This week I was dismissive about the Dynamic Funds that swept this year’s Canadian Investment Awards. I argued that it’s easy to celebrate past performance, but impossible to identify managers whose success will continue in the future. One commenter, a financial advisor, disagreed and suggested that choosing a manager who will outperform is no different from identifying a skilled hockey player.

This week I was dismissive about the Dynamic Funds that swept this year’s Canadian Investment Awards. I argued that it’s easy to celebrate past performance, but impossible to identify managers whose success will continue in the future. One commenter, a financial advisor, disagreed and suggested that choosing a manager who will outperform is no different from identifying a skilled hockey player.

This comparison just doesn’t hold up. If a hockey player scores twice as many points as the average player for several years in a row, it is highly likely his superior performance will continue, because skill determines virtually 100% of a player’s results. Sidney Crosby can be fully expected to outscore the average NHL player for a very long time.

Investing is nothing like playing in the NHL. The bulk of an investor’s return comes from simply accepting market risk, which requires no skill whatsoever. Anyone who buys an index fund can instantly obtain near-market returns, and indeed, he or she will beat most professional managers after costs. I accept that it’s possible to identify skilled managers, but the best they can hope for is returns that are incrementally better. One can never hope to identify a money manager who will dramatically outperform his or her peers, or the market averages, with anything like the consistency of a Sidney Crosby.

The NHL’s Couch Potato

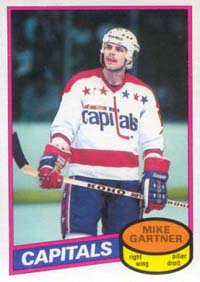

All these hockey metaphors made me wonder: what NHL player best represents the index investor? The name that comes to mind is Mike Gartner. Most non-hockey fans have probably never heard of Gartner, even though he played in the NHL for almost two decades before retiring in 1998. He was never a household name because he never had a single season with mind-blowing numbers. In fact, he never once led the league in any major scoring category:

| Seasons played: | 19 |

| Number of 50-goal seasons: | 1 |

| Highest one-season goal total: | 50 |

| Seasons leading the NHL in goals: | 0 |

| Number of 100-point seasons: | 1 |

| Highest one-season point total: | 102 |

| Scoring titles: | 0 |

So was Mike Gartner an “average” player? Hardly. Gartner scored 708 goals in his career, which places him sixth overall, ahead of Mario Lemieux, Steve Yzerman and Jaromir Jagr. In 2001, he was inducted into the Hockey Hall of Fame.

Mike Gartner was one of the fastest skaters in the NHL, but he was not more skilled than Lemieux, or even Yzerman or Jagr. He didn’t have to be. Gartner had longevity: on average, he missed no more than five games per season — he was “fully invested” for 19 years. More important, he was extremely consistent: while he never exceed the 50-goal benchmark in any season, he scored 30 or more goals a remarkable 17 times, something neither Wayne Gretzky nor Gordie Howe ever managed.

The lesson for investors is this: Gartner was not the best performer in any given year, never won a major NHL award, and never won a Stanley Cup. He never got the respect he deserved — The Hockey News insulted him by ranking him 89th in their Top 100. Yet despite all of this, his long-term performance was not merely good, or even great: he was one of the most successful hockey players of all time.

Next time someone asks you why you would invest with index funds that will never beat the market or win a Canadian Investment Award, take them to the Hockey Hall of Fame and tell them the story of Mike Gartner.

great post !

look at this one “`how costs destroy your returns“

http://moneywatch.bnet.com/investing/blog/wise-investing/how-costs-destroy-your-returns/1880/?tag=col1;blog-river

Excellent post Dan, I love the analogy. Did Mike Gartner just come to your mind or did you have to dig him up through a bit of research? Anyway, a creative take on the often sterile conversation about indexing vs active management.

@DM: Thanks, you can never go wrong by invoking hockey analogies. I had to look up the details of Gartner’s stats, of course, but I thought of him right away. I’ve always admired guys like him who are consistently excellent even if they never get the headlines.

I was not familiar with Mike Gartner but this analogy is almost perfect. And that’s what index funds are. The Mike Gartners of the investing world. They’ll never be flashy, you can’t brag about them at cocktail parties but year-in and year-out they’ll do the job consistently and well. What’s more, you are getting such a player for the lowest salary in the league.

Great Post Dan.

Great post! My response is to tell them about Bill Miller at Legg Mason. Smart! Beat the S&P 500 15 years straight. Fabulous performance – until it wasn’t. How about Long Term Cap Mgt.? Two Nobel Prize winning economists – the guys who developed risk theory. Is your guy smarter than them? The head of LTCM was formerly head of risk arbitrage at Salomon Brothers. Trust me – you have to be pretty smart to head up risk arb at Solly. With their fancy smancy “value at risk” model they brought global markets to their knees. This was back in ’98. Did your guy have hands on investment experience then? Do you really know what his performance was back then.

Saying a high scoring hockey player will outperform is logically different from saying an investment manager will outperform. The evidence is there.

He was a fast skater but it was amazing that he never lead the league in scoring.

Great analysis with TSX

CP, let me address your hockey analogy, because other than being creative, I don’t think it is the correct way to look at it. (BTW – I did read your rebuttal post to the Dynamic article and while I thought Chevreau’s article was fair and balanced, I thought your counter-points were strong ones).

And second, I am trying to be done work for the holidays and hand with my daughters so I will not be getting into a long back and forth debate or replying unless I think someone has made an interesting comment or observation. Not really a fair way to post, but just want to state that up front.

But back to your hockey analogy….it is convenient and easy to take a guy like a Mike Gartner – one of the most talented guys ever to play the game – and say he is to the game of hockey what indexing is to investing. But I think there is a more honest and realistic way to look at it.

Indexing to me is looking at ALL the guys who play any type of hockey in the world. The elite NHLers, AHL pros, European players, simple games of shinny on frozen ponds, minor hockey, and the most fun of all, the beer leagues like I play in.

There are thousands of people that play or try to play hockey. If you could collect everyone’s skill level (from the god-like Ovechkin’s to the 5 year old kid who skates on his ankles) and somehow average it, you would likely come out with player much like myself. I am average at hockey in every sense of the word. I play weekly and am a decent skater, I am a crappy stick handler and have a weak shot. I play in an average league and I am an average player in that average league. Average!

I would argue that I, Mr. Average, am to the game of hockey what passive indexing is to investing. The average, nothing more and nothing less.

Now, let’s say we are faced with the task of looking at a bunch of hockey players and are trying to determine who is going to make it to the NHL. If I had to do that, I would use the process of elimination to improve my chances. I think everyone could agree it would not be too hard to eliminate the vast majority of players who simply have no chance of ever playing professionally. Crappy skater – eliminate. Terrible shot – eliminate. Doesn’t live and breath hockey and want to play it all the time – eliminate. Small and slow – eliminate. Etc. Etc. Etc. Once this is done you’d be left with a much smaller group of the better and above-average players.

You certain 100% without question do the same thing with investment choices. I can eliminate most of choices and be left with a small group that has a decent chance of being well above average. Labour Sponsored fund? Eliminate, they are garbage. High MER, eliminate – too expensive. High turnover – eliminate. Index hugging – eliminate. No co-investment of managers own money – eliminate. Manager buys Nortel at $124 a share because he feels he has to in order to stay employed? Eliminate. Etc. Etc. Etc.

Similarly, passive devotees need to do the same thing. Eliminate those ETFs with high tracking error, large bid asked spreads, low fees, etc., etc., etc.

Whether it is hockey or more importantly investing, I am surprised the simple logic of eliminating the crappy options seems to be difficult for some people to accept.

I have no problem with indexing and completely understand its appeal. Many of the ‘index devotees’ underestimate the discipline required to successfully index – nor will they believe and accept that most people who try to index fail because they can’t stick with it or their emotions and behaviour get the better of them (just like active) . The Canadian Capitalist, for example, is someone I believe has the discipline and will be successful in his passive investing strategy, but he is in the minority (just like active investors)

I don’t want indexing for my own portfolio because I feel I can get better results actively. (this will difficult to many readers to accept) I also can’t understand the appeal of buying things like the TSX that had 1/3rd Nortel, or 1/3 oil at $147 barrel, or Nasdaq at 5000, and this goes hand-in-hand with being a passive investor. Passive investors can’t care about those things but I do. Also have never met anyone who has consistently and successfully followed an indexing strategy for 10 years (this will change as time goes on but I haven’t yet) .

I like reading Canadian Capitalist because I think he is very intelligent. More importantly though, I value reading about a well thought out opinion that is different to my opinions. That is how I learn and get better. I encourage commenters on this blog to do the same. With that in mind, I find it funny how offended people got at what was – agree with the writer or not – a very fair and balanced article by Jon Chevreau.

@Rob: Thanks for the reply. I do enjoy a friendly debate, and I appreciate your openness in considering both sides.

At the risk of torturing these metaphors, I’ll try once more to make my point:

– In chess, skill determines 100% of performance. If I play Gary Kasparov 100 times, I will lose every single game.

– Skill determines 0% of performance in bingo. Two people playing 100 games can be expected to win roughly 50 times each.

– Somewhere in between is poker: skill is a huge factor, but luck also plays a role. An average player will beat a highly skilled player some of the time due to luck.

Which of these games is closest to investing? You seem to think it is closer to chess. Some (like John De Goey, quoted in Chevreau’s article) believe it’s like bingo, and it’s all luck, but I don’t believe this. I think it’s more like poker: clearly there are skilled money managers, but as in poker, there are many factors that the players can’t control, so skill is only so useful. And because of the higher costs incurred by the active money manger, the usefulness of his skill is diminished further.

Imagine an average poker player at a casino that takes $1 from every pot, and compare his performance to a more highly skilled player whose casino rakes $5 per hand. Can the skilled player overcome this additional cost? You may believe so, but with all due respect, you work for the casino.

Re: Rob “Also have never met anyone who has consistently and successfully followed an indexing strategy for 10 years (this will change as time goes on but I haven’t yet) .”

Come to the States. A lot of the the money managed by the huge pension funds is indexed. These are multi-billion $ funds with well compensated staffs. Analysts at these funds hold degrees from the best business schools in the nation.

They have found that when they choose the “best” 4 equity managers to outperform the S&P 500 that after several years one does great, one does poorly, and two are average. Average them all together, take out fees and you’re better off indexing.

If they can’t choose superior managers I for one have to wonder. By the way I experienced this first hand as an analyst for the United Mine Workers Health & Retirement Funds inn Washington D.C.

Eliminate all the fluff, get the very best by what ever criteria you choose (hint: past performance is worthless) and you’ve got a 20% chance of outperforming after fees. At least that’s how I read the evidence. Do -it-yourself and you at least have a 50% chance.

Have a great holidays guys. Enjoying this back-and-forth.

@couch – actually I don’t think of it as chess at all. I believe poker is the best analogy to investing. A bit of science and a bit of luck, but most of all behaviour , patiece, and discipline drives success over the long term because science and luck even out over time.

Didn’t understand the last paragraph you wrote – can you clarify?

@diy – I know pensions have used indexing but I’d argue that most get into it at the peak of markets, and many also use super expensive hedge funds, etc. I think that many of the pensions employ consultants of little value because they focus too much on past performance and their role – like many bad advisors – is to give the client whatever they want. Too many change course when it doesn’t “seem” like it’s working. I stand by my comment.

@diy – past performance is not worthless at all. If a fund has just shot the lights out and had a great year, it is usually a good idea to not add to it, take income from that if that is what you need, and possibly rebalance (rarely because of tax cost, but sometimes)

The way the masses use past performance is disastrous to their results. There is great information in past performance – it is just how you use it.

Nice post Dan!

While I’m a fan of dividend investing, your posts (like this one) continue to reinforce with me that index investing in my RRSP is an excellent compliment to my other (dividend) strategy.

The market is much like a casino indeed. Many people run to the slots but it’s actually poker and blackjack where you can win. The house has much lower margins for the latter two. I would argue if you’re a dividend investor holding a Canadian bank, you are the casino.

@Financial Cents: Thanks for the comment. While holding bank stocks can obviously allow you to share in the bank’s profits, you’re doing so with significant risk. A casino, on the other hand, turns all of the risk over to the players and reaps profits no matter who wins or loses. Big difference!

Mike Gartner was one of my favourite players- just awesome!!

Greg Smith

PS- I understand the article was not about hockey- but MG was more important than the TSX.