets.morningstar.ca/ArticleTemplate/ArticleGL.aspx?id=533682

Many articles have been written lately concerning phantom distributions and ROC distributions affecting the ACB for Canadian ETFs…. this is good because I think many DIY investors in Canada are unaware of this, I agree with the following comment from a globeandmail reader:

“There is such a wide gap between the perception that ETFs are a simple way to invest, and the reality that confounds the retail investor when, for example, tax time rolls around.”

http://www.theglobeandmail.com/globe-investor/funds-and-etfs/etfs/how-to-keep-more-of-your-etf-nest-egg/article10207129/#dashboard/follows/

http://www.theglobeandmail.com/globe-investor/investor-education/haunted-by-phantom-etf-distributions/article18225076/#dashboard/follows/

http://www.theglobeandmail.com/globe-investor/investor-education/more-fun-with-phantom-distributions/article18409698/#dashboard/follows/

@JAS

Thank you for the explanation. What to do however with the foreign income distributions listed in the annual reports? Is that paid out or a phantom re-investment by the fund?

@IlyaK:

All distributions (Canadian dividends, foreign income, capital gain distributions) are distributed once a year in december. If you activate the DRIP option, instead of receiving the amount in cash, you will get an automatic transaction to buy new mutual fund shares with the amount received. You will then need to adjust your ACB just like for any transaction when you buy new shares ( if you track it yourself, otherwise TDWaterhouse does a good job of tracking it’s mutual funds ACB). There are no phantom/hiddend re-investment distributions (like for ETFs) with TD e series mutual funds. The re-invested distribution is optional, and is not hidden, it will show up as a new transaction to buy new mutual fund shares.

@IlyaK

For what it’s worth, I’m considering using a mix of TD e series fund and Horizon’s tax-friendly swap ETFs (HXT/HXS) for my business investment account.

@Jas

Thank you. I have TD eseries in my registered accounts. I understand your approach, but for my goals, I will personally not use TD efunds in my non-registered account as I don’t want to have to pay taxes yearly on distributions before re-investing them (less gets compounded every year) – though of course I am keeping my eye on diversification considering the relatives sizes of my non-registered and registered accounts.

My next worry is the 15% withholding tax on US dividends inside the HXS account – I’m thinking of simply investing in US-based investments directly in my RRSP account to avoid the withholding.

@ilyak: There is no withholding tax on HXS because there are no dividends. However, there is a 0.30% “swap fee” charged on top of the fund’s MER, so the effect is similar (a 15% withholding tax on a 2% yield = 0.30%). The one important difference is that the swap fee is not recoverable on your tax return.

Thank you CCP – great explanation!

I’ve been pondering a particular ACB scenario and was curious on your take Dan:

In a non-registered account:

(A) Let’s say you got a USD denominated inheritance of $10k USD (no estate tax in Canada => tax free), and at the time USDCAD = 1.

(B) A month later, USDCAD = 1.1, and you spend $2000 USD to buy 50 units * $40 USD of a US-traded stock.

(C) A month after that, USDCAD = 1.15 and you sell your 50 units which are now priced at $41 USD each.

There’s clearly a capital gain from B to C – it comes from both currency and asset appreciation. But is there a capital gain from A to B? We “sold” US dollars that we originally got at par in CAD-terms to exchange it for the stock purchase. How does the appreciation from 1 to 1.1 get taxed?

@Dave: I would question whether you are “selling USD” to make the purchase of the US stock, since the stock is denominated in USD and you are using USD cash to purchase it. You are not converting it to CAD. But this is really a question for a tax advisor. I can tell you that most people don’t report that gain from par to 1.1, but that doesn’t mean it’s acceptable to ignore it.

@Dan: Indeed; clearly it’s not a ‘sale’ in the typically envisioned sense. All I meant is that an asset ($2k USD) was disposed of (“sold” in quotation marks) for more CAD than the ‘cost’ at acquisition.

I definitely take your point that there’s a theoretical vs practical distinction to be made here. It’s not all that common of a scenario to begin with, and the magnitudes of the exchange rate and stock purchases would deeply factor into whether it should be considered ‘material’.

Thanks for your reply.