In our recent white paper, After-Tax Returns, Justin Bender and I introduced a methodology for measuring the effect of income taxes on ETF returns. Justin also created a downloadable spreadsheet you can use to estimate the after-tax returns of funds in your own portfolio.

As we explain in the paper, funds with similar pre-tax returns can look quite different when you compare their performance after the CRA has taken its cut. Remember that on a pre-tax basis investment gains are reported in the same way whether they’re Canadian dividends, fully taxable income or capital gains. If you’re investing in a tax-sheltered account, it’s all the same. But in a non-registered account, distributions are taxed in different ways, and this can dramatically affect the amount of money you actually keep.

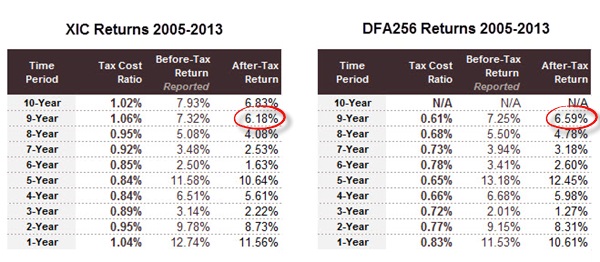

Here’s a real-world example that illustrates how large the difference can be. Justin collected the distribution and price data for the iShares Core S&P/TSX Capped Composite (XIC) and the DFA Canadian Core Equity Fund (DFA256) over the nine years ending in 2013. Both funds track the broad Canadian stock market, so you would expect similar returns. And indeed, during that period XIC’s annualized before-tax return was 7.32%, while the DFA fund returned 7.25%. The difference is so small that we’ll call it a draw. However, the calculator revealed a significant difference in after-tax performance:

Sources: BlackRock Canada, Dimensional Fund Advisors Canada ULC, Justin Bender, PWL Capital Inc.

Despite lagging XIC slightly before taxes, the DFA fund outperformed by 0.41% annually on an after-tax basis. Over the full nine-year period, the DFA fund’s tax cost ratio (which estimates the amount of a fund’s distributions lost to taxes) was 0.61%, compared with 1.06% for XIC.

Why the difference?

Before you make an investment decision based on an analysis like this, however, it’s worth digging a little deeper to find the reason for the large difference in after-tax returns.

One of the factors—explained in detail in the white paper—is that funds with higher MERs tend to have lower tax cost ratios. That’s because funds typically deduct their management fees before passing along distributions to their investors. This can make a higher-cost fund appear more tax-efficient, though of course the investor is simply losing money to fees rather than taxes. In our comparison above, the DFA Canadian Core Equity Fund (DFA256) had a relatively high MER of 0.59% in 2005, though that has since come down to 0.38%. Meanwhile, XIC had a management expense ratio of 0.18% back in 2005, and while that later increased to 0.25% the ETF has always been cheaper than the DFA fund.

But the biggest culprit was likely the index changes XIC underwent in the mid-2000s. When it was first launched, XIC tracked the S&P/TSX 60 Capped Index, which includes only large-cap stocks. It changed its mandate in November 2005 and began tracking the broader S&P/TSX Capped Composite Index. The buying and selling of stocks during that transition resulted in some large capital gains distributions, and investors would have been handed a tax bill for these gains even if they never sold units in the ETF. But to be fair, unless XIC changes its underlying index again, that’s not likely to be a problem going forward.

This is a reminder that the most tax-efficient index funds and ETFs are likely to be the ones that cover the broadest swath of the market. An index of large-cap stocks will likely see new companies moving in and out, which will force index fund managers to sell their holdings and replace them. As we’ve seen, that can trigger capital gains that get passed along to the investor. This is also the case with ETFs that screen for stocks with specific characteristics, such as the iShares S&P/TSX Canadian Dividend Aristocrats (CDZ), which distributed very large capital gains in 2010, 2011 and 2012 as it kicked out companies that failed to raise their dividends.

Total-market funds that hold large, mid and small-cap stocks are likely to distribute less in capital gains: they typically have much lower turnover, since their makeup rarely changes. DFA equity funds enjoy a unique tax benefit in this respect. They generally attempt to hold the entire asset class—the DFA Canadian Core Equity Fund (DFA256) holds more than 500 companies, for example, or about twice as many as XIC—but they do not track a specific index, so they are not forced to add or remove holdings just to avoid tracking error.

Thanks Dan, really great information as usual. Quick question, i assume all these types of calculations are done with an assumption that tax brackets remain constant throughout the time periods. Is this correct?

“An index of large-cap stocks will likely see new companies moving in and out, which will force index fund managers to sell their holdings and replace them. As we’ve seen, that can trigger capital gains that get passed along to the investor.”

I’m confused by this. Will those capital gain taxes reduce the NAV/price of the fund? Or will investor have to pay the tax? How will this effect our capital gains when we sell our ETF shares?

@françois: The assumptions about personal tax rates are explained in the white paper. We assume that the investor is in the highest provincial tax bracket in all cases, so it’s essentially a worst-case scenario.

@Daniel: The NAV will not change meaningfully because the fund will typically sell shares for a given dollar amount and then use those same dollars to repurchase other shares. So the net asset value does not change.

Since none of the proceeds get distributed to fund holders this would be a “reinvested capital gains distribution.” It’s meaningless if you hold the fund in an RRSP or TFSA, but if you hold it in a taxable account you will receive a T-slip with the amount of the capital gain and you’ll need to report it on your tax return.

Reinvested capital gains increase the adjusted cost base of your ETF shares, so you should keep track of them. If you don’t, you’ll pay tax on the capital gains again when you sell those shares:

https://canadiancouchpotato.com/2013/04/04/calculating-your-adjusted-cost-base-with-etfs/

@Dan. Thanks. This makes these matter more important, as i can generally control years where i select to take selling gains (i have had a tendency to have a high standard deviation in income), so it makes sense for me to consider this, and aim for low transaction indexes.

CCP

which index funds do you think should be used for non-registered account? ETFs are cheapest however i’d like to keep record keeping at a minimal and add small amounts at a time.

in your model profiles you say to use RBF556, TDB661 and NBC839 , are these the best option for non reg account as well?

@Jake: If you’re using index mutual funds rather than ETFs you generally don’t need to worry about recordkeeping, since the fund companies will track the book value for you. Tracking ACB manually is typically only an issue with ETFs.

One of the associated problems with keeping track of dividend distributions capital gain distributions, and interest distribution for a stock, ETF, or index fund.

Is there a single source of information on the Internet where I can find out what these numbers have been in the past years for a specific ETF for example?

Hi CCP,

Berkshire stock ‘B’ does not give dividends. I would only get taxed on it upon selling (capital gains). I am planning on adding new money annually to buy more shares.

Would I still need to calculate the ACB?

Thank you.

@Pacific: Every ETF’s web page includes distribution breakdowns for each calendar year. For more detail you can download the breakdowns from the CDS Innovations website:

http://www.cdsinnovations.ca/applications/taxforms/taxforms.nsf/Splash?Openpage

Not sure if you have seen our previous white paper on this issue:

https://canadiancouchpotato.com/2013/04/04/calculating-your-adjusted-cost-base-with-etfs/

@Essy: Technically you are always responsible for calculating your ACB. But if you hold your shares at a single brokerage and you never move them, chances are the brokerage’s calculation of your book value are going to be accurate. As long as there are no DRIPs or other reinvested distributions to complicate things that should be adequate.

Dan, you had hinted this in your post but perhaps it wasn’t explicit for me. Are the MERs baked into the before-tax return? As well, XIC also has an expense ratio of 0.05% as based on the Blackrock site, but I’m not sure when that reduction in MER occurred. Is there a way to confirm when it was reduced?

@Simon: Before-tax returns are always reported net of fees, so you don’t need to subtract the MER. As for XIC, it dropped its fee to 0.05% this March. So ironically, that fee reduction will likely increase the fund’s tax cost ratio, but the net after-tax return to investors will be higher than when the fee was 0.25%.

Hi Dan, your paper brings the point that the only thing that really counts is after-tax performance but can be complicated to calculate and apply. Is there a rule of thumb that can be used whereby the tax efficiency is always or close to 100%?

@Daniel C: Using our methodology the only way a fund could have 100% tax efficiency (a tax cost ratio of 0%) would be to have no taxable distributions. I suppose swap-based ETF (like HXT, HXS and HBB from Horizons) would fit that description. Though, again, tax cost ratio is only one factor to consider. One also needs to consider fees and risks.

Are gains on HBB classed as capital gains or regular income by CRA? It is my understanding gains on HXT and HXS are classed as capital gains, or am I mistaken?

@Sixtyplus: You’re correct. The swap-based ETFs from Horizons are structured so there are no distributions and any increase in price would be considered capital gains. And these would only be realized when you sell units in the fund. You should understand that it is possible these products could distribute taxable income in the future. See the last section of this blog post:

https://canadiancouchpotato.com/2014/05/08/a-tax-friendly-bond-etf-on-the-horizon/

Thanks Dan and Justin. This was clearly a lot of work and very detailed. It will take me a while to comprehend.

Just wondering, has any similar analysis been done to see how much efficiency can be recovered by systematically doing tax harvesting? (aka tax loss selling)

Also, besides ETFs like HXT and HXS, are their other funds that specifically try to optimize tax efficiency? It seems to me that there is a huge opportunity for a mutual fund that holds a passive portfolio with a tax loss harvesting overlay. I believe that the Mawer Tax Effective Balanced fund does tax harvesting but it’s not passive.

Thanks a lot, Dan. I must use this to estimate the after-tax returns of funds in my own portfolio. Thanks again for a helpful article.

Hi, after reading this document (https://www.pwlcapital.com/pwl/media/pwl-media/PDF-files/White-Papers/2016-06-17_-Bender-Bortolotti_Foreign_Withholding_Taxes_Hyperlinked.pdf?ext=.pdf), I believe that in most case, it is more tax-effective to hold International equity in a non-registered account as the difference between holding them in a tax sheltered VS non-registered account is more than for US stocks. Also, I believe that it is even more true for emerging markets equity as iShares and Vanguard ETFs don’t hold stocks directly.

I would like to know if it is better to hold an International/Emerging markets ETF in non-registered account and a Canadian-listed ETF of US stocks in a tax sheltered account?

Thank you.